91-1109 Laaulu St Unit 9 Ewa Beach, HI 96706

Estimated Value: $627,187 - $785,000

2

Beds

2

Baths

1,009

Sq Ft

$664/Sq Ft

Est. Value

About This Home

This home is located at 91-1109 Laaulu St Unit 9, Ewa Beach, HI 96706 and is currently estimated at $669,547, approximately $663 per square foot. 91-1109 Laaulu St Unit 9 is a home located in Honolulu County with nearby schools including Ewa Elementary School, Ewa Makai Middle School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 9, 2021

Sold by

Cortez Rosalyn Zabala and Cortez Edward Benjamin

Bought by

Chambers Jessica Lynn and Chambers Timothy Michio

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$605,412

Outstanding Balance

$550,507

Interest Rate

2.9%

Mortgage Type

FHA

Estimated Equity

$119,040

Purchase Details

Closed on

Jun 10, 2015

Sold by

Gore Kenneth Robert

Bought by

Zabala Cortez Rosalyn and Cortez Edward Benjamin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$423,922

Interest Rate

3.64%

Mortgage Type

VA

Purchase Details

Closed on

Oct 17, 2003

Sold by

Harada Elaine Tomoe

Bought by

Gore Kenneth Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

6.14%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chambers Jessica Lynn | -- | First American Title Of Hawaii | |

| Zabala Cortez Rosalyn | $415,700 | Tg | |

| Zabala Cortez Rosalyn | $415,700 | Tg | |

| Gore Kenneth Robert | $205,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chambers Jessica Lynn | $605,412 | |

| Previous Owner | Zabala Cortez Rosalyn | $423,922 | |

| Previous Owner | Gore Kenneth Robert | $204,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,119 | $637,800 | $197,600 | $440,200 |

| 2024 | $2,119 | $605,500 | $190,000 | $415,500 |

| 2023 | $2,379 | $679,800 | $190,000 | $489,800 |

| 2022 | $1,927 | $550,500 | $182,400 | $368,100 |

| 2021 | $1,719 | $491,200 | $182,400 | $308,800 |

| 2020 | $1,673 | $478,000 | $182,400 | $295,600 |

| 2019 | $1,665 | $514,900 | $167,200 | $347,700 |

| 2018 | $1,665 | $475,800 | $136,800 | $339,000 |

| 2017 | $1,577 | $450,600 | $103,300 | $347,300 |

| 2016 | $1,141 | $406,000 | $97,200 | $308,800 |

| 2015 | $1,128 | $402,300 | $94,200 | $308,100 |

| 2014 | -- | $356,000 | $116,000 | $240,000 |

Source: Public Records

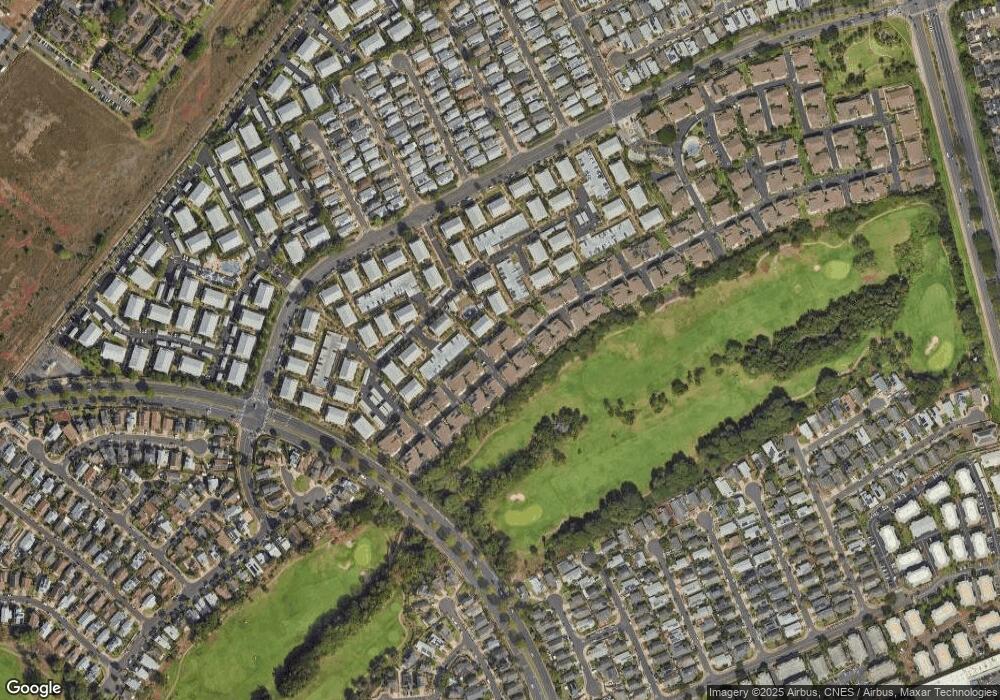

Map

Nearby Homes

- 91-1119 Mikohu St Unit 28

- 91-1159 Mikohu St Unit 35

- 91-1005 Mikohu St Unit 14

- 91-1062 Mikohu St Unit 4

- 91-1056 Mikohu St Unit 7

- 91-1145 Laaulu St Unit 12

- 91-1144 Laaulu St Unit 13

- 91-1018 Mikohu St Unit 20R

- 91-1018 Mikohu St Unit 20

- 91-1030 Puahala St Unit 24

- 91-1008 Waimomona Place

- 91-932 Laaulu St Unit 45

- 91-905 Puahala St Unit 45

- 91-945 Laaulu St Unit 44C

- 91-945 Laaulu St Unit 44

- 91-941 Laaulu St Unit 43

- 91-940 Puahala St Unit 39

- 91-1120 Puahala St Unit 18

- 91-781 Puamaeole St Unit 16

- 91-950 Laaulu St Unit 42

- 91-1109 Laaulu St Unit 9

- 91-1109 Laaulu St Unit G

- 91-1109 Laaulu St Unit B

- 91-1109 Laaulu St Unit 9

- 91-1109 Laaulu St Unit 9

- 91-1109 Laaulu St Unit 9

- 91-1110 Laaulu St Unit 16

- 91-1110 Laaulu St Unit 16

- 91-1110 Laaulu St Unit 16

- 91-1110 Laaulu St Unit 16

- 91-1110 Laaulu St Unit 16

- 91-1110 Laaulu St Unit 16

- 91-1110 Laaulu St Unit 16

- 91-1109 Mikohu St Unit 24

- 91-1109 Mikohu St Unit 24

- 91-1109 Mikohu St Unit 24

- 91-1109 Mikohu St Unit 24

- 91-1109 Mikohu St Unit 24

- 91-1109 Mikohu St Unit 24S

- 91-1100 Laaulu St Unit 17