Estimated Value: $148,000 - $376,381

4

Beds

2

Baths

3,392

Sq Ft

$81/Sq Ft

Est. Value

About This Home

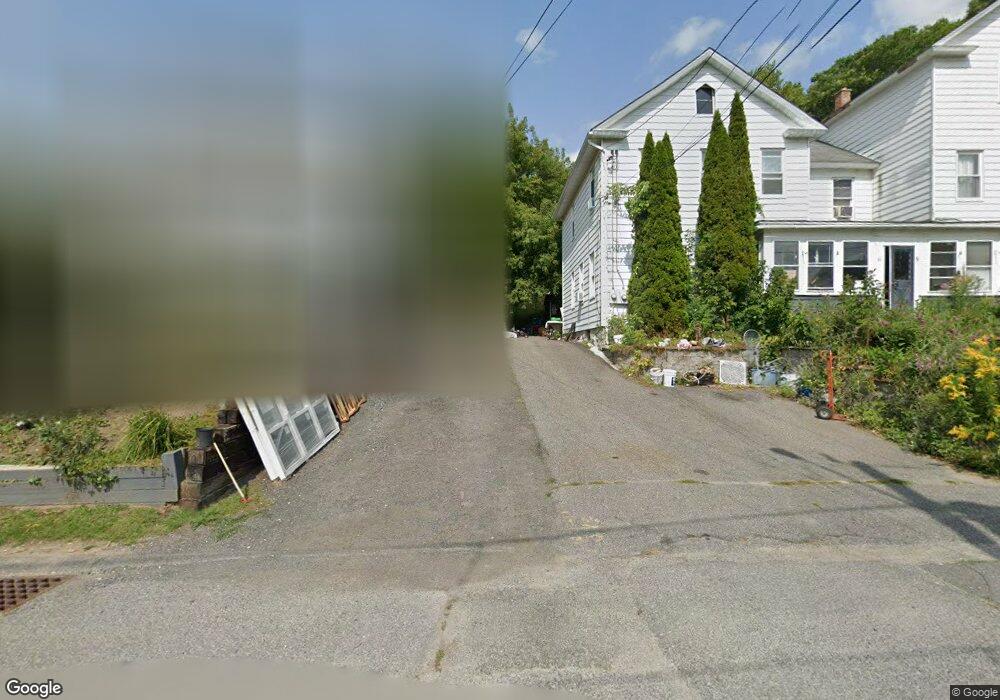

This home is located at 9 Beech St Unit 11, Adams, MA 01220 and is currently estimated at $273,345, approximately $80 per square foot. 9 Beech St Unit 11 is a home located in Berkshire County with nearby schools including Hoosac Valley Middle & High School, Berkshire Arts & Technology Charter Public School, and St. Stanislaus Kostka School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 13, 2006

Sold by

Holland Melissa L and Leja Melissa L

Bought by

Cadrett Paula M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Outstanding Balance

$110,454

Interest Rate

6.47%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$162,891

Purchase Details

Closed on

Nov 21, 1996

Sold by

Paland Jean and Chenail Mildred L

Bought by

Holland Steven M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,000

Interest Rate

7.81%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cadrett Paula M | $195,000 | -- | |

| Holland Steven M | $79,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cadrett Paula M | $185,000 | |

| Previous Owner | Holland Steven M | $78,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,400 | $258,700 | $41,500 | $217,200 |

| 2024 | $4,138 | $235,900 | $38,900 | $197,000 |

| 2023 | $3,844 | $207,200 | $35,800 | $171,400 |

| 2022 | $3,752 | $179,600 | $31,100 | $148,500 |

| 2021 | $3,920 | $173,300 | $31,100 | $142,200 |

| 2020 | $3,741 | $171,000 | $31,500 | $139,500 |

| 2019 | $3,658 | $171,000 | $31,500 | $139,500 |

| 2018 | $3,740 | $168,400 | $31,500 | $136,900 |

| 2017 | $3,599 | $168,400 | $31,500 | $136,900 |

| 2016 | $3,211 | $150,100 | $31,500 | $118,600 |

| 2015 | $3,120 | $146,000 | $33,200 | $112,800 |

| 2014 | $2,945 | $147,600 | $33,200 | $114,400 |

Source: Public Records

Map

Nearby Homes

- 10 Enterprise St

- 50 Commercial St

- 4 Edmunds St Unit A101

- 29 Crandall St

- 9 Pinnacle Point

- 34-36 Crandall St

- 6 Crandall St

- 52 Alger St

- 21 Overlook Terrace

- 219 West Rd

- 17 Morningside Ave

- 30 Summer St

- 71 Park St Unit 75

- 2 Melrose St

- 3 Melrose St

- 46 E Orchard Terrace

- 5 Richmond St

- 27 2nd St

- 2 Valley St

- 16-18 E Hoosac St