900 Olde Sterling Way Dayton, OH 45459

Woodbourne-Hyde Park NeighborhoodEstimated Value: $726,421 - $899,000

3

Beds

3

Baths

4,642

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 900 Olde Sterling Way, Dayton, OH 45459 and is currently estimated at $808,474, approximately $174 per square foot. 900 Olde Sterling Way is a home located in Montgomery County with nearby schools including Primary Village North, John Hole Elementary, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 3, 2010

Sold by

Union Savings Bank

Bought by

Talcott Frederick L and Talcott Katheryn R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

5.05%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 24, 2010

Sold by

Premier Builders Supply Inc and Gerhard Mark Robert

Bought by

Union Savings Bank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

5.05%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 2, 2009

Sold by

Burg Steven D

Bought by

Usb Mortgage Corporation

Purchase Details

Closed on

Mar 15, 2007

Sold by

Alex Bell Inc

Bought by

Burg Steven D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

6.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 9, 2001

Sold by

Aba Partners Pll

Bought by

Alex Bell Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Talcott Frederick L | $450,000 | Attorney | |

| Union Savings Bank | $415,000 | None Available | |

| Usb Mortgage Corporation | -- | None Available | |

| Burg Steven D | $112,000 | Attorney | |

| Alex Bell Inc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Talcott Frederick L | $380,000 | |

| Previous Owner | Burg Steven D | $84,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,630 | $214,450 | $31,500 | $182,950 |

| 2023 | $12,630 | $214,450 | $31,500 | $182,950 |

| 2022 | $15,989 | $214,450 | $31,500 | $182,950 |

| 2021 | $16,033 | $214,450 | $31,500 | $182,950 |

| 2020 | $16,011 | $214,450 | $31,500 | $182,950 |

| 2019 | $15,546 | $187,220 | $31,500 | $155,720 |

| 2018 | $16,490 | $187,220 | $31,500 | $155,720 |

| 2017 | $15,648 | $187,220 | $31,500 | $155,720 |

| 2016 | $16,343 | $184,530 | $31,500 | $153,030 |

| 2015 | $15,985 | $184,530 | $31,500 | $153,030 |

| 2014 | $15,985 | $184,530 | $31,500 | $153,030 |

| 2012 | -- | $200,830 | $35,000 | $165,830 |

Source: Public Records

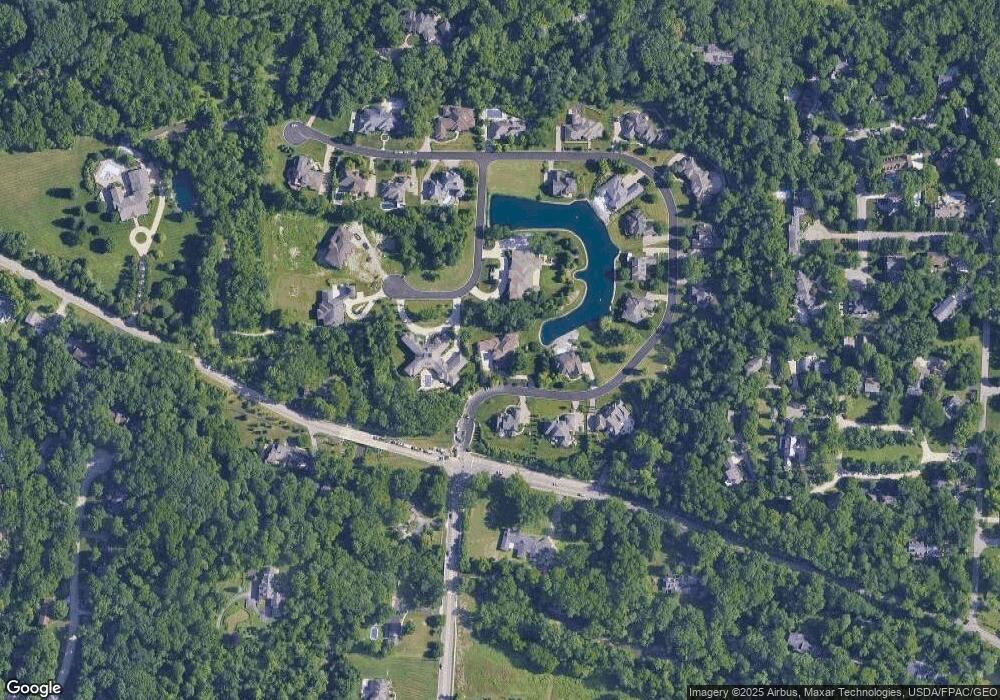

Map

Nearby Homes

- 901 Olde Sterling Way

- 950 Olde Sterling Way

- 6013 Gothic Place

- 6561 Fieldson Rd

- 1464 W Alex Bell Rd

- 5920 Mad River Rd

- 1221 Wood Mill Trail

- 427 Meadowview Dr

- 480 Southbrook Dr

- 1553 Roamont Dr

- 6401 Broken Arrow Place

- 6342 Seton Hill St

- 1487 Beaushire Cir

- 6121 Old Spanish Trail

- 5451 Folkestone Dr

- 6106 Old Spanish Trail

- 6630 Carinthia Dr

- 1931 Alda Ct

- 1241 Agate Trail

- 4286 Apple Branch Dr

- 912 Olde Sterling Way

- 870 Southwick Cir

- 890 Southwick Cir

- 909 Olde Sterling Way

- 917 Olde Sterling Way

- 930 Olde Sterling Way

- 938 Olde Sterling Way

- 974 Olde Sterling Way

- 986 Olde Sterling Way

- 925 W Alex Bell Rd

- 972 W Alex Bell Rd

- 6501 Mcewen Rd

- 962 Olde Sterling Way

- 1075 W Alex Bell Rd

- 992 Olde Sterling Way

- 933 Olde Sterling Way

- 860 Southwick Cir

- 860 Southwick

- 998 Olde Sterling Way

- 981 Olde Sterling Way