883 Jones Rd Uvalda, GA 30473

Estimated Value: $208,000 - $266,361

--

Bed

3

Baths

2,002

Sq Ft

$116/Sq Ft

Est. Value

About This Home

This home is located at 883 Jones Rd, Uvalda, GA 30473 and is currently estimated at $232,090, approximately $115 per square foot. 883 Jones Rd is a home located in Montgomery County with nearby schools including Montgomery County Elementary School, Montgomery County Middle School, and Montgomery County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2017

Sold by

Chambers Sindy Victoria

Bought by

Chambers Jason Lee

Current Estimated Value

Purchase Details

Closed on

Jan 11, 2012

Sold by

Chambers Jason Lee

Bought by

Chambers Sindy Victoria

Purchase Details

Closed on

May 3, 2006

Sold by

Altamaha Bank & Trust Co

Bought by

Chambers Jason Lee

Purchase Details

Closed on

Oct 25, 2002

Sold by

Chambers Jason

Bought by

Mclain Dennis E and Mclain Jr

Purchase Details

Closed on

Feb 8, 2000

Sold by

Chambers Jason

Bought by

Chambers Jason

Purchase Details

Closed on

Sep 14, 1998

Sold by

Youmans Hollis

Bought by

Chambers Jason

Purchase Details

Closed on

Jan 31, 1968

Sold by

Jones Gilman

Bought by

Youmans Hollis

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chambers Jason Lee | -- | -- | |

| Chambers Sindy Victoria | -- | -- | |

| Chambers Sindy Victoria | -- | -- | |

| Chambers Jason Lee | $70,000 | -- | |

| Mclain Dennis E | $59,100 | -- | |

| Chambers Jason | -- | -- | |

| Chambers Jason | $60,000 | -- | |

| Youmans Hollis | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,946 | $65,777 | $5,120 | $60,657 |

| 2023 | $2,054 | $68,743 | $5,120 | $63,623 |

| 2022 | $2,054 | $68,743 | $5,120 | $63,623 |

| 2021 | $2,042 | $68,743 | $5,120 | $63,623 |

| 2020 | $1,812 | $59,508 | $5,120 | $54,388 |

| 2019 | $1,780 | $59,508 | $5,120 | $54,388 |

| 2018 | $1,611 | $59,508 | $5,120 | $54,388 |

| 2017 | $1,653 | $61,059 | $5,120 | $55,939 |

| 2016 | $1,644 | $61,059 | $5,120 | $55,939 |

| 2015 | -- | $61,059 | $5,120 | $55,939 |

| 2014 | -- | $61,059 | $5,120 | $55,939 |

Source: Public Records

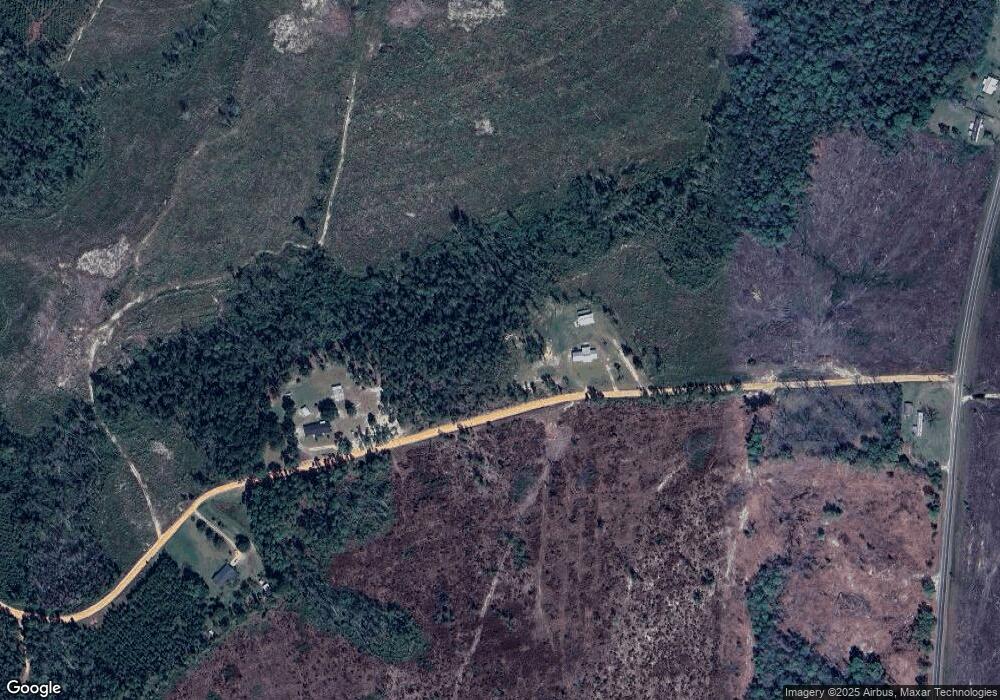

Map

Nearby Homes

- 00 Georgia 135

- 5223 Georgia 135

- 5407 U S 221

- 0 Smyrna Rd Unit 10645048

- 0 Smyrna Rd Unit 23816

- 298 Bud Denton Rd

- 789 B Hitchcock Rd

- 143 Sadie Galbreath Rd

- 274 Cedarwood Subdivision Rd

- 1686 Georgia 56

- 674 McNatt Falls Rd

- 346 Collie Williams Rd

- 3242 Cedar Crossing Vidalia Rd

- 0 Gray's Landing Rd Unit 23834

- 0 Gray's Landing Rd Unit 10647341

- 496 Grays Landing Rd

- 0 Dead River Rd Unit 22915185

- 347 Benton Powell Rd

- 4822 Georgia 15

- 4262 Ga Highway 15

- 738 Jones Rd

- 1475 Gibbs Bridge Rd

- 1144 Gibbs Bridge Rd

- 1403 Gibbs Bridge Rd

- 1489 Gibbs Bridge Rd

- 1423 Gibbs Bridge Rd

- 1423 Gibbs Bridge Rd

- 345 Johnson Ln

- 955 Gibbs Bridge Rd

- 939 Gibbs Bridge Rd

- 1436 Gibbs Bridge Rd

- 1621 Gibbs Bridge Rd

- 500 Jones Rd

- 975 Gibbs Bridge Rd

- 1844 George Davis Rd

- 1083 Gibbs Bridge Rd

- 1717 George Davis Rd

- 1632 Gibbs Bridge Rd

- 1716 George Davis Rd

- 136 Ava St