9 Cutting Dr Maynard, MA 01754

Estimated Value: $775,000 - $877,000

4

Beds

3

Baths

1,976

Sq Ft

$412/Sq Ft

Est. Value

About This Home

This home is located at 9 Cutting Dr, Maynard, MA 01754 and is currently estimated at $813,276, approximately $411 per square foot. 9 Cutting Dr is a home located in Middlesex County with nearby schools including Green Meadow School, Fowler School, and Maynard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 1998

Sold by

Palermo Julie

Bought by

Gavin David D and Gavin Stephanie W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,730

Interest Rate

6.68%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 24, 1995

Sold by

Demarco Michael J

Bought by

Encarnacion Abel and Encarnacion Julie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,000

Interest Rate

7.6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 2, 1992

Sold by

Rkk Dev Corp

Bought by

Demarco Michaelj

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gavin David D | $229,700 | -- | |

| Encarnacion Abel | $203,000 | -- | |

| Demarco Michaelj | $184,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Demarco Michaelj | $215,000 | |

| Closed | Demarco Michaelj | $206,730 | |

| Previous Owner | Demarco Michaelj | $149,000 | |

| Closed | Demarco Michaelj | $0 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,066 | $676,700 | $280,600 | $396,100 |

| 2024 | $11,280 | $630,900 | $267,200 | $363,700 |

| 2023 | $10,870 | $573,000 | $254,500 | $318,500 |

| 2022 | $10,244 | $499,200 | $213,800 | $285,400 |

| 2021 | $9,833 | $488,000 | $213,800 | $274,200 |

| 2020 | $9,794 | $474,500 | $193,400 | $281,100 |

| 2019 | $9,401 | $446,800 | $184,800 | $262,000 |

| 2018 | $32,518 | $423,500 | $168,000 | $255,500 |

| 2017 | $9,321 | $423,500 | $168,000 | $255,500 |

| 2016 | $8,999 | $423,500 | $168,000 | $255,500 |

| 2015 | $8,531 | $382,400 | $160,300 | $222,100 |

| 2014 | $8,305 | $372,600 | $155,200 | $217,400 |

Source: Public Records

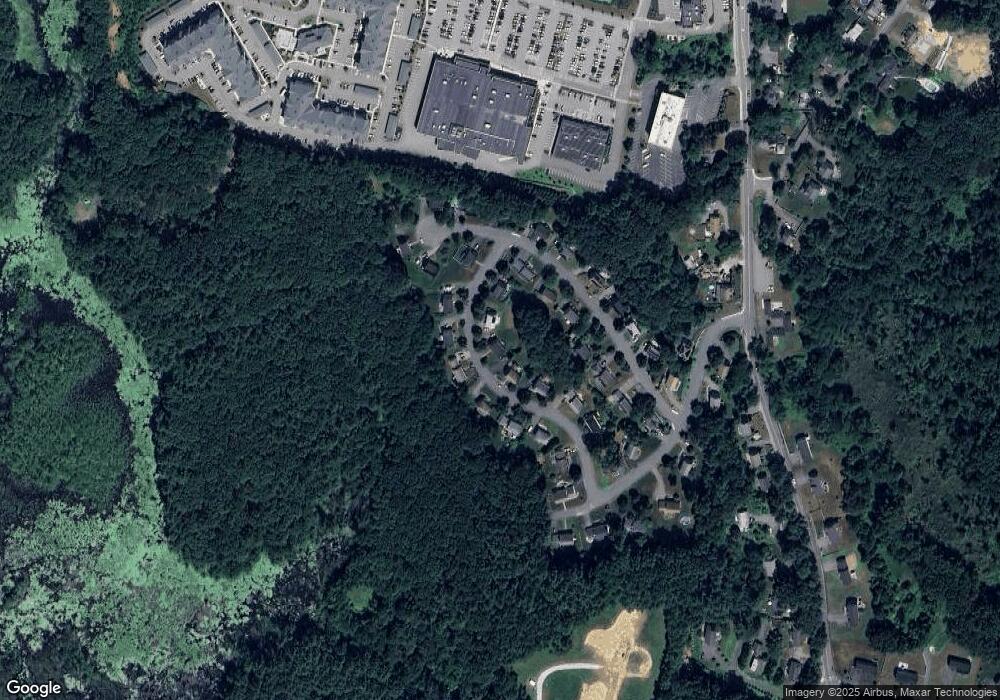

Map

Nearby Homes

- 31-33 Roosevelt St

- 41 Taylor Rd

- 13 Arthur St Unit 15

- 5 Hayes St Unit 5

- 57 Longfellow Rd

- 377 Willis Rd

- 28 Waltham St Unit A

- 22 Douglas Ave Unit 2

- 22 Douglas Ave Unit 1

- 55 Widow Rites Ln

- 45 Widow Rites Ln

- 45 Webster Cir

- 10 Mill St Unit B

- 23 Deer Path Unit 5

- 24 Deer Path Unit 5

- 30 Harness Ln

- 15 Harness Ln

- 66 Powder Mill Rd

- 68 Powder Mill Rd

- 2 & 6 Powder Mill Rd

Your Personal Tour Guide

Ask me questions while you tour the home.