91-1201 Kaneana St Unit 3 Ewa Beach, HI 96706

Estimated Value: $476,000 - $509,000

2

Beds

2

Baths

710

Sq Ft

$686/Sq Ft

Est. Value

About This Home

This home is located at 91-1201 Kaneana St Unit 3, Ewa Beach, HI 96706 and is currently estimated at $486,876, approximately $685 per square foot. 91-1201 Kaneana St Unit 3 is a home located in Honolulu County with nearby schools including Ewa Beach Elementary School, Ewa Makai Middle School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2021

Sold by

Perry Ian Ahmad

Bought by

Barayuga Landon Batara and Balisa Carrie Anne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$390,000

Outstanding Balance

$353,096

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$133,780

Purchase Details

Closed on

Jan 20, 2015

Sold by

Clements Matthew James and Clements Brandy Lynn

Bought by

Perry Ian Ahmad

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$267,122

Interest Rate

3.87%

Purchase Details

Closed on

May 15, 2009

Sold by

Clements Matthew James

Bought by

Clements Matthew James and Clements Brandy Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$238,950

Interest Rate

4.82%

Mortgage Type

VA

Purchase Details

Closed on

Jul 3, 2006

Sold by

Christy Earl Raymond and Christy Alison Reiko

Bought by

Clements Matthew James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$242,250

Interest Rate

6.63%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barayuga Landon Batara | $405,000 | Tg | |

| Perry Ian Ahmad | $261,500 | Or | |

| Perry Ian Ahmad | $261,500 | Or | |

| Clements Matthew James | -- | Itc | |

| Clements Matthew James | $255,000 | Itc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barayuga Landon Batara | $390,000 | |

| Previous Owner | Perry Ian Ahmad | $267,122 | |

| Previous Owner | Clements Matthew James | $238,950 | |

| Previous Owner | Clements Matthew James | $242,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,286 | $487,500 | $139,400 | $348,100 |

| 2024 | $1,286 | $487,300 | $134,000 | $353,300 |

| 2023 | $1,059 | $502,700 | $134,000 | $368,700 |

| 2022 | $1,048 | $399,300 | $128,700 | $270,600 |

| 2021 | $1,272 | $363,400 | $128,700 | $234,700 |

| 2020 | $1,228 | $350,900 | $128,700 | $222,200 |

| 2019 | $1,110 | $351,600 | $118,000 | $233,600 |

| 2018 | $1,110 | $317,200 | $96,500 | $220,700 |

| 2017 | $1,017 | $290,500 | $72,900 | $217,600 |

| 2016 | $923 | $263,800 | $68,600 | $195,200 |

| 2015 | $917 | $261,900 | $66,500 | $195,400 |

| 2014 | $613 | $233,500 | $83,600 | $149,900 |

Source: Public Records

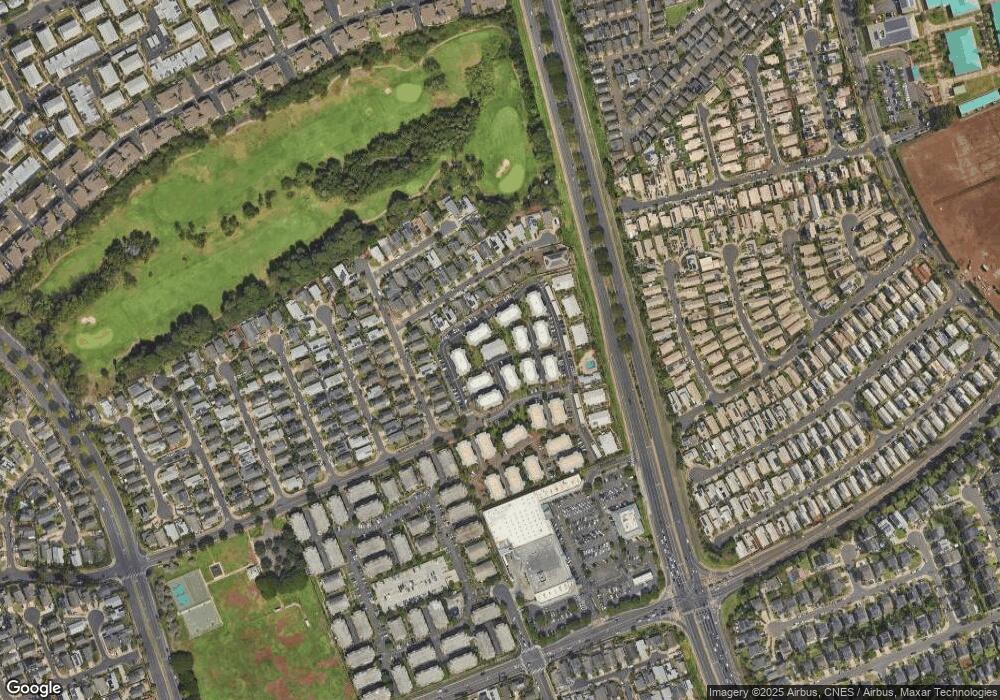

Map

Nearby Homes

- 91-1201 Kaneana St Unit 1H

- 91-1209 Kaneana St Unit 7

- 91-1217 Kaneana St Unit 14I

- 91-1213 Kaneana St Unit 12

- 91-1197 Kamoawa St

- 91-207 Hanapouli Cir Unit 38

- 91-234 Hanapouli Cir Unit 28

- 91-299 Hanapouli Cir Unit 1C

- 91-284 Hanapouli Cir Unit 7

- 91-295 Hanapouli Cir Unit 2H

- 91-289 Hanapouli Cir Unit 5

- 91-291 Hanapouli Cir Unit 4

- 91-1005 Leleoi St Unit 91

- 91-271 Hanapouli Cir Unit 14

- 91-1012 Laaulu St Unit 28

- 91-1030 Hoopili St Unit 54

- 91-979 Laaulu St Unit 36

- 91-1035 Laaulu St Unit 24

- 91-996 Laaulu St Unit 32

- 91-945 Laaulu St Unit 44C

- 91-1201 Kaneana St Unit 1I

- 91-1201 Kaneana St Unit 1J

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 2C

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3J

- 91-1201 Kaneana St Unit 2H

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 1D

- 91-1201 Kaneana St Unit 4

- 91-1201 Kaneana St Unit 2E

- 91-1207 Kaneana St Unit 6

- 91-1207 Kaneana St Unit 6

- 91-1207 Kaneana St Unit 6B

- 91-1207 Kaneana St Unit 6

- 91-1207 Kaneana St Unit 6