91-1201 Kaneana St Unit 3 Ewa Beach, HI 96706

Estimated Value: $453,000 - $509,000

2

Beds

2

Baths

710

Sq Ft

$677/Sq Ft

Est. Value

About This Home

This home is located at 91-1201 Kaneana St Unit 3, Ewa Beach, HI 96706 and is currently estimated at $480,840, approximately $677 per square foot. 91-1201 Kaneana St Unit 3 is a home located in Honolulu County with nearby schools including Ewa Beach Elementary School, Ewa Makai Middle School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2014

Sold by

Cash Rose Michelle Yvette Haunani and Tam Michael Lawrence

Bought by

Kekuna Denise Vena Kapikookalani

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$152,340

Interest Rate

4.16%

Estimated Equity

$328,500

Purchase Details

Closed on

Jul 9, 2009

Sold by

Sorge Henry Michael and Sorge Gadie

Bought by

Cash Rose Michelle Yvette Haunani and Tam Michael Lawrence

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,900

Interest Rate

5.59%

Purchase Details

Closed on

May 25, 2006

Sold by

Pardo Lori Masayo

Bought by

Sorge Henry Michael and Sorge Gadie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$243,000

Interest Rate

8.52%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kekuna Denise Vena Kapikookalani | $250,000 | Or | |

| Kekuna Denise Vena Kapikookalani | $250,000 | Or | |

| Cash Rose Michelle Yvette Haunani | $195,000 | Tg | |

| Sorge Henry Michael | $270,000 | Itc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kekuna Denise Vena Kapikookalani | $200,000 | |

| Closed | Kekuna Denise Vena Kapikookalani | $200,000 | |

| Previous Owner | Cash Rose Michelle Yvette Haunani | $198,900 | |

| Previous Owner | Sorge Henry Michael | $243,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,146 | $487,500 | $139,400 | $348,100 |

| 2024 | $1,146 | $487,300 | $134,000 | $353,300 |

| 2023 | $908 | $502,700 | $134,000 | $368,700 |

| 2022 | $908 | $399,300 | $128,700 | $270,600 |

| 2021 | $782 | $363,400 | $128,700 | $234,700 |

| 2020 | $738 | $350,900 | $128,700 | $222,200 |

| 2019 | $811 | $351,600 | $118,000 | $233,600 |

| 2018 | $690 | $317,200 | $96,500 | $220,700 |

| 2017 | $737 | $290,500 | $72,900 | $217,600 |

| 2016 | $643 | $263,800 | $68,600 | $195,200 |

| 2015 | $917 | $261,900 | $66,500 | $195,400 |

| 2014 | $333 | $233,500 | $83,600 | $149,900 |

Source: Public Records

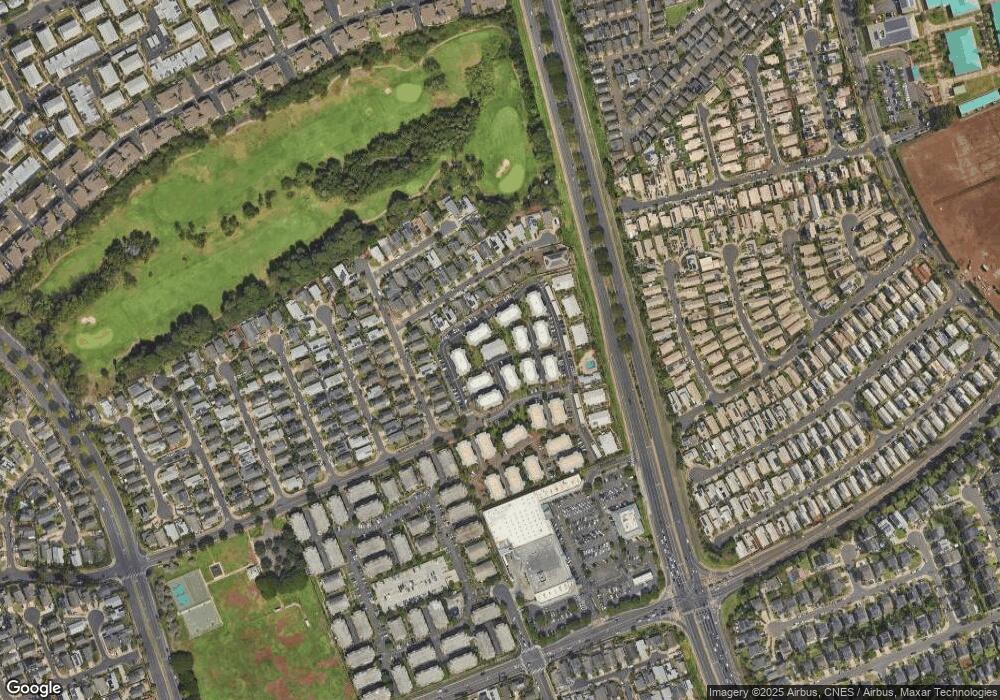

Map

Nearby Homes

- 91-1217 Kaneana St Unit 14I

- 91-1201 Kaneana St Unit 1H

- 91-1213 Kaneana St Unit 12

- 91-1209 Kaneana St Unit 7

- 91-1197 Kamoawa St

- 91-207 Hanapouli Cir Unit 38

- 91-234 Hanapouli Cir Unit 28

- 91-299 Hanapouli Cir Unit 1C

- 91-295 Hanapouli Cir Unit 2H

- 91-284 Hanapouli Cir Unit 7

- 91-289 Hanapouli Cir Unit 5

- 91-291 Hanapouli Cir Unit 4

- 91-271 Hanapouli Cir Unit 14

- 91-1005 Leleoi St Unit 91

- 91-1012 Laaulu St Unit 28

- 91-1030 Hoopili St Unit 54

- 91-978 Piliokahe Place

- 91-1032 Kamaehu St

- 91-979 Laaulu St Unit 36

- 91-1035 Laaulu St Unit 24

- 91-1201 Kaneana St Unit 1I

- 91-1201 Kaneana St Unit 1J

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 2C

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3J

- 91-1201 Kaneana St Unit 2H

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 3

- 91-1201 Kaneana St Unit 1D

- 91-1201 Kaneana St Unit 4

- 91-1201 Kaneana St Unit 2E

- 91-1207 Kaneana St Unit 6

- 91-1207 Kaneana St Unit 6

- 91-1207 Kaneana St Unit 6B

- 91-1207 Kaneana St Unit 6

- 91-1207 Kaneana St Unit 6