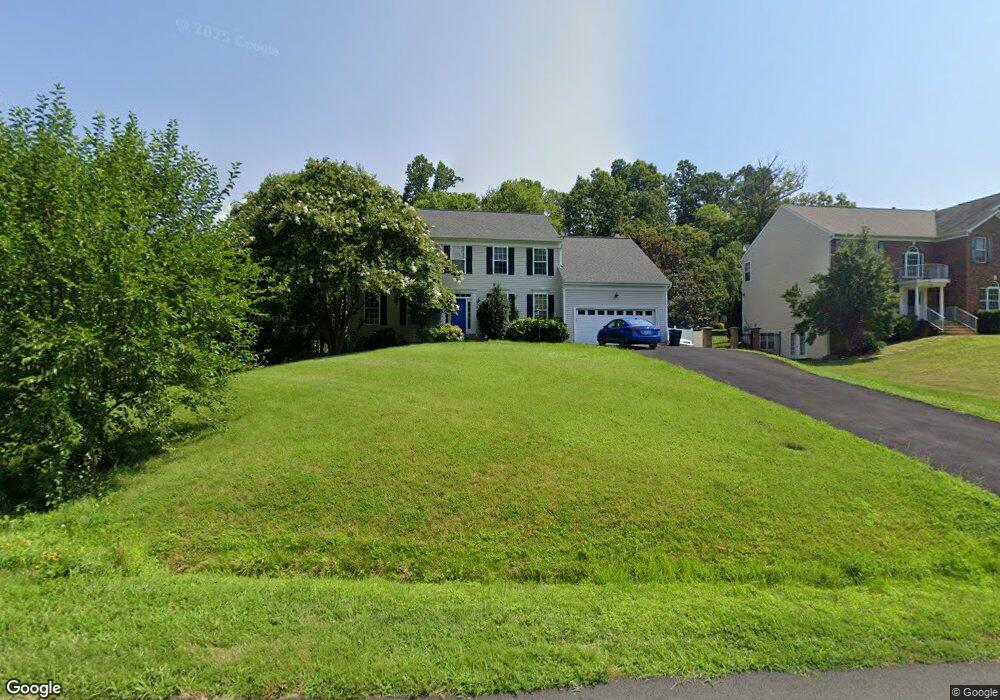

9022 Igoe St Lorton, VA 22079

Crosspointe NeighborhoodEstimated Value: $988,000 - $1,077,000

4

Beds

4

Baths

2,810

Sq Ft

$366/Sq Ft

Est. Value

About This Home

This home is located at 9022 Igoe St, Lorton, VA 22079 and is currently estimated at $1,027,309, approximately $365 per square foot. 9022 Igoe St is a home located in Fairfax County with nearby schools including Halley Elementary School, South County Middle School, and South County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2021

Sold by

Ward Mark A and Ward Sun S

Bought by

Ward Mark A and Ward Sun S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$623,000

Outstanding Balance

$476,141

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$551,168

Purchase Details

Closed on

Oct 30, 2007

Sold by

Marcum Timothy F

Bought by

Ward Mark A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$588,000

Interest Rate

6.43%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ward Mark A | -- | Accommodation | |

| Ward Mark A | $735,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ward Mark A | $623,000 | |

| Previous Owner | Ward Mark A | $588,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,525 | $896,440 | $448,000 | $448,440 |

| 2024 | $9,525 | $822,220 | $407,000 | $415,220 |

| 2023 | $10,601 | $939,370 | $433,000 | $506,370 |

| 2022 | $9,129 | $798,320 | $358,000 | $440,320 |

| 2021 | $8,298 | $707,140 | $314,000 | $393,140 |

| 2020 | $8,048 | $680,020 | $302,000 | $378,020 |

| 2019 | $7,428 | $627,600 | $296,000 | $331,600 |

| 2018 | $6,999 | $608,600 | $277,000 | $331,600 |

| 2017 | $7,799 | $671,760 | $277,000 | $394,760 |

| 2016 | $7,782 | $671,760 | $277,000 | $394,760 |

| 2015 | $7,355 | $659,020 | $272,000 | $387,020 |

| 2014 | $6,633 | $595,670 | $247,000 | $348,670 |

Source: Public Records

Map

Nearby Homes

- 8625 Oak Chase Cir

- 8622 Cross Chase Ct

- 8834 Ox Rd

- 8811 Ox Rd

- The Grant Plan at Southern Oaks Reserve

- The Taylor Plan at Southern Oaks Reserve

- 8560 Koluder Ct

- 8757 Southern Oaks Place

- 8761 Southern Oaks Place

- 8542 Blue Rock Ln

- 8504 Blue Rock Ln

- 8503 Bertsky Ln

- 8970 Fascination Ct Unit 315

- 8703 Flowering Dogwood Ln

- 8605 Eagle Glen Terrace

- 8912 Yellow Daisy Place

- 8431 Ambrose Ct

- 8011 Treasure Tree Ct

- 8153 Old Barrington Blvd

- 9423 Ox Rd