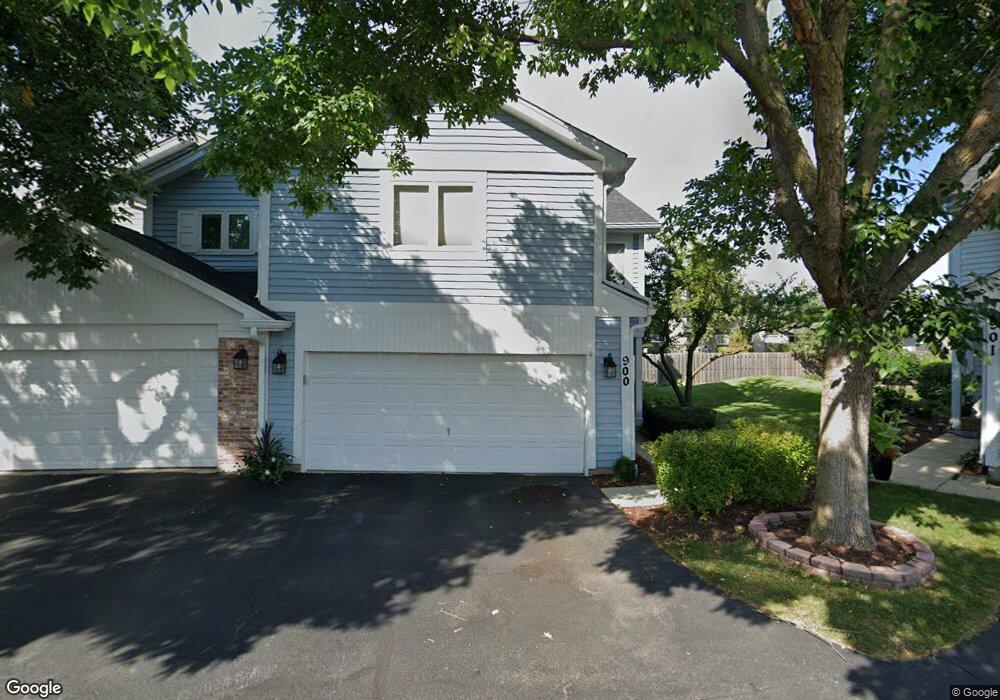

900 Lauren Ct Westmont, IL 60559

South Westmont NeighborhoodEstimated Value: $367,492 - $376,000

2

Beds

2

Baths

1,432

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 900 Lauren Ct, Westmont, IL 60559 and is currently estimated at $370,623, approximately $258 per square foot. 900 Lauren Ct is a home located in DuPage County with nearby schools including Holmes Elementary School, Maercker Elementary School, and Westview Hills Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2015

Sold by

Rocha Matthew W and Ugay Jonathan V

Bought by

Rocha Matthew W and Ugay Jonathan V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,480

Outstanding Balance

$33,033

Interest Rate

3.87%

Mortgage Type

New Conventional

Estimated Equity

$337,590

Purchase Details

Closed on

Jul 31, 2008

Sold by

Wheeler John W

Bought by

Wheeler John W and John W Revocable Trust

Purchase Details

Closed on

Jan 29, 2007

Sold by

Molera Chito

Bought by

Rocha Matthew W and Wheeler John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,000

Interest Rate

6.22%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 23, 1993

Sold by

State Bank Of Countryside

Bought by

Molera Chito

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,840

Interest Rate

6.93%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rocha Matthew W | -- | Attorney | |

| Wheeler John W | -- | None Available | |

| Rocha Matthew W | $260,000 | First American Title Ins Co | |

| Molera Chito | $136,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rocha Matthew W | $81,480 | |

| Previous Owner | Rocha Matthew W | $95,000 | |

| Previous Owner | Molera Chito | $131,840 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,382 | $102,829 | $23,692 | $79,137 |

| 2023 | $6,094 | $94,530 | $21,780 | $72,750 |

| 2022 | $5,595 | $85,850 | $19,780 | $66,070 |

| 2021 | $5,410 | $84,870 | $19,550 | $65,320 |

| 2020 | $5,307 | $83,190 | $19,160 | $64,030 |

| 2019 | $5,148 | $79,820 | $18,380 | $61,440 |

| 2018 | $5,312 | $80,020 | $18,430 | $61,590 |

| 2017 | $5,020 | $77,000 | $17,730 | $59,270 |

| 2016 | $4,919 | $73,490 | $16,920 | $56,570 |

| 2015 | $5,062 | $72,020 | $16,580 | $55,440 |

| 2014 | $5,096 | $72,190 | $16,620 | $55,570 |

| 2013 | $4,942 | $71,850 | $16,540 | $55,310 |

Source: Public Records

Map

Nearby Homes

- 12 James Dr

- 245 Carlisle Ave

- 907 S Williams St Unit 212

- 907 S Williams St Unit 206

- 907 S Williams St Unit 210

- 511 S Cass Ave

- 263 Deming Place

- 1017 Fordham Way

- 55 W 64th St Unit 202

- 67 W 64th St Unit 101

- 55 W 64th St Unit 102

- 1313 Cass Ln E Unit 301

- 1040 Longford Ct

- 500 S Wilmette Ave

- 47 W Pier Dr Unit 102

- 61 Pier Dr Unit 202

- 440 Lindley Ave

- 428 S Warwick Ave

- 220 Memory Ln Unit 3

- 532 W 59th St

- 902 Lauren Ct

- 901 Lauren Ct Unit 3

- 903 Lauren Ct

- 904 Lauren Ct

- 906 Lauren Ct

- 905 Lauren Ct Unit 3

- 907 Lauren Ct

- 10 W 60th St

- 908 Lauren Ct

- 910 Lauren Ct

- 901 Jordan Ct

- 909 Lauren Ct Unit 3

- 903 Jordan Ct

- 912 Lauren Ct

- 905 Jordan Ct

- 911 Lauren Ct

- 907 Jordan Ct

- 6002 S Cass Ave Unit 6002B

- 6002 S Cass Ave Unit B

- 913 Lauren Ct