91-238 Lukini Place Unit 21 Ewa Beach, HI 96706

Estimated Value: $939,157 - $1,218,000

3

Beds

3

Baths

1,866

Sq Ft

$569/Sq Ft

Est. Value

About This Home

This home is located at 91-238 Lukini Place Unit 21, Ewa Beach, HI 96706 and is currently estimated at $1,061,039, approximately $568 per square foot. 91-238 Lukini Place Unit 21 is a home located in Honolulu County with nearby schools including Keoneula Elementary School, Ewa Makai Middle School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 8, 2016

Sold by

Jefferis John Levis and Jefferis Myong Suk

Bought by

Smith Lyle Marvin and Smith Candace Gaye

Current Estimated Value

Purchase Details

Closed on

Aug 3, 2009

Sold by

Kerr John Miller and Kerr Marcia Jean

Bought by

Jefferis John Lewis and Jefferis Myong Suk

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$564,975

Interest Rate

5.37%

Mortgage Type

VA

Purchase Details

Closed on

Jul 10, 2002

Sold by

Gentry Homes Ltd

Bought by

Kerr John Miller and Kerr Marcia Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,750

Interest Rate

4.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Lyle Marvin | $660,000 | Tg | |

| Smith Lyle Marvin | $660,000 | Tg | |

| Jefferis John Lewis | $625,000 | Itc | |

| Kerr John Miller | $403,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jefferis John Lewis | $564,975 | |

| Previous Owner | Kerr John Miller | $322,750 | |

| Closed | Kerr John Miller | $60,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,605 | $939,500 | $429,800 | $509,700 |

| 2024 | $2,199 | $904,200 | $429,800 | $474,400 |

| 2023 | $2,317 | $902,100 | $460,500 | $441,600 |

| 2022 | $2,462 | $843,300 | $404,700 | $438,600 |

| 2021 | $2,071 | $731,800 | $263,000 | $468,800 |

| 2020 | $2,090 | $737,100 | $296,800 | $440,300 |

| 2019 | $2,196 | $747,400 | $307,000 | $440,400 |

| 2018 | $2,155 | $735,700 | $307,000 | $428,700 |

| 2017 | $1,944 | $675,500 | $245,600 | $429,900 |

| 2016 | $1,854 | $649,700 | $281,400 | $368,300 |

| 2015 | $1,921 | $668,900 | $268,900 | $400,000 |

| 2014 | $1,611 | $656,500 | $240,600 | $415,900 |

Source: Public Records

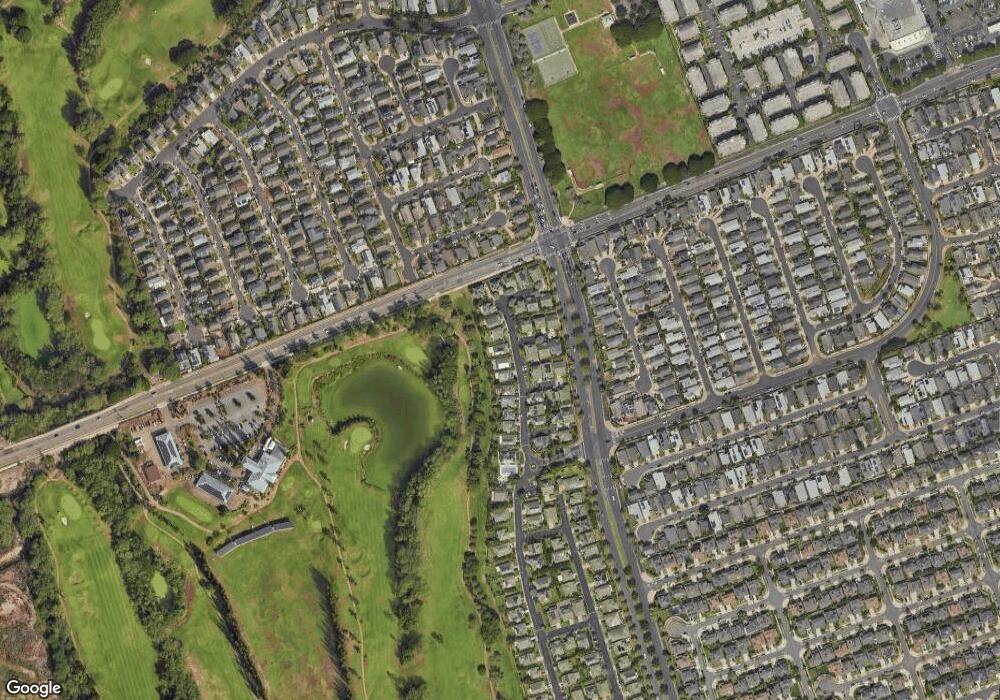

Map

Nearby Homes

- 91-224 Lukini Place Unit 13

- 91-247 Lukini Place Unit 31

- 91-802 Luanaiki St Unit 39

- 91-738 Launahele St Unit 66

- 91-818 Lualai St Unit 69

- 91-271 Hanapouli Cir Unit 14

- 91-284 Hanapouli Cir Unit 7

- 91-291 Hanapouli Cir Unit 4

- 91-289 Hanapouli Cir Unit 5

- 91-107 Puhikani Place

- 91-234 Hanapouli Cir Unit 28

- 91-1116 Hualewa Place

- 91-295 Hanapouli Cir Unit 2H

- 91-299 Hanapouli Cir Unit 1C

- 91-6221 Kapolei Pkwy Unit 431

- 91-6221 Kapolei Pkwy Unit 418

- 91-6221 Kapolei Pkwy Unit 425

- 91-6221 Kapolei Pkwy Unit 407

- 91-207 Hanapouli Cir Unit 38

- 91-978 Piliokahe Place

- 91-234 Lukini Place

- 91-234 Lukini Place Unit 20

- 91-242 Lukini Place

- 91-242 Lukini Place Unit 28

- 91-230 Lukini Place Unit 14

- 91-231 Lukini Place Unit 22

- 91-244 Lukini Place

- 91-241 Lukini Place

- 91-233 Lukini Place Unit 23

- 91-248 Lukini Place

- 91-248 Lukini Place Unit 38

- 91-219 Lukini Place Unit 12

- 91-243 Lukini Place

- 91-239 Lukini Place Unit 26

- 91-227 Lukini Place Unit 18

- 91-220 Lukini Place Unit 5

- 91-247 Lukini Place

- 91-253 Lukini Place

- 91-253 Lukini Place Unit 34

- 91-237 Lukini Place Unit 25