91-1024 Huliau St Unit 40 Ewa Beach, HI 96706

Estimated Value: $447,000 - $463,000

2

Beds

1

Bath

682

Sq Ft

$665/Sq Ft

Est. Value

About This Home

This home is located at 91-1024 Huliau St Unit 40, Ewa Beach, HI 96706 and is currently estimated at $453,855, approximately $665 per square foot. 91-1024 Huliau St Unit 40 is a home located in Honolulu County with nearby schools including Holomua Elementary School, Ilima Intermediate School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2019

Sold by

Yamamoto James Eiji

Bought by

Garduque Vandolf Viernes

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,333

Outstanding Balance

$292,472

Interest Rate

4.1%

Estimated Equity

$161,383

Purchase Details

Closed on

Dec 23, 2008

Sold by

Hale Joseph and Hale Elena Martin

Bought by

Yamamoto James Eiji

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

6.03%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 10, 1999

Sold by

Gentry Homes Ltd

Bought by

Crail Gordon Camino and Crail Elena Martin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,060

Interest Rate

7.2%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garduque Vandolf Viernes | -- | Or | |

| Garduque Vandolf Viernes | -- | Or | |

| Yamamoto James Eiji | $185,000 | Fam | |

| Crail Gordon Camino | $114,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garduque Vandolf Viernes | $333,333 | |

| Closed | Garduque Vandolf Viernes | $333,333 | |

| Previous Owner | Yamamoto James Eiji | $175,750 | |

| Previous Owner | Crail Gordon Camino | $111,060 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,571 | $453,800 | $169,300 | $284,500 |

| 2024 | $1,571 | $448,900 | $162,800 | $286,100 |

| 2023 | $1,560 | $445,800 | $162,800 | $283,000 |

| 2022 | $1,246 | $356,100 | $156,300 | $199,800 |

| 2021 | $1,140 | $325,800 | $156,300 | $169,500 |

| 2020 | $1,126 | $321,600 | $156,300 | $165,300 |

| 2019 | $790 | $354,800 | $143,300 | $211,500 |

| 2018 | $790 | $305,700 | $117,400 | $188,300 |

| 2017 | $706 | $281,600 | $88,100 | $193,500 |

| 2016 | $572 | $243,400 | $82,900 | $160,500 |

| 2015 | $569 | $242,700 | $80,400 | $162,300 |

| 2014 | $679 | $231,800 | $78,900 | $152,900 |

Source: Public Records

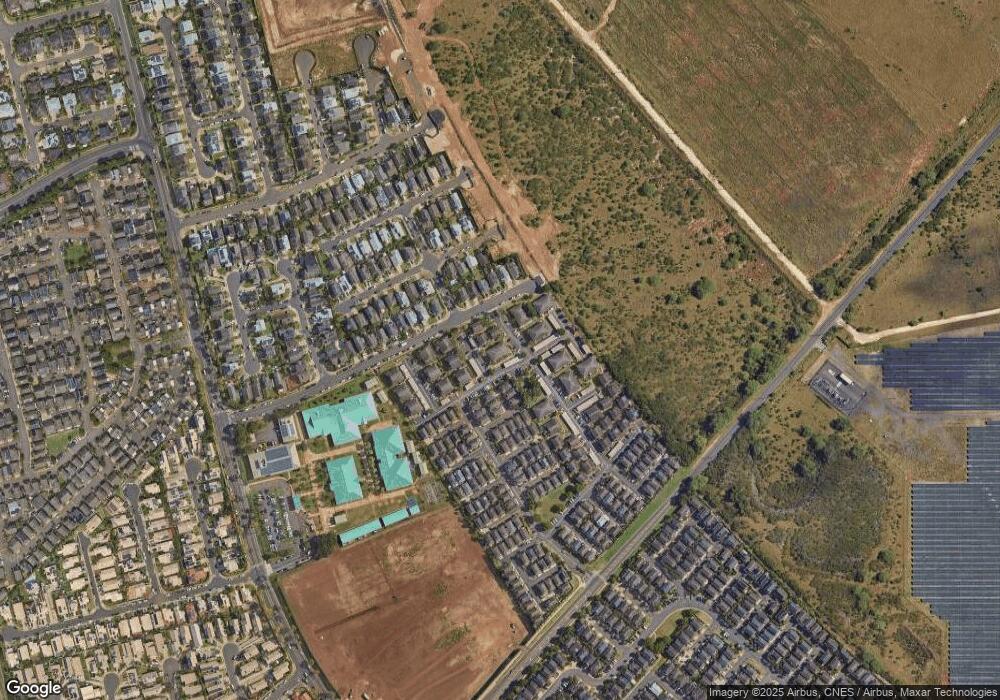

Map

Nearby Homes

- 91-1028 Laulauna St Unit 9

- 91-1051 Laulauna St Unit 3

- 91-1040 Hoomaka St Unit 16

- 91 Laupai St

- 91-1010 Huliau St Unit 5C

- 91-1018 Laulauna St Unit 124

- 91-1011 Laulauna St Unit 136

- 91-1022 Huliau St Unit 1A

- 91-280 Makalea St Unit 23

- 91-292 Makalea St Unit 29

- 91-318 Makalea St Unit 42

- 91-1659 Kaukolu St

- 91-338 Makalea St Unit 52

- 91-215 Keonekapu Place

- 91-380 Makalea St Unit 73

- 91-1040 Komoaina St Unit 73

- 91-1025-B Hoomaka St Unit 76

- 91-297 Makalauna Place Unit 1

- 91-422 Makalea St Unit 94

- 91-1021 Kuina St Unit 119

- 91-1024 Huliau St Unit E40

- 91-1024 Huliau St Unit P40

- 91-1024 Huliau St Unit 40M

- 91-1024 Huliau St Unit 40

- 91-1024 Huliau St Unit 40S

- 91-1024 Huliau St Unit 40

- 91-1024 Huliau St Unit 40

- 91-1028 Huliau St Unit 3

- 91-1028 Huliau St Unit 3

- 911026 Huliau St Unit 2A

- 91-1026 Huliau St Unit 2

- 91-1026 Huliau St Unit 2

- 91-1030 Huliau St Unit 1B

- 91-1030 Huliau St Unit 1A

- 91 Huliau St

- 91-1041 Hoomaka St Unit 51

- 91-1057 Laulauna St Unit 1

- 91-1057 Laulauna St Unit 1

- 91-1057 Laulauna St Unit 1

- 91-1057 Laulauna St Unit 1