8902 Eastwind Way Unit 8902 West Chester, OH 45069

West Chester Township NeighborhoodEstimated Value: $331,000 - $347,000

2

Beds

2

Baths

1,863

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 8902 Eastwind Way Unit 8902, West Chester, OH 45069 and is currently estimated at $338,624, approximately $181 per square foot. 8902 Eastwind Way Unit 8902 is a home located in Butler County with nearby schools including Freedom Elementary School, Lakota Ridge Junior School, and Lakota West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2020

Sold by

Estate Of Jean Verbarg

Bought by

Verbarg Daniel and Verbarg Paul

Current Estimated Value

Purchase Details

Closed on

Mar 15, 2005

Sold by

Baldwin Daniel N and Baldwin Christine M

Bought by

Verbarg John and Verbarg Jean

Purchase Details

Closed on

Aug 29, 2003

Sold by

Brauch Daniel P and Emmons Mary B

Bought by

Baldwin Daniel N and Baldwin Christine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,550

Interest Rate

5.97%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 26, 1999

Sold by

Hills Communities Inc

Bought by

Brauch Daniel P and Brauch Judith H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,500

Interest Rate

6.78%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Verbarg Daniel | -- | None Available | |

| Verbarg John | $172,000 | Classic Title Agency Llc | |

| Baldwin Daniel N | $167,500 | Prodigy Title Agency Llc | |

| Brauch Daniel P | $152,795 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Baldwin Daniel N | $160,550 | |

| Previous Owner | Brauch Daniel P | $86,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,321 | $102,130 | $12,250 | $89,880 |

| 2023 | $4,290 | $102,130 | $12,250 | $89,880 |

| 2022 | $4,083 | $71,240 | $12,250 | $58,990 |

| 2021 | $3,700 | $68,430 | $12,250 | $56,180 |

| 2020 | $3,227 | $68,430 | $12,250 | $56,180 |

| 2019 | $5,415 | $56,510 | $12,250 | $44,260 |

| 2018 | $2,710 | $56,510 | $12,250 | $44,260 |

| 2017 | $2,745 | $56,510 | $12,250 | $44,260 |

| 2016 | $2,824 | $54,810 | $12,250 | $42,560 |

| 2015 | $2,816 | $54,810 | $12,250 | $42,560 |

| 2014 | $2,616 | $54,810 | $12,250 | $42,560 |

| 2013 | $2,616 | $50,260 | $12,250 | $38,010 |

Source: Public Records

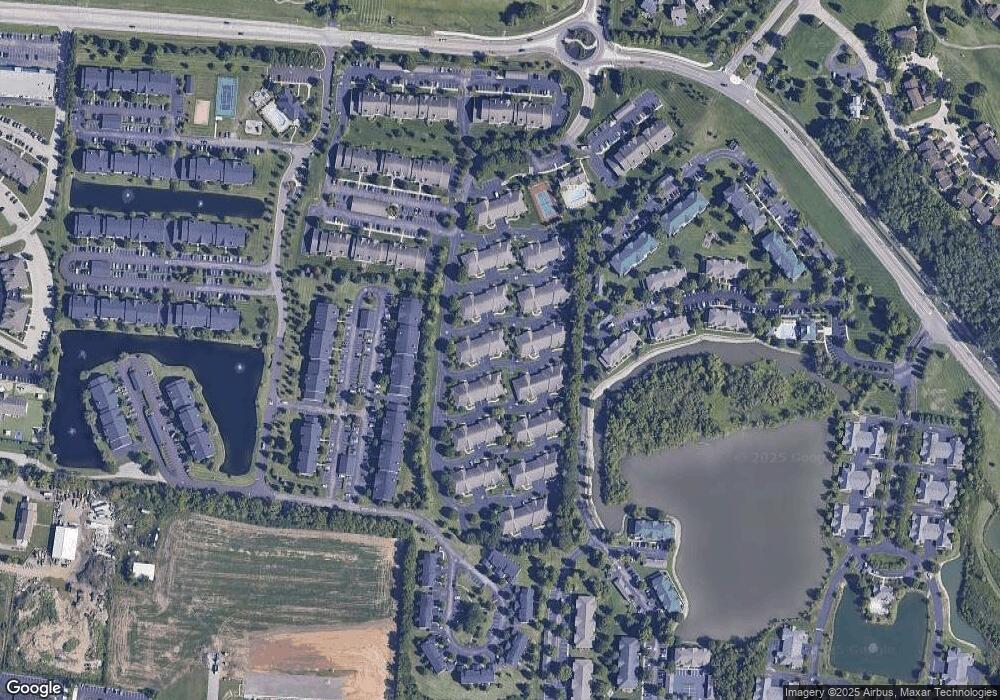

Map

Nearby Homes

- 8512 Breezewood Ct

- 8395 Spring Valley Ct

- 5271 Pros Dr

- 8050 Tollbridge Ct

- 4543 Spikerush Ln Unit 4543

- 5356 Pros Dr

- 8135 Timbertree Way Unit 3

- 7956 Bobtail Ct

- 5340 Windbrook Trail

- 5365 Leaf Back Dr

- 5396 Leatherwood Dr

- 5602 Plowshare Way

- 8021 Pinnacle Point Dr

- 8021 Pinnacle Point Dr Unit 102

- 8003 Pinnacle Point Dr

- 7908 Pinnacle Point Dr

- 7904 Woodglen Dr

- 8330 Park Place

- 8105 Vegas Cir

- 5648 Eagle Nest Ct

- 8803 Windsong Way

- 8900 Eastwind Way Unit 8900

- 8801 Windsong Way

- 8903 Eastwind Way Unit 8903

- 8807 Windsong Way Unit 8807

- 8800 Windsong Way Unit 8800

- 9002 Galewind Way Unit 2

- 8802 Wind Song Way

- 8802 Windsong Way Unit 8802

- 8907 Eastwind Way

- 8907 Eastwind Way Unit 8907

- 8901 Eastwind Way Unit 8901

- 8701 Whispering Willows Way Unit 8701

- 9006 Galewind Way Unit 9006

- 8806 Windsong Way

- 9000 Galewind Way Unit 9000

- 8809 Windsong Way Unit 8809

- 8908 Eastwind Way Unit 8908

- 8909 Eastwind Way Unit 8909

- 8707 Whispering Willows Way Unit 8707