896 Patterns Dr SW Unit 5 Mableton, GA 30126

Estimated Value: $154,000 - $242,405

3

Beds

2

Baths

1,369

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 896 Patterns Dr SW Unit 5, Mableton, GA 30126 and is currently estimated at $192,351, approximately $140 per square foot. 896 Patterns Dr SW Unit 5 is a home located in Cobb County with nearby schools including Mableton Elementary School, Floyd Middle School, and South Cobb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2018

Sold by

Selene Finance Lp

Bought by

Obleton Nashombi

Current Estimated Value

Purchase Details

Closed on

Jan 11, 2016

Sold by

The Secretary Of Housing And Urban Devel

Bought by

Selene Finance Lp

Purchase Details

Closed on

Feb 11, 2015

Sold by

Selene Finance Lp

Bought by

Secretary Of Housing And Urban Developme

Purchase Details

Closed on

Jan 6, 2015

Sold by

Genaw Daniel E

Bought by

Selene Finance Lp

Purchase Details

Closed on

Apr 15, 2008

Sold by

Coe Cheryl

Bought by

Genaw Daniel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,764

Interest Rate

6.08%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 20, 2006

Sold by

Coe Edward P

Bought by

Coe Cheryl

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Obleton Nashombi | $65,000 | -- | |

| Selene Finance Lp | -- | -- | |

| Secretary Of Housing And Urban Developme | -- | -- | |

| Selene Finance Lp | $79,512 | -- | |

| Genaw Daniel | $82,000 | -- | |

| Coe Cheryl | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Genaw Daniel | $78,764 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,123 | $70,448 | $16,000 | $54,448 |

| 2024 | $1,837 | $60,928 | $14,000 | $46,928 |

| 2023 | $1,585 | $52,580 | $14,000 | $38,580 |

Source: Public Records

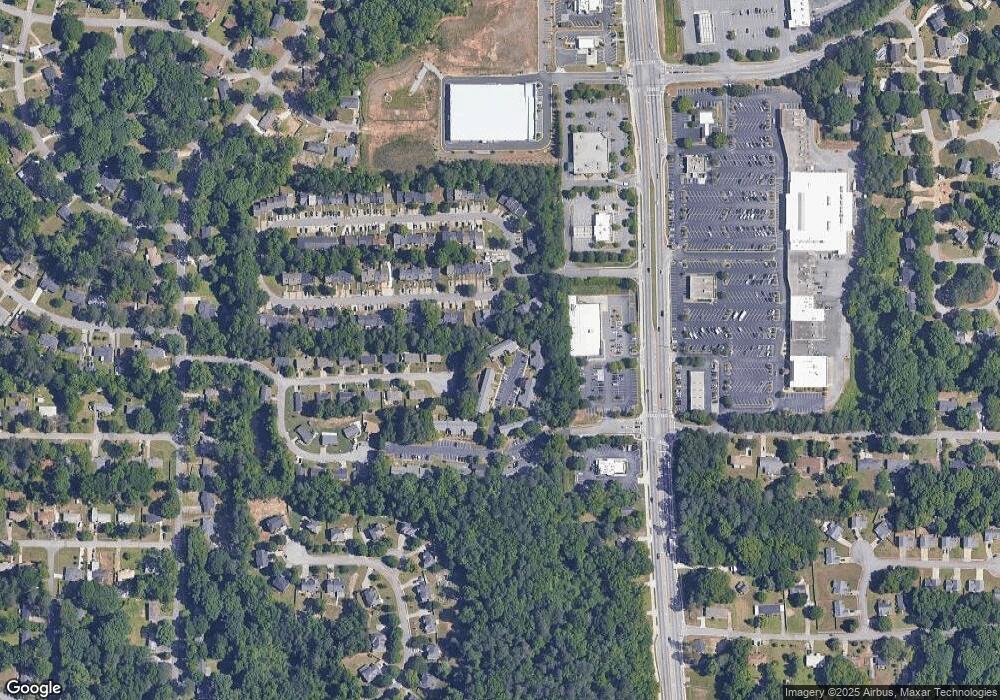

Map

Nearby Homes

- 885 Patterns Dr SW

- 4973 White Blvd SW

- 4938 White Blvd SW

- 926 Green Valley Rd SW

- 5205 Silhouette Ln SW

- 4167 Waratah Way

- 5177 White Blvd SW

- 5190 White Blvd SW

- 4397 Treadle Rd SW

- 968 Woodward Cir SW

- 4976 Mable Lake Dr SW

- 1047 Retner Dr SW

- 5287 Maple Valley Rd SW

- 1056 Retner Dr SW Unit 3

- 5341 Old Floyd Rd SW

- 640 Monticello Dr SW

- 581 Maran Ln SW

- 1132 Lafayette Dr SW

- 4643 Piston Jct SW

- 4672 Vernon Dr SW

- 896 Patterns Dr SW Unit 896

- 896 Patterns Dr SW

- 894 Patterns Dr SW

- 892 Patterns Dr SW

- 894 Patterns Dr SW Unit 894

- 898 Patterns Dr SW

- 763 Joseph Club Dr SW

- 765 Joseph Club Dr SW

- 899 Patterns Dr SW

- 895 Patterns Dr SW Unit 895

- 895 Patterns Dr SW

- 895 Patterns Dr SW

- 897 Patterns Dr SW

- 769 Joseph Club Dr SW

- 893 Patterns Dr SW

- 893 Patterns Dr SW Unit 893

- 771 Joseph Club Dr SW

- 761 Joseph Club Dr SW

- 759 Joseph Club Dr SW

- 890 Patterns Dr SW

Your Personal Tour Guide

Ask me questions while you tour the home.