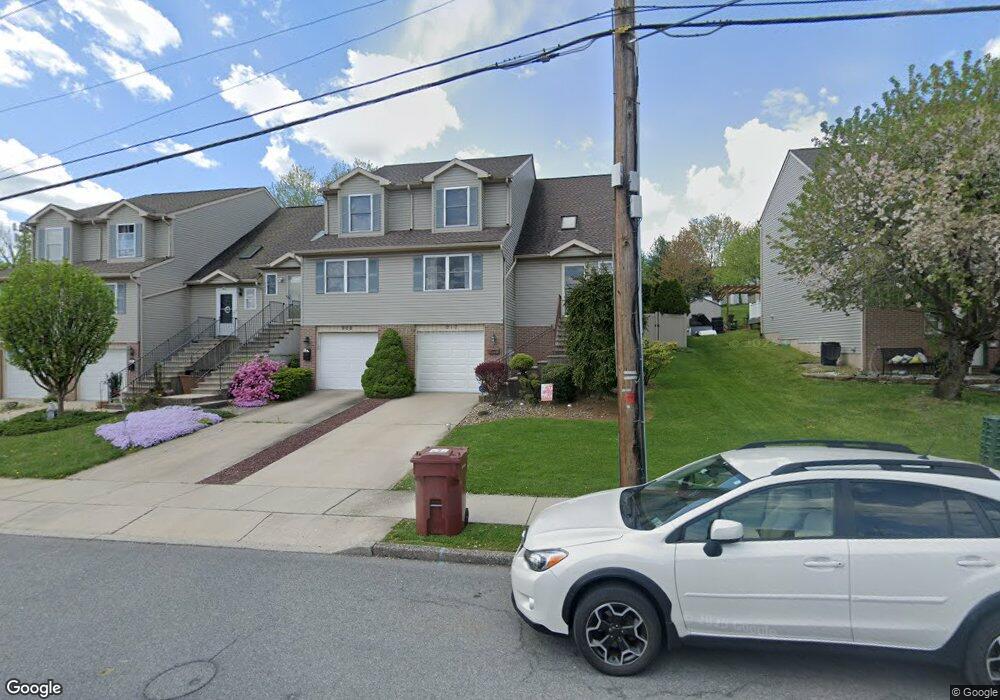

910 Front St Whitehall, PA 18052

Fullerton NeighborhoodEstimated Value: $338,000 - $396,000

3

Beds

3

Baths

1,886

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 910 Front St, Whitehall, PA 18052 and is currently estimated at $355,722, approximately $188 per square foot. 910 Front St is a home located in Lehigh County with nearby schools including George D Steckel Elementary School, Zephyr Elementary School, and Clarence M Gockley Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2016

Sold by

Reed Timothy R and Domitrovits Susan J

Bought by

Reed Timothy R and Reed Susan J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,000

Outstanding Balance

$49,644

Interest Rate

3.44%

Mortgage Type

New Conventional

Estimated Equity

$306,078

Purchase Details

Closed on

Apr 17, 2009

Sold by

Kiser Carol A

Bought by

Reed Timothy R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

4.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 5, 1999

Sold by

Frank Garger

Bought by

Kiser Carol A

Purchase Details

Closed on

Jun 26, 1997

Sold by

Garger and Maria

Bought by

Ward Gary H

Purchase Details

Closed on

Mar 7, 1994

Sold by

Rapoport Gerald N

Bought by

Garger Frank and Garger Maria

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reed Timothy R | -- | None Available | |

| Reed Timothy R | $190,000 | -- | |

| Kiser Carol A | $114,850 | -- | |

| Ward Gary H | $114,000 | -- | |

| Garger Frank | $420,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reed Timothy R | $106,000 | |

| Closed | Reed Timothy R | $152,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,744 | $195,900 | $18,800 | $177,100 |

| 2024 | $5,551 | $195,900 | $18,800 | $177,100 |

| 2023 | $5,436 | $195,900 | $18,800 | $177,100 |

| 2022 | $5,313 | $195,900 | $177,100 | $18,800 |

| 2021 | $5,225 | $195,900 | $18,800 | $177,100 |

| 2020 | $5,024 | $195,900 | $18,800 | $177,100 |

| 2019 | $4,633 | $195,900 | $18,800 | $177,100 |

| 2018 | $4,512 | $195,900 | $18,800 | $177,100 |

| 2017 | $4,430 | $195,900 | $18,800 | $177,100 |

| 2016 | -- | $195,900 | $18,800 | $177,100 |

| 2015 | -- | $195,900 | $18,800 | $177,100 |

| 2014 | -- | $195,900 | $18,800 | $177,100 |

Source: Public Records

Map

Nearby Homes