90 Brian Ln Effort, PA 18330

Estimated Value: $290,000 - $337,000

4

Beds

2

Baths

1,754

Sq Ft

$181/Sq Ft

Est. Value

About This Home

This home is located at 90 Brian Ln, Effort, PA 18330 and is currently estimated at $317,746, approximately $181 per square foot. 90 Brian Ln is a home located in Monroe County with nearby schools including Pleasant Valley Intermediate School, Pleasant Valley Elementary School, and Pleasant Valley Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2021

Sold by

Mcclellan Linda D and Koabel Linda D

Bought by

Cordova Blanca and Lutia Carmen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,125

Outstanding Balance

$195,557

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$122,189

Purchase Details

Closed on

Oct 30, 2006

Sold by

Beebe Leonard W and Beebe Elvida M

Bought by

Mcclellan Linda D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

9.03%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cordova Blanca | $236,500 | Keystone Premier Stlmt Svcs | |

| Mcclellan Linda D | $200,000 | Fidelity Home Abstract |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cordova Blanca | $216,125 | |

| Previous Owner | Mcclellan Linda D | $100,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $958 | $120,130 | $26,000 | $94,130 |

| 2024 | $797 | $120,130 | $26,000 | $94,130 |

| 2023 | $3,638 | $120,130 | $26,000 | $94,130 |

| 2022 | $3,539 | $120,130 | $26,000 | $94,130 |

| 2021 | $3,373 | $120,130 | $26,000 | $94,130 |

| 2019 | $3,852 | $21,610 | $3,000 | $18,610 |

| 2018 | $3,809 | $21,610 | $3,000 | $18,610 |

| 2017 | $3,765 | $21,610 | $3,000 | $18,610 |

| 2016 | $599 | $21,610 | $3,000 | $18,610 |

| 2015 | -- | $21,610 | $3,000 | $18,610 |

| 2014 | -- | $21,610 | $3,000 | $18,610 |

Source: Public Records

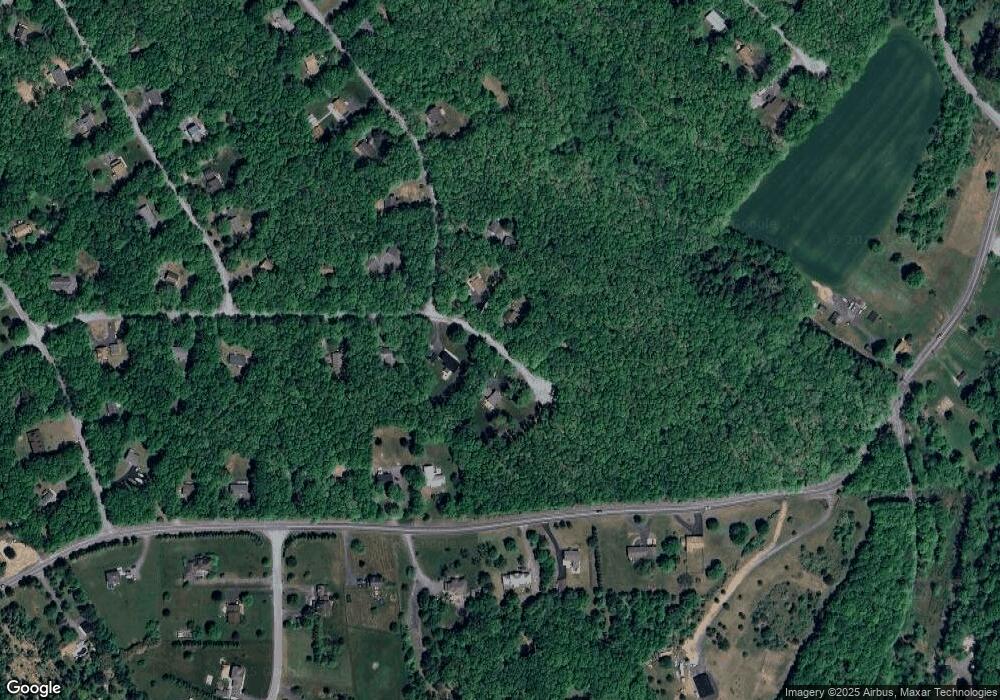

Map

Nearby Homes

- 144 Shenkel Rd

- 138 Jennifer Ln

- 232 Shenandoah Trail

- 140 Alcott Ln

- 226 Apache Dr

- lot 253 Service Rd

- 171 Foothill Blvd

- 0 Johns Rd 549 Rd N

- 1912 Johns Rd

- 113 Wilson Ct

- 25 Rollingwood Trail

- 2641 Yellowstone Dr

- 2540 Allegheny Dr

- 1055 Sugar Hollow Rd

- 1670 Erie Ct

- Lot 103 Russell Ct

- 0 Johns Rd Unit PM-136428

- 899 Lower Mountain Dr

- 341 Donalds Rd

- 409 Warner Dr

Your Personal Tour Guide

Ask me questions while you tour the home.