900 Johnson Bend Rd Weatherford, TX 76088

Estimated Value: $340,000

--

Bed

--

Bath

600

Sq Ft

$567/Sq Ft

Est. Value

About This Home

This home is located at 900 Johnson Bend Rd, Weatherford, TX 76088 and is currently estimated at $340,000, approximately $566 per square foot. 900 Johnson Bend Rd is a home located in Parker County with nearby schools including Peaster Elementary School, Peaster Middle School, and Peaster High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2007

Sold by

Bartlett Stephen J and Bartlett Denise

Bought by

Bird Steven K and Bird April

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,800

Outstanding Balance

$46,777

Interest Rate

6.32%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$293,223

Purchase Details

Closed on

Mar 13, 2007

Sold by

Bartlett Stephen J and Bartlett Denise M

Bought by

Bird Steven K and Bird April M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,800

Outstanding Balance

$46,777

Interest Rate

6.32%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$293,223

Purchase Details

Closed on

Jul 3, 2003

Sold by

Inner-Finance Inc

Bought by

Bird Steven K and Bird April

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bird Steven K | -- | -- | |

| Bird Steven K | -- | Stnt | |

| Bird Steven K | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bird Steven K | $77,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,836 | $150,603 | $35,620 | $114,983 |

| 2024 | $2,836 | $163,790 | $35,620 | $128,170 |

| 2023 | $2,836 | $163,790 | $35,620 | $128,170 |

| 2022 | $2,487 | $124,680 | $32,530 | $92,150 |

| 2021 | $2,506 | $124,680 | $32,530 | $92,150 |

| 2020 | $1,755 | $85,550 | $11,600 | $73,950 |

| 2019 | $1,843 | $85,550 | $11,600 | $73,950 |

| 2018 | $1,706 | $78,920 | $10,000 | $68,920 |

| 2017 | $1,697 | $78,920 | $10,000 | $68,920 |

| 2016 | $1,565 | $72,780 | $10,000 | $62,780 |

| 2015 | $1,544 | $72,780 | $10,000 | $62,780 |

| 2014 | $1,091 | $50,870 | $10,000 | $40,870 |

Source: Public Records

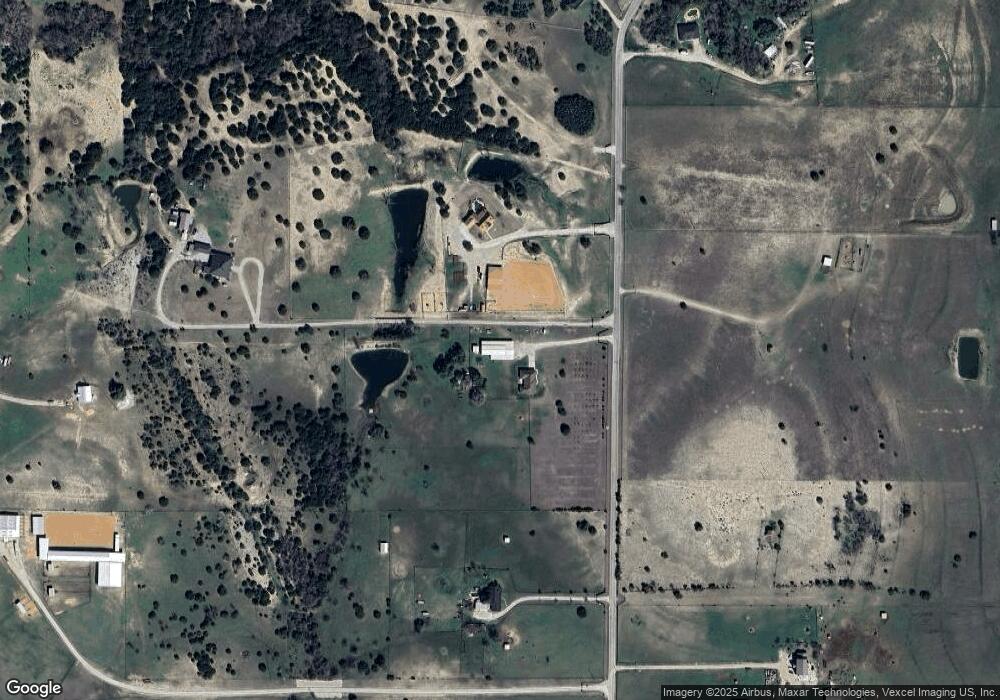

Map

Nearby Homes

- 950 Johnson Bend Rd

- 1205 Johnson Bend Rd

- 175 Bittersweet Trail

- 162 Bittersweet Trail

- 3601 Oak Cir

- 4320 Fm 920

- 201 Flat Rock Ln

- 4200 Fm 920

- 3533 Fir St

- 319 Green Acres Rd

- 111 Sharla Smelley Rd

- TBD Fm 920 Peaster Hwy

- 312 Green Acres Rd

- 3667 Oak Cir

- 3639 Cedar St

- 1047 Twin Creeks Dr

- 105 Paige St

- 1043 Twin Creeks Dr

- 187 Gibson Ln Unit 171 - 187 Odd Number

- 300 Constitution Ct

- 1312 Johnson Bend Rd

- 770 Johnson Bend Rd

- 830 Johnson Bend Rd

- 720 Johnson Bend Rd

- 777 Johnson Bend Rd

- 733 Johnson Bend Rd

- 001 Johnson Bend Rd

- 0 Johnson Bend Rd Unit 11733386

- 1201 Johnson Bend Rd

- 977 Johnson Bend Rd

- 712 Johnson Bend Rd

- 1209 Johnson Bend Rd

- 5074 Fm 920

- 690 Johnson Bend Rd

- 581 Johnson Bend Rd

- 4938 Fm 920

- 1213 Johnson Bend Rd

- 982 Johnson Bend Rd

- 640 Johnson Bend Rd

- 166 Bittersweet Trail