885 Wilde Run Ct Roswell, GA 30075

Edenwilde NeighborhoodEstimated Value: $914,327 - $1,040,000

5

Beds

4

Baths

3,353

Sq Ft

$296/Sq Ft

Est. Value

About This Home

This home is located at 885 Wilde Run Ct, Roswell, GA 30075 and is currently estimated at $993,776, approximately $296 per square foot. 885 Wilde Run Ct is a home located in Fulton County with nearby schools including Sweet Apple Elementary School, Elkins Pointe Middle School, and Milton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2025

Sold by

Ackley Charles

Bought by

Ackley Charles Tr and Ackley Deanne Tr

Current Estimated Value

Purchase Details

Closed on

Oct 22, 2004

Sold by

Hillebert Allen O and Hillebert Catherine

Bought by

Ackely Deanne and Ackely Charles

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$295,000

Interest Rate

5.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 18, 2000

Sold by

Haymore D H

Bought by

Hillebert Allen O and Hillebert Catherine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Interest Rate

8.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 5, 1999

Sold by

Fairgreen Capital Lp

Bought by

Haymore D H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ackley Charles Tr | -- | -- | |

| Ackely Deanne | $454,400 | -- | |

| Hillebert Allen O | $360,000 | -- | |

| Haymore D H | $53,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ackely Deanne | $295,000 | |

| Previous Owner | Hillebert Allen O | $288,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,284 | $364,000 | $61,800 | $302,200 |

| 2023 | $9,648 | $341,800 | $68,800 | $273,000 |

| 2022 | $5,790 | $286,000 | $53,240 | $232,760 |

| 2021 | $6,675 | $219,480 | $35,680 | $183,800 |

| 2020 | $6,773 | $216,880 | $35,280 | $181,600 |

| 2019 | $1,068 | $215,440 | $39,920 | $175,520 |

| 2018 | $5,590 | $210,360 | $38,960 | $171,400 |

| 2017 | $5,814 | $214,400 | $38,520 | $175,880 |

| 2016 | $5,787 | $214,400 | $38,520 | $175,880 |

| 2015 | $6,978 | $214,400 | $38,520 | $175,880 |

| 2014 | $5,254 | $184,160 | $26,160 | $158,000 |

Source: Public Records

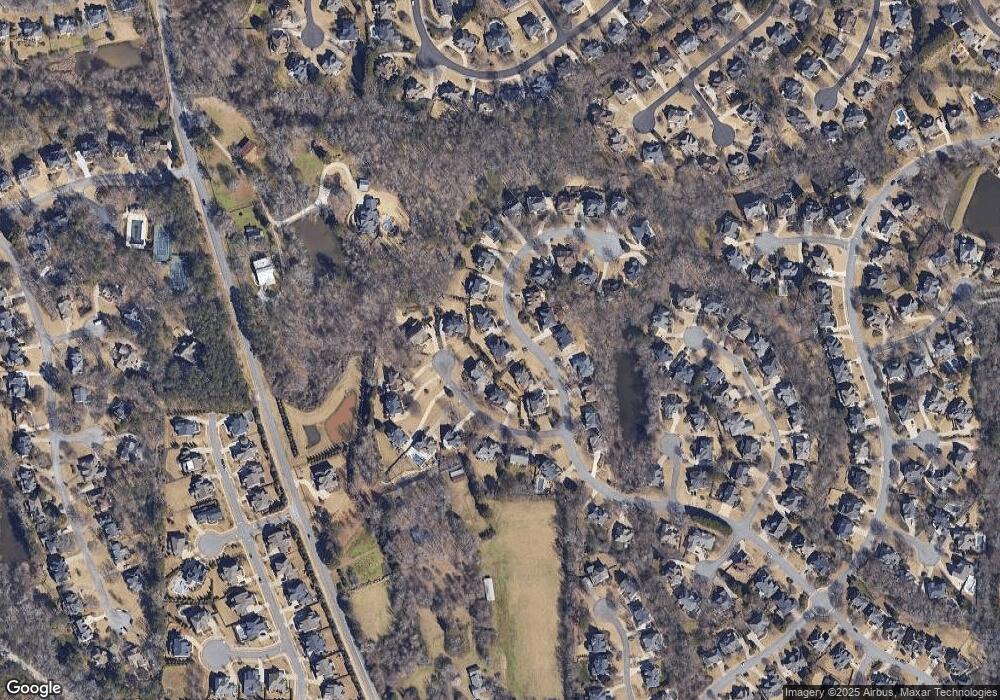

Map

Nearby Homes

- 105 Kensington Pond Ct

- 406 Sweet Apple Cir

- 161 Brook Ln

- 515 Kent Rd

- 4404 Orchard Trace

- 1565 Parkside Dr

- 113 Quinn Way

- 2230 Ashton Dr

- 127 Quinn Way

- 12867 Etris Walk

- 137 Quinn Way

- 580 Stillhouse Ln Unit 2

- 666 Abbey Ct

- 12655 New Providence Rd

- 640 Mae Ln

- 285 N Farm Dr

- 290 Rucker Rd

- 1115 Primrose Dr

- 12857 Waterside Dr

- 325 Summer Shade Ln

- 895 Wilde Run Ct

- 875 Wilde Run Ct

- 315 Summer Shade Ln

- 335 Summer Shade Ln

- 870 Wilde Run Ct

- 865 Wilde Run Ct

- 860 Wilde Run Ct

- 905 Wilde Run Ct

- 880 Wilde Run Ct

- 850 Wilde Run Ct

- 890 Wilde Run Ct

- 345 Summer Shade Ln

- 855 Wilde Run Ct

- 330 Summer Shade Ln

- 370 Summer Shade Ln

- 900 Wilde Run Ct

- 360 Summer Shade Ln

- 320 Summer Shade Ln

- 830 Wilde Run Ct