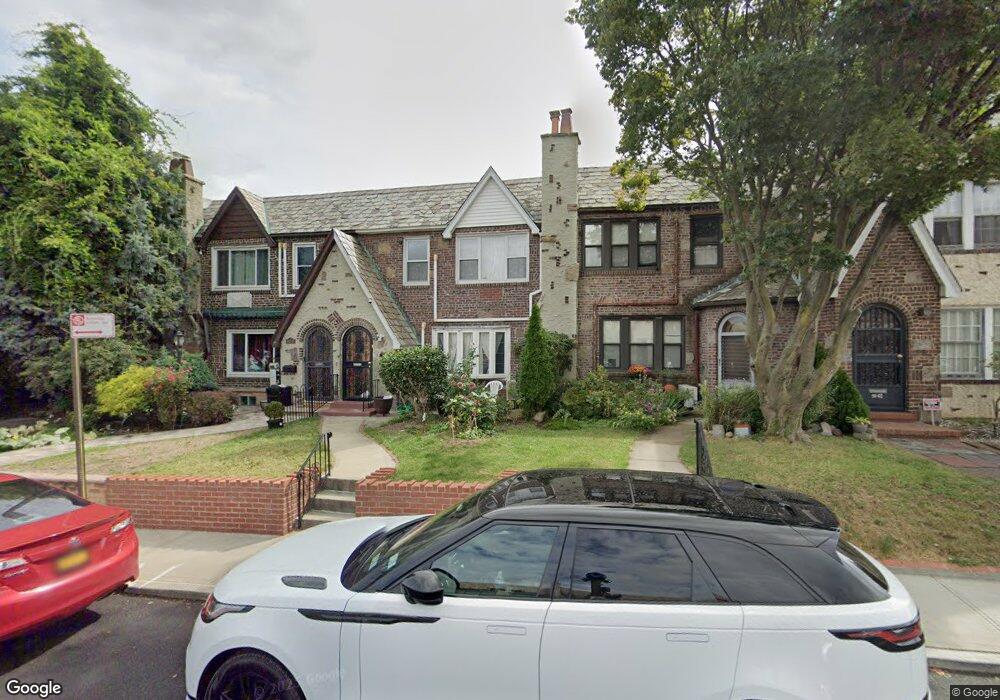

90-06 63rd Ave Rego Park, NY 11374

Rego Park NeighborhoodEstimated Value: $988,113 - $1,319,000

2

Beds

1

Bath

1,330

Sq Ft

$880/Sq Ft

Est. Value

About This Home

This home is located at 90-06 63rd Ave, Rego Park, NY 11374 and is currently estimated at $1,171,028, approximately $880 per square foot. 90-06 63rd Ave is a home located in Queens County with nearby schools including P.S. 139 Rego Park, J.H.S. 190 Russell Sage, and Forest Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2013

Sold by

My Ngo Sau As Administrator and Of The Estate Of Chi Yung Mui

Bought by

Sau My Ngo

Current Estimated Value

Purchase Details

Closed on

Nov 8, 2000

Sold by

Citarella Marie and Oliva Eleanor

Bought by

Mui Peter

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

7.64%

Purchase Details

Closed on

Aug 24, 2000

Sold by

Oliva Eleanor and Oliva James A

Bought by

Oliva Eleanor

Purchase Details

Closed on

Feb 25, 1998

Sold by

Oliva Angelina

Bought by

Oliva James A and Citarella Marie

Purchase Details

Closed on

Dec 19, 1996

Sold by

Oliva Angelina

Bought by

Oliva James A and Citarella Marie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sau My Ngo | -- | -- | |

| Sau My Ngo | -- | -- | |

| Mui Peter | $250,000 | Fidelity National Title Ins | |

| Mui Peter | $250,000 | Fidelity National Title Ins | |

| Oliva Eleanor | -- | Fidelity National Title | |

| Oliva Eleanor | -- | Fidelity National Title | |

| Oliva James A | -- | First American Title Ins Co | |

| Oliva James A | -- | First American Title Ins Co | |

| Oliva James A | -- | First American Title Ins Co | |

| Oliva James A | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mui Peter | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,563 | $50,018 | $12,949 | $37,069 |

| 2024 | $9,575 | $49,014 | $11,917 | $37,097 |

| 2023 | $9,045 | $46,434 | $11,280 | $35,154 |

| 2022 | $4,234 | $59,280 | $16,980 | $42,300 |

| 2021 | $8,481 | $54,780 | $16,980 | $37,800 |

| 2020 | $8,527 | $57,300 | $16,980 | $40,320 |

| 2019 | $6,252 | $53,100 | $16,980 | $36,120 |

| 2018 | $7,590 | $38,695 | $11,095 | $27,600 |

| 2017 | $7,150 | $36,547 | $12,628 | $23,919 |

| 2016 | $6,638 | $36,547 | $12,628 | $23,919 |

| 2015 | $3,939 | $34,735 | $13,955 | $20,780 |

| 2014 | $3,939 | $34,038 | $13,522 | $20,516 |

Source: Public Records

Map

Nearby Homes

- 6324 Alderton St

- 90-2 63rd Dr Unit 5C

- 90-02 63rd Dr Unit 5J

- 63-15 Everton St

- 62-98 Woodhaven Blvd Unit 6F

- 62-98 Woodhaven Blvd Unit 3

- 62-98 Woodhaven Blvd Unit 4M

- 6298 Woodhaven Blvd Unit 4I

- 86-08 63rd Dr

- 87-30 62nd Ave Unit 7

- 87-30 62nd Ave Unit 5

- 87-30 62nd Ave Unit 10A

- 62-66 Austin St

- 63-95 Austin St Unit 5F

- 63-95 Austin St Unit 6G

- 63-95 Austin St Unit 2C

- 6395 Austin St Unit 2F

- 63-127 Fitchett St

- 86-31 62nd Ave

- 63-16 84th Place