902 Locust Ln Unit 2 Peotone, IL 60468

Estimated Value: $369,758 - $420,000

3

Beds

3

Baths

--

Sq Ft

0.25

Acres

About This Home

This home is located at 902 Locust Ln Unit 2, Peotone, IL 60468 and is currently estimated at $398,440. 902 Locust Ln Unit 2 is a home located in Will County with nearby schools including Peotone Elementary School, Peotone Intermediate Center, and Peotone Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2011

Sold by

Tomasek David and Tomasek Melissa

Bought by

Hartt Michael D and Hartt Stacey A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,430

Outstanding Balance

$144,669

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$253,771

Purchase Details

Closed on

Feb 2, 2007

Sold by

Peotone Bank & Trust Co

Bought by

Tomasek David and Tomasek Melissa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,005

Interest Rate

6.23%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 10, 2006

Sold by

J & J Investment Group Llc

Bought by

Peotone Bank & Trust Co and Trust #91401

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,005

Interest Rate

6.23%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hartt Michael D | $214,900 | Attorneys Title Guaranty Fun | |

| Tomasek David | $260,500 | 1St American Title | |

| Peotone Bank & Trust Co | -- | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hartt Michael D | $209,430 | |

| Previous Owner | Tomasek David | $245,005 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,487 | $97,597 | $17,861 | $79,736 |

| 2023 | $5,487 | $91,820 | $18,161 | $73,659 |

| 2022 | $5,123 | $82,832 | $16,383 | $66,449 |

| 2021 | $4,893 | $76,547 | $15,140 | $61,407 |

| 2020 | $4,750 | $72,694 | $14,378 | $58,316 |

| 2019 | $4,961 | $72,694 | $14,378 | $58,316 |

| 2018 | $5,302 | $72,694 | $14,378 | $58,316 |

| 2017 | $5,266 | $71,794 | $15,011 | $56,783 |

| 2016 | $5,189 | $70,387 | $14,717 | $55,670 |

| 2015 | $5,468 | $68,072 | $14,233 | $53,839 |

| 2014 | $5,468 | $68,072 | $14,233 | $53,839 |

| 2013 | $5,468 | $68,559 | $14,335 | $54,224 |

Source: Public Records

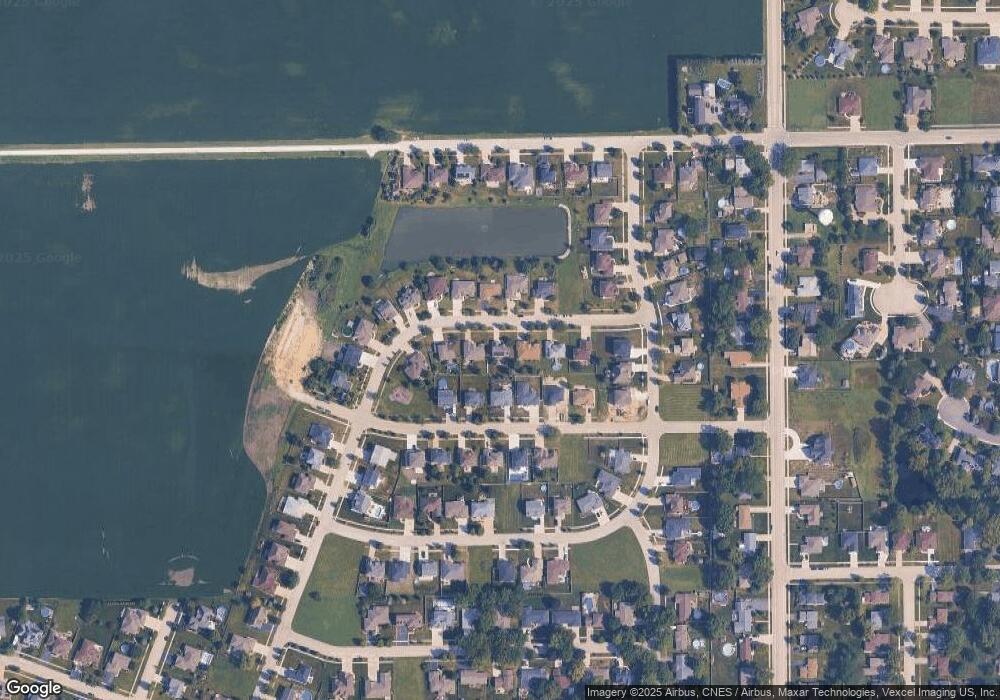

Map

Nearby Homes

- The Sommerville Plan at Westgate Manor

- The FoxGrove Plan at Westgate Manor

- The Prairie View Plan at Westgate Manor

- The Aspen II Plan at Westgate Manor

- The Manchester II Plan at Westgate Manor

- The Prairie II Plan at Westgate Manor

- The Stonebridge II Plan at Westgate Manor

- 927 Locust Ln

- 405 Locust Ln

- Lot 015 S Rathje Rd

- 28200 S Lagrange Hwy

- Sec.32 W T 33n R 13e Rd

- 1035 Bonnie Ln

- 0 W Wilmington Rd

- 332 W North St

- 333 W North St

- 823 Oriole Dr

- 00 S Center Rd

- 0 W Wilmington Rd

- 200 W Crawford St

- 906 Locust Ln

- 820 W Locust Ln

- 903 Garfield Ave

- 914 Locust Ln

- 907 Garfield Ave

- 816 Locust Ln

- 910 W Locust Ln

- 910 Locust Ln

- 907 Locust Ln

- 903 Locust Ln

- 911 Garfield Ave

- 821 W Locust Ln

- 815 Garfield Ave

- 408 S Westgate Dr

- 817 Locust Ln

- 804 Locust Ln

- 911 Locust Ln

- 811 Garfield Ave

- 813 W Locust Ln

- 902 Garfield Ave