8N369 Corron Rd Elgin, IL 60124

Bowes NeighborhoodEstimated Value: $532,000 - $639,000

4

Beds

2

Baths

2,282

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 8N369 Corron Rd, Elgin, IL 60124 and is currently estimated at $571,323, approximately $250 per square foot. 8N369 Corron Rd is a home located in Kane County with nearby schools including Howard B. Thomas Grade School, Prairie Knolls Middle School, and Central Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 10, 2025

Sold by

Wuestenberg Randal and Wuestenberg Carrie L

Bought by

Wuestenberg Revocable Trust and Wuestenberg

Current Estimated Value

Purchase Details

Closed on

Oct 26, 1995

Sold by

Burke Thomas J and Burke Joan M

Bought by

Wuestenberg Randal L and Wuestenberg Carrie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

7.61%

Purchase Details

Closed on

Sep 1, 1994

Sold by

Olesen William L and Olesen Frieda R

Bought by

Burke Thomas J and Burke Joan M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Interest Rate

8.59%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wuestenberg Revocable Trust | -- | None Listed On Document | |

| Wuestenberg Randal L | $300,000 | -- | |

| Burke Thomas J | $230,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wuestenberg Randal L | $80,000 | |

| Previous Owner | Burke Thomas J | $230,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,235 | $159,675 | $40,535 | $119,140 |

| 2023 | $10,267 | $138,559 | $36,667 | $101,892 |

| 2022 | $10,913 | $137,147 | $35,595 | $101,552 |

| 2021 | $10,831 | $127,824 | $34,388 | $93,436 |

| 2020 | $10,802 | $125,527 | $33,770 | $91,757 |

| 2019 | $10,810 | $123,904 | $33,333 | $90,571 |

| 2018 | $10,012 | $115,816 | $34,200 | $81,616 |

| 2017 | $10,650 | $123,970 | $33,569 | $90,401 |

| 2016 | $11,283 | $121,029 | $32,773 | $88,256 |

| 2015 | -- | $112,139 | $32,773 | $79,366 |

| 2014 | -- | $112,139 | $32,773 | $79,366 |

| 2013 | -- | $114,055 | $33,333 | $80,722 |

Source: Public Records

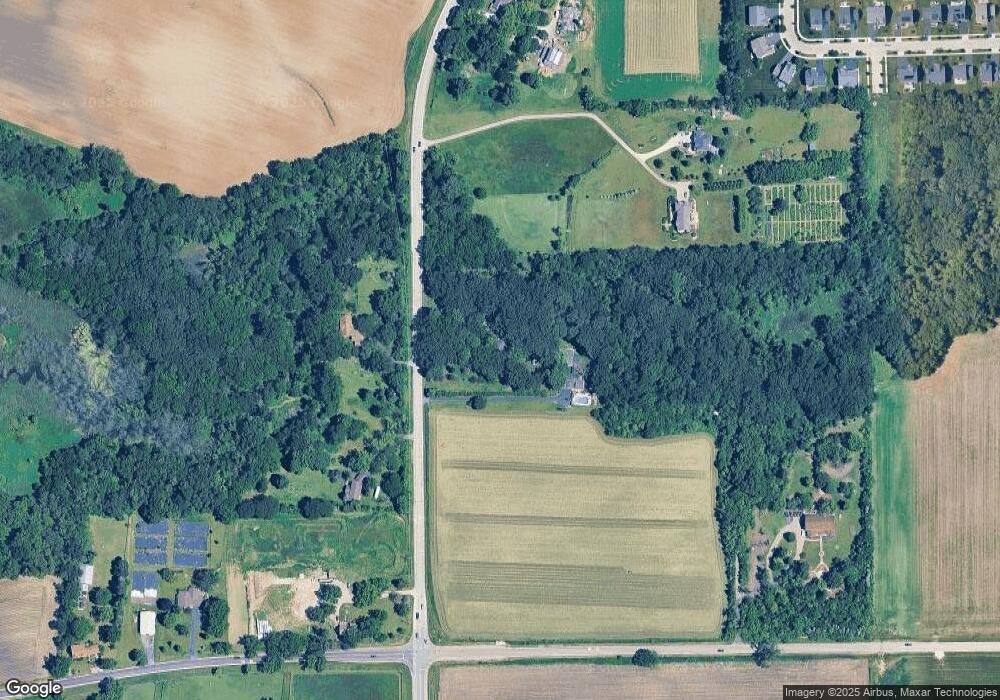

Map

Nearby Homes

- 3660 Thornhill Dr

- 3587 Sandstone Cir

- 3620 Sahara Rd

- 1846 Chandolin Ln

- 1850 Chandolin Ln

- 1848 Chandolin Ln

- 1842 Coralito Ln

- 1851 Diamond Dr

- 1847 Diamond Dr

- 1858 Chandolin Ln

- 1854 Chandolin Ln

- 1867 Chandolin Ln

- 1865 Chandolin Ln

- 1863 Chandolin Ln

- 1857 Chandolin Ln

- 1853 Chandolin Ln

- 3591 Sandstone Cir

- 3588 Sandstone Cir

- 3590 Sandstone Cir

- 3553 Doral Dr

- 8N345 Corron Rd

- 1 Corron Rd

- 8N382 Corron Rd

- 8N260 Corron Rd

- Lot 1 Corron Rd

- 8N445 Corron Rd

- 1700 Corron Rd

- 8N457 Corron Rd

- 8N567 Corron Rd

- 40W332 McDonald Rd

- 3681 Thornhill Dr

- 3683 Thornhill Dr

- 3679 Thornhill Dr

- 40 McDonald Rd

- 3685 Thornhill Dr

- 3677 Thornhill Dr

- 3687 Thornhill Dr

- 40W622 McDonald Rd

- 3680 Thornhill Dr

- 3674 Thornhill Dr

Your Personal Tour Guide

Ask me questions while you tour the home.