91-1025 Puwalu St Unit 31 Ewa Beach, HI 96706

Estimated Value: $713,000 - $756,000

3

Beds

3

Baths

1,226

Sq Ft

$601/Sq Ft

Est. Value

About This Home

This home is located at 91-1025 Puwalu St Unit 31, Ewa Beach, HI 96706 and is currently estimated at $736,401, approximately $600 per square foot. 91-1025 Puwalu St Unit 31 is a home located in Honolulu County with nearby schools including Holomua Elementary School, Ilima Intermediate School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2025

Sold by

Sejalbo Erwin Dejos and Robelyn Laureta

Bought by

Erwin Dejos Sejalbo And Robelyn Laureta Sejal and Sejalbo

Current Estimated Value

Purchase Details

Closed on

Sep 13, 2021

Sold by

Sejalbo Erwin Dejos and Sejalbo Robelyn Laureta

Bought by

Sejalbo Erwin Dejos and Sejalbo Robelyn Laureta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$499,800

Interest Rate

2.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 22, 2016

Sold by

Sejalbo Erwin Dejos and Sejalbo Robelyn Laureta

Bought by

The Erwin Dejos Sejalbo & Robelyn Lauret and Sejalbo Robelyn Laureta

Purchase Details

Closed on

Jun 5, 2006

Sold by

Bryant Bruce Elbert and Bryant Blanquita Nieves

Bought by

Sejalbo Erwin Dejos and Sejalbo Robelyn Laureta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$344,000

Interest Rate

6.87%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jan 13, 2003

Sold by

Kim Chad Yong Kang

Bought by

Bryant Bruce Elbert and Bryant Blanquita Nieves

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$229,500

Interest Rate

6.15%

Mortgage Type

VA

Purchase Details

Closed on

May 25, 1999

Sold by

Gentry Homes Ltd

Bought by

Kim Chad Yong Kang

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,753

Interest Rate

6.86%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Erwin Dejos Sejalbo And Robelyn Laureta Sejal | -- | None Listed On Document | |

| Sejalbo Erwin Dejos | -- | Fntic | |

| Sejalbo Erwin Dejos | -- | Fntic | |

| The Erwin Dejos Sejalbo & Robelyn Lauret | -- | None Available | |

| The Erwin Dejos Sejalbo & Robelyn Lauret | -- | None Available | |

| Sejalbo Erwin Dejos | $430,000 | None Available | |

| Bryant Bruce Elbert | $225,000 | -- | |

| Kim Chad Yong Kang | $204,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sejalbo Erwin Dejos | $499,800 | |

| Previous Owner | Sejalbo Erwin Dejos | $344,000 | |

| Previous Owner | Bryant Bruce Elbert | $229,500 | |

| Previous Owner | Kim Chad Yong Kang | $198,753 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,174 | $733,300 | $493,400 | $239,900 |

| 2024 | $2,174 | $741,100 | $476,400 | $264,700 |

| 2023 | $1,820 | $720,100 | $476,400 | $243,700 |

| 2022 | $1,988 | $668,000 | $448,700 | $219,300 |

| 2021 | $1,589 | $553,900 | $338,200 | $215,700 |

| 2020 | $1,612 | $560,600 | $340,300 | $220,300 |

| 2019 | $1,621 | $543,100 | $333,500 | $209,600 |

| 2018 | $1,567 | $527,800 | $306,300 | $221,500 |

| 2017 | $1,451 | $494,700 | $214,400 | $280,300 |

| 2016 | $1,225 | $429,900 | $238,200 | $191,700 |

| 2015 | $1,194 | $421,100 | $129,500 | $291,600 |

| 2014 | $905 | $397,000 | $142,600 | $254,400 |

Source: Public Records

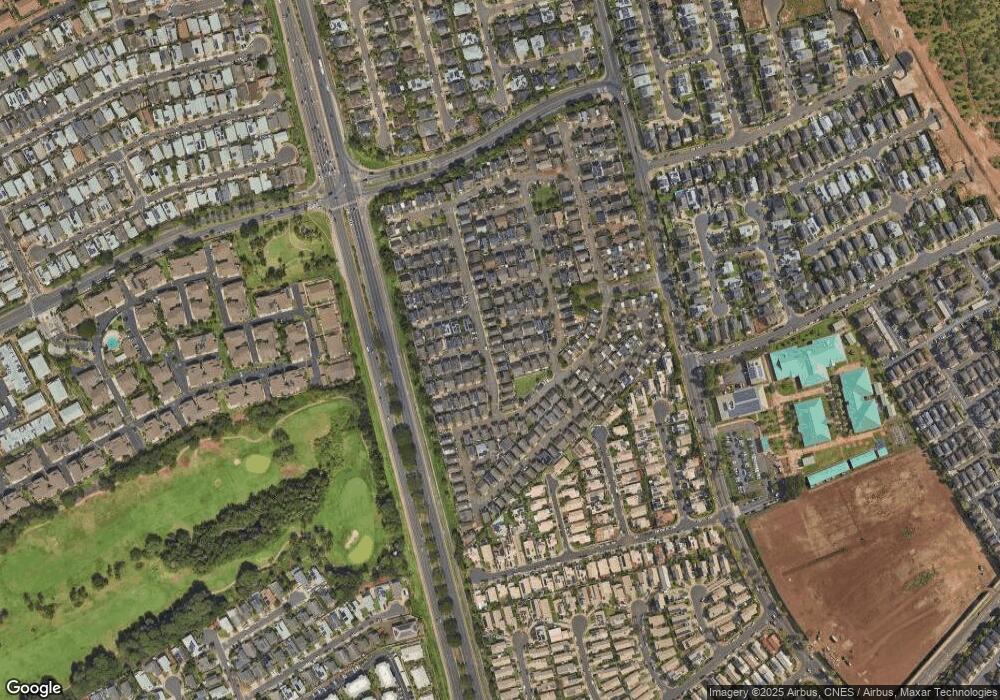

Map

Nearby Homes

- 91-1021 Kuina St Unit 119

- 91-214 Hoopaa Place Unit 113

- 91-1025-B Hoomaka St Unit 76

- 91-1030 Hoopili St Unit 54

- 91-207 Niukahiki Place Unit 64

- 91-1032 Mikiala St Unit 182

- 91-1005 Leleoi St Unit 91

- 91-215 Keonekapu Place

- 91-996 Laaulu St Unit 32

- 91-988 Laaulu St Unit 34B

- 91-1012 Laaulu St Unit 28

- 91-202 Makaina Place

- 91-979 Laaulu St Unit 36

- 91-1022 Huliau St Unit 1A

- 91-1010 Huliau St Unit 5C

- 91-1035 Laaulu St Unit 24

- 91-957 Laaulu St Unit 40

- 91 Laupai St

- 91-1659 Kaukolu St

- 91-1040 Hoomaka St Unit 16

- 91-200 Hoopaa Place Unit 110

- 91-1021 Puwalu St Unit 30

- 91-1017 Puwalu St Unit 29

- 91-1013 Puwalu St Unit 28

- 91-1029 Puwalu St Unit 32

- 91-201 Papahi Place Unit 124

- 91-204 Hoopaa Place Unit 111

- 91-1033 Puwalu St Unit 33

- 91-219 Hoopohu Place Unit 37

- 91-1037 Puwalu St Unit 34

- 91-201 Hoopaa Place Unit 109

- 91-209-209 Hoopaa Place

- 91-205 Papahi Place Unit 123

- 91-208 Hoopaa Place Unit 112

- 91-220 Hoopohu Place Unit 48

- 91-205 Hoopaa Place Unit 108

- 91-220 Hoowehi Place Unit 24

- 91-1041 Puwalu St Unit 35

- 91-200 Papahi Place Unit 125

- 91-216 Hoopohu Place Unit 47