91-540 Puamaeole St Unit D Ewa Beach, HI 96706

Estimated Value: $524,000 - $537,000

2

Beds

2

Baths

810

Sq Ft

$655/Sq Ft

Est. Value

About This Home

This home is located at 91-540 Puamaeole St Unit D, Ewa Beach, HI 96706 and is currently estimated at $530,664, approximately $655 per square foot. 91-540 Puamaeole St Unit D is a home located in Honolulu County with nearby schools including Ewa Elementary School, Ewa Makai Middle School, and James Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2022

Sold by

Calma-Adriano Lora Jane and Adriano Joseph Arceo

Bought by

Scammahorn Katlyn Ileane and Besmer Daniel Brooke

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$480,700

Outstanding Balance

$458,796

Interest Rate

5.3%

Mortgage Type

New Conventional

Estimated Equity

$71,868

Purchase Details

Closed on

Jan 5, 2001

Sold by

American Svgs Bank Fsb

Bought by

Calma Lora Jane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,200

Interest Rate

7.65%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 26, 2000

Sold by

Green Adelbert and Lee Chunghui

Bought by

American Svgs Bank Fsb

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scammahorn Katlyn Ileane | $525,000 | Premier Title | |

| Scammahorn Katlyn Ileane | -- | Premier Title | |

| Calma Lora Jane | $93,000 | -- | |

| American Svgs Bank Fsb | $90,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Scammahorn Katlyn Ileane | $480,700 | |

| Closed | Scammahorn Katlyn Ileane | $480,700 | |

| Previous Owner | Calma Lora Jane | $90,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,336 | $521,800 | $214,400 | $307,400 |

| 2024 | $1,336 | $501,600 | $206,100 | $295,500 |

| 2023 | $1,209 | $545,300 | $206,100 | $339,200 |

| 2022 | $1,590 | $454,400 | $197,900 | $256,500 |

| 2021 | $1,377 | $393,400 | $197,900 | $195,500 |

| 2020 | $1,345 | $384,300 | $197,900 | $186,400 |

| 2019 | $1,292 | $388,600 | $181,400 | $207,200 |

| 2018 | $1,292 | $369,100 | $148,400 | $220,700 |

| 2017 | $1,093 | $312,200 | $112,100 | $200,100 |

| 2016 | $1,030 | $294,400 | $105,500 | $188,900 |

| 2015 | $1,000 | $285,600 | $102,200 | $183,400 |

| 2014 | $795 | $264,300 | $125,900 | $138,400 |

Source: Public Records

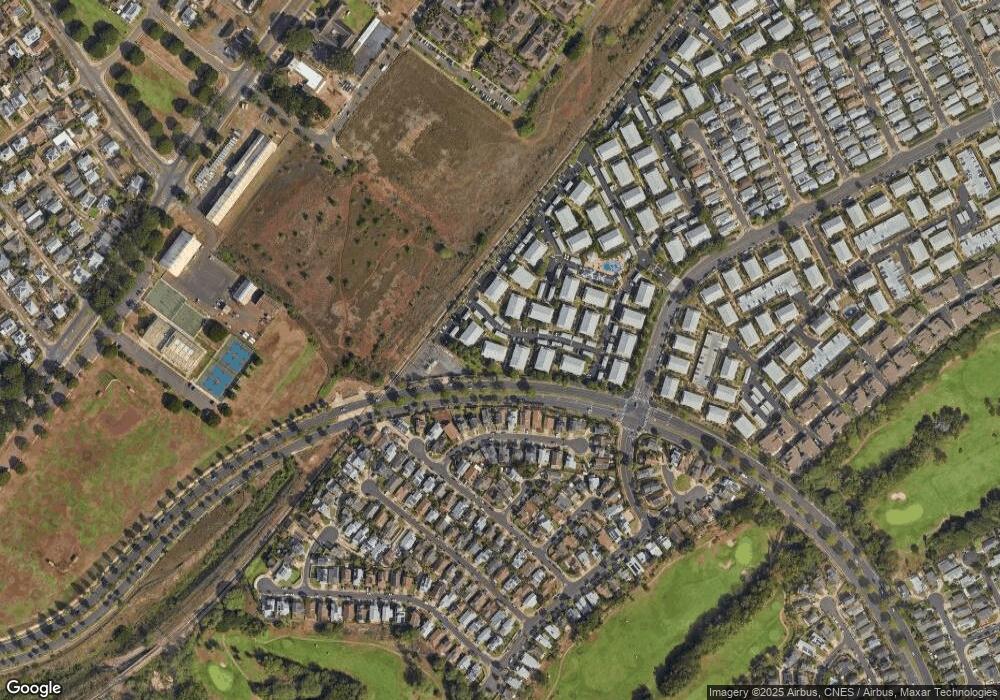

Map

Nearby Homes

- 91-540 Puamaeole St Unit 49

- 91-568 Puamaeole St Unit 50

- 91-905 Puahala St Unit 45

- 91-1018 Mikohu St Unit 20R

- 91-1018 Mikohu St Unit 20

- 91-681 Puamaeole St Unit 28

- 91-121 Maohaka Way

- 91-1030 Puahala St Unit 24

- 91-1056 Mikohu St Unit 7

- 91-1062 Mikohu St Unit 4

- 91-1145 Laaulu St Unit 12

- 91-781 Puamaeole St Unit 16

- 91-1144 Laaulu St Unit 13

- 91-1119 Mikohu St Unit 28

- 91-1723 Kapeku Loop

- 91-1725 Kapeku Loop

- 91-3641 Iwikuamoo St Unit 9212

- 91-3641 Iwikuamoo St Unit 2111

- 91-3641 Iwikuamoo St Unit 5205

- 91-1159 Mikohu St Unit 35

- 91-540 Puamaeole St Unit 49

- 91-540 Puamaeole St Unit T

- 91-540 Puamaeole St Unit 49

- 91-540 Puamaeole St Unit 49

- 91-540 Puamaeole St Unit 49

- 91-540 Puamaeole St Unit B

- 91-534 Puamaeole St Unit 48

- 91-534 Puamaeole St Unit 48

- 91-534 Puamaeole St Unit 48

- 91-534 Puamaeole St Unit S

- 91-534 Puamaeole St Unit 48

- 91-534 Puamaeole St Unit 48

- 91-534 Puamaeole St Unit U

- 91-568 Puamaeole St Unit 50

- 91-568 Puamaeole St Unit 50

- 91-568 Puamaeole St Unit 50

- 91-568 Puamaeole St Unit 50

- 91-568 Puamaeole St Unit 50

- 91-568 Puamaeole St Unit 50

- 91-568 Puamaeole St Unit S