91-2069 Kaioli St Unit 6602 Ewa Beach, HI 96706

Estimated Value: $701,953 - $739,000

3

Beds

3

Baths

1,105

Sq Ft

$650/Sq Ft

Est. Value

About This Home

This home is located at 91-2069 Kaioli St Unit 6602, Ewa Beach, HI 96706 and is currently estimated at $718,738, approximately $650 per square foot. 91-2069 Kaioli St Unit 6602 is a home located in Honolulu County with nearby schools including Keoneula Elementary School, Ewa Makai Middle School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2018

Sold by

Upadhyaya Anil

Bought by

Jett Hunter Lee and Jett Edwinalyn Rose Cera

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$547,490

Outstanding Balance

$478,460

Interest Rate

4.6%

Mortgage Type

VA

Estimated Equity

$240,278

Purchase Details

Closed on

Aug 5, 2016

Sold by

Cruz John Sotelo and Cruz Elizabeth Cairel

Bought by

Updhyaya Anil

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$490,320

Interest Rate

3.48%

Mortgage Type

VA

Purchase Details

Closed on

Sep 23, 2008

Sold by

Fairways Edge Development Llc

Bought by

Cruz John Sotelo and Cruz Elizabeth Cairel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$352,650

Interest Rate

6.49%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jett Hunter Lee | $530,000 | Hta | |

| Updhyaya Anil | $480,000 | Fam | |

| Updhyaya Anil | $480,000 | Fam | |

| Cruz John Sotelo | $353,400 | Tg |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jett Hunter Lee | $547,490 | |

| Previous Owner | Updhyaya Anil | $490,320 | |

| Previous Owner | Cruz John Sotelo | $352,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,966 | $691,300 | $293,500 | $397,800 |

| 2024 | $1,966 | $681,600 | $282,200 | $399,400 |

| 2023 | $1,959 | $730,500 | $282,200 | $448,300 |

| 2022 | $1,959 | $659,600 | $270,900 | $388,700 |

| 2021 | $1,558 | $545,000 | $270,900 | $274,100 |

| 2020 | $1,525 | $535,700 | $270,900 | $264,800 |

| 2019 | $1,540 | $560,400 | $248,400 | $312,000 |

| 2018 | $1,540 | $520,000 | $203,200 | $316,800 |

| 2017 | $1,392 | $477,800 | $153,500 | $324,300 |

| 2016 | $1,526 | $436,000 | $144,500 | $291,500 |

| 2015 | $1,172 | $414,900 | $140,000 | $274,900 |

| 2014 | $887 | $369,700 | $147,000 | $222,700 |

Source: Public Records

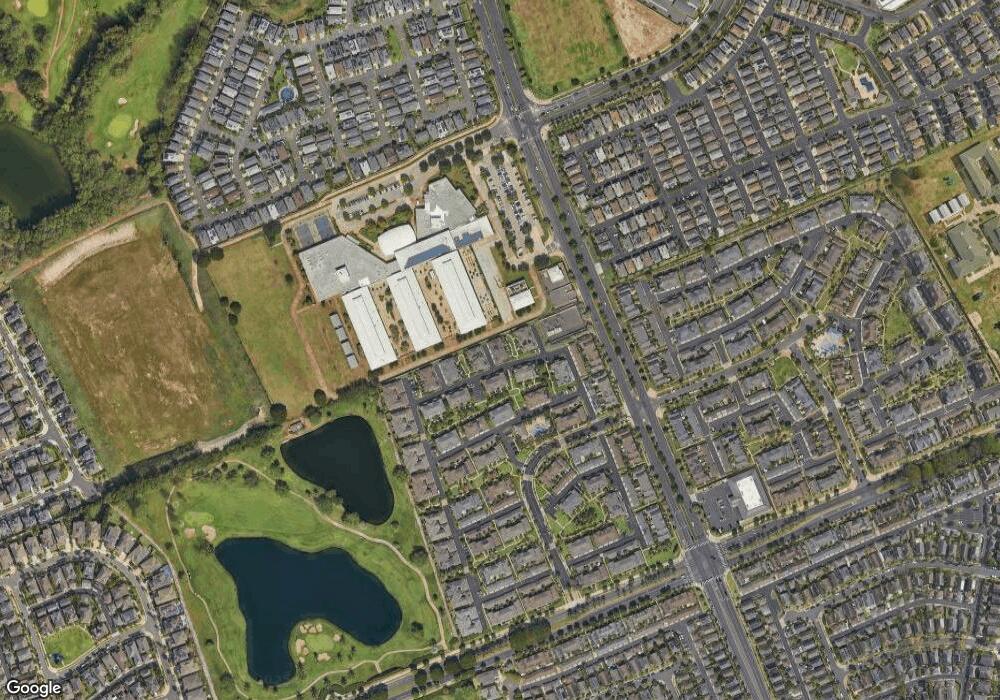

Map

Nearby Homes

- 91-2071 Kaioli St Unit 701

- 91-2083 Kaioli St Unit 1303

- 91-2091 Kaioli St Unit 1602

- 91-2070 Kaioli St Unit 4403

- 91-2123 Kaioli St Unit 3001

- 91-2017 Kaioli St Unit 4102

- 91-2032 Kaioli St Unit 6006

- 91-1211 Keoneula Blvd Unit 2D5

- 91-1033 Kaipalaoa St Unit 1402

- 91-6417 Kapolei Pkwy

- 91-1040 Waikapuna St

- 91-1027 Kaipalaoa St Unit 1103

- 91-1153 Kaileonui St

- 91-1001 Keaunui Dr Unit 136

- 91-1001 Keaunui Dr Unit 111

- 91-1001 Keaunui Dr Unit 35

- 91-1312 Keoneula Blvd Unit 203

- 91-1121 Keoneula Blvd Unit L5

- 91-772 Launahele St Unit 99

- 91-1013 Waiemi St

- 91-2073 Kaioli St Unit 8803

- 91-2073 Kaioli St Unit 802

- 91-2069 Kaioli St Unit 6604

- 91-2067 Kaioli St Unit 5504

- 91-2067 Kaioli St Unit 5501

- 91-2075 Kaioli St Unit 903

- 91-2071 Kaioli St Unit 7703

- 91-2069 Kaioli St Unit 6601

- 91-2071 Kaioli St Unit 7702

- 91-2073 Kaioli St Unit 8801

- 91-2073 Kaioli St Unit 8804

- 91-2071 Kaioli St Unit 7704

- 91-2075 Kaioli St Unit 9902

- 91-2071 Kaioli St Unit 7701

- 91-2075 Kaioli St Unit 9901

- 91-2075 Kaioli St Unit 904

- 91-2067 Kaioli St Unit 5502

- 91-2069 Kaioli St Unit 6603

- 91-2067 Kaioli St Unit 5503

- 91-2073 Kaioli St Unit 804