Estimated Value: $276,000 - $300,000

3

Beds

2

Baths

1,560

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 8939 County Rd E, Delta, OH 43515 and is currently estimated at $284,284, approximately $182 per square foot. 8939 County Rd E is a home located in Fulton County with nearby schools including Delta Elementary School, Pike-Delta-York Middle School, and Pike-Delta-York High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 11, 2018

Sold by

Ford Thomas J

Bought by

Ford Thomas J and Ford Carol A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$82,948

Interest Rate

4.4%

Mortgage Type

New Conventional

Estimated Equity

$201,336

Purchase Details

Closed on

May 17, 2010

Sold by

Brehm Lelia M

Bought by

Ford Thomas J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,320

Interest Rate

5.3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 8, 2003

Sold by

Warren Sylvia C and Keith Sylvia Warren

Bought by

Brehm Lelia M and Lelia M Brehm Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ford Thomas J | -- | None Available | |

| Ford Thomas J | $157,900 | Attorney | |

| Brehm Lelia M | $157,500 | Louisville Title Agency For |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ford Thomas J | $140,000 | |

| Closed | Ford Thomas J | $126,320 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,231 | $75,780 | $10,500 | $65,280 |

| 2023 | $2,943 | $75,780 | $10,500 | $65,280 |

| 2022 | $3,054 | $60,970 | $8,750 | $52,220 |

| 2021 | $3,115 | $60,970 | $8,750 | $52,220 |

| 2020 | $3,124 | $60,970 | $8,750 | $52,220 |

| 2019 | $2,669 | $54,360 | $8,330 | $46,030 |

| 2018 | $2,577 | $54,360 | $8,330 | $46,030 |

| 2017 | $2,542 | $54,360 | $8,330 | $46,030 |

| 2016 | $2,506 | $50,160 | $8,330 | $41,830 |

| 2015 | $2,385 | $50,160 | $8,330 | $41,830 |

| 2014 | $2,381 | $50,160 | $8,330 | $41,830 |

| 2013 | $2,411 | $49,910 | $8,750 | $41,160 |

Source: Public Records

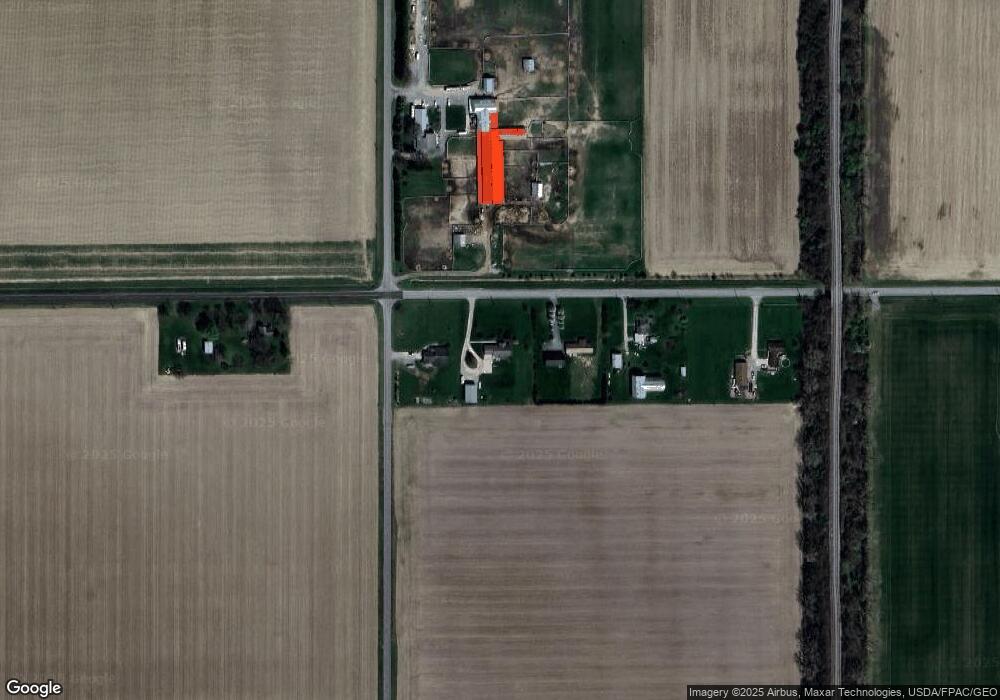

Map

Nearby Homes

- 11470 County Rd E

- 302 Adrian St

- 518 Providence St

- 207 Wood St

- 308 Monroe St

- 305 Mckinley St

- 929 Linwood Ave

- 318 Hidden Ridge Dr

- 2049 Pear Tree Ln

- 2061 Redbud Ln

- 315 Cherrytree Ln

- 320 Crabtree Ln

- 2158 Redbud Ln

- 8069 Fulton County 7-2

- 6881 County Road B

- 810 Greenview Ave

- 8069 County Road 7

- 7373 County Road 12

- 1066 Seneca Dr

- 1062 Seneca Dr

- 8939 County Road E

- 8975 County Road E

- 8975 County Rd E

- 8899 County Road E

- 8863 County Road E

- 5086 County Road 9

- 8777 County Road E

- 9069 County Road E

- 8777 County Rd E

- 8643 County Road E

- 9263 County Rd E

- 5300 County Road 9

- 4600 County Road 9

- 8580 County Road E

- 5330 County Road 9

- 8520 County Road E

- 8520 County Rd E

- 4540 County Road 9

- 5400 County Road 9

- 4502 County Road 9

Your Personal Tour Guide

Ask me questions while you tour the home.