8839 Eagleview Dr Unit 88396 West Chester, OH 45069

West Chester Township NeighborhoodEstimated Value: $192,000 - $203,000

2

Beds

2

Baths

1,025

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 8839 Eagleview Dr Unit 88396, West Chester, OH 45069 and is currently estimated at $196,776, approximately $191 per square foot. 8839 Eagleview Dr Unit 88396 is a home located in Butler County with nearby schools including Freedom Elementary School, Lakota Ridge Junior School, and Lakota West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2024

Sold by

Kash Dianna L

Bought by

Manhema Manuel and Cruickshank Nelia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,830

Outstanding Balance

$169,848

Interest Rate

6.77%

Mortgage Type

FHA

Estimated Equity

$26,928

Purchase Details

Closed on

Aug 19, 2003

Sold by

Lewis Leah R

Bought by

Kash Dianna L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,450

Interest Rate

5.62%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 1, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Manhema Manuel | $175,000 | None Listed On Document | |

| Manhema Manuel | $175,000 | None Listed On Document | |

| Kash Dianna L | $85,000 | Old National Title | |

| -- | $60,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Manhema Manuel | $171,830 | |

| Closed | Manhema Manuel | $171,830 | |

| Previous Owner | Kash Dianna L | $82,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,229 | $53,820 | $6,300 | $47,520 |

| 2023 | $2,213 | $53,820 | $6,300 | $47,520 |

| 2022 | $1,903 | $33,990 | $6,300 | $27,690 |

| 2021 | $1,731 | $32,670 | $6,300 | $26,370 |

| 2020 | $1,772 | $32,670 | $6,300 | $26,370 |

| 2019 | $2,493 | $26,010 | $6,300 | $19,710 |

| 2018 | $1,482 | $26,010 | $6,300 | $19,710 |

| 2017 | $1,508 | $26,010 | $6,300 | $19,710 |

| 2016 | $1,601 | $26,010 | $6,300 | $19,710 |

| 2015 | $1,590 | $26,010 | $6,300 | $19,710 |

| 2014 | $1,587 | $26,010 | $6,300 | $19,710 |

| 2013 | $1,587 | $25,100 | $6,300 | $18,800 |

Source: Public Records

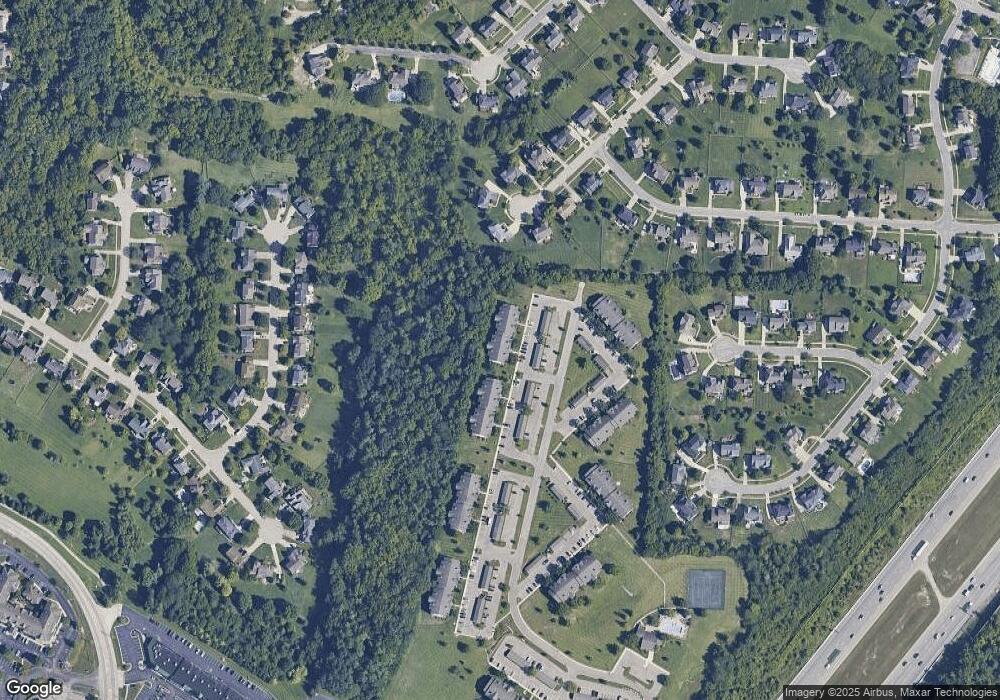

Map

Nearby Homes

- 8831 Eagleview Dr

- 8859 Eagleview Dr

- 8871 Timberchase Ct

- 8919 Eagleview Dr

- 8583 Kates Way

- 8222 Lindfield Dr

- 6036 Bardean Dr

- 6241 Skyline Dr

- 8164 Foxdale Ct

- 5648 Eagle Nest Ct

- 6724 Maverick Dr

- 8062 Kennesaw Dr

- Palisades Plan at West Ridge

- Brentwood Plan at West Ridge

- Wilshire Plan at West Ridge

- Moorgate Plan at West Ridge - Noble

- Everton Plan at West Ridge - Noble

- Kingsmark Plan at West Ridge - Prestige

- 6791 Cork Dr

- 6812 Cork Dr

- 8839 Eagleview Dr Unit 1

- 8839 Eagleview Dr

- 8839 Eagleview Dr

- 8839 Eagleview Dr Unit 88399

- 8839 Eagleview Dr Unit 88398

- 8839 Eagleview Dr

- 8839 Eagleview Dr Unit 88395

- 8839 Eagleview Dr Unit 88394

- 8839 Eagleview Dr Unit 88393

- 8839 Eagleview Dr Unit 88392

- 8839 Eagleview Dr Unit 88391

- 8839 Eagleview Dr

- 8839 Eagleview Dr Unit 7

- 8839 Eagleview Dr Unit 3

- 8839 Eagleview Dr Unit 4

- 8839 Eagleview Dr Unit 5

- 8839 Eagleview Dr Unit 7

- 8839 Eagleview Dr Unit 10

- 8839 Eagleview Dr Unit 9

- 8839 Eagleview Dr Unit 11