9101 Weeping Willow Ct Highlands Ranch, CO 80130

Eastridge NeighborhoodEstimated Value: $705,000 - $748,619

4

Beds

3

Baths

2,303

Sq Ft

$314/Sq Ft

Est. Value

About This Home

This home is located at 9101 Weeping Willow Ct, Highlands Ranch, CO 80130 and is currently estimated at $722,655, approximately $313 per square foot. 9101 Weeping Willow Ct is a home located in Douglas County with nearby schools including Fox Creek Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 2015

Sold by

Dixon Larry J

Bought by

Stadnicka Zischke Marta and Zischke Scott

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$353,479

Outstanding Balance

$268,116

Interest Rate

3.5%

Mortgage Type

FHA

Estimated Equity

$454,539

Purchase Details

Closed on

Jul 30, 2004

Sold by

Dixon Gwendolyn A

Bought by

Dixon Larry J

Purchase Details

Closed on

Nov 30, 2001

Sold by

Dixon Gwendolyn A

Bought by

Dixon Gwendolyn A

Purchase Details

Closed on

Jul 13, 2001

Sold by

Weiland Mark R and Weiland Mary Kathleen

Bought by

Dixon Gwendolyn A

Purchase Details

Closed on

Mar 5, 1997

Sold by

Merle Trulove James and Dee Shannon Dee

Bought by

Weiland Mark R and Weiland Mary Kathleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,250

Interest Rate

7.74%

Purchase Details

Closed on

Feb 23, 1993

Sold by

Kief Edward R and Kief Dianne L

Bought by

Trulove James Merle and Trulove Shanno

Purchase Details

Closed on

Mar 30, 1992

Sold by

Richmond Homes Inc Ii

Bought by

Kief Edward R and Kief Dianne L

Purchase Details

Closed on

Dec 10, 1991

Sold by

Mission Viejo Co

Bought by

Richmond Homes Inc Ii

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stadnicka Zischke Marta | $360,000 | Colorado Escrow & Title | |

| Dixon Larry J | -- | -- | |

| Dixon Gwendolyn A | -- | -- | |

| Dixon Gwendolyn A | $255,000 | -- | |

| Weiland Mark R | $175,000 | -- | |

| Trulove James Merle | $135,000 | -- | |

| Kief Edward R | $127,300 | -- | |

| Richmond Homes Inc Ii | $202,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stadnicka Zischke Marta | $353,479 | |

| Previous Owner | Weiland Mark R | $166,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,711 | $53,660 | $13,260 | $40,400 |

| 2023 | $4,702 | $53,660 | $13,260 | $40,400 |

| 2022 | $3,352 | $36,690 | $8,900 | $27,790 |

| 2021 | $3,487 | $36,690 | $8,900 | $27,790 |

| 2020 | $3,377 | $36,410 | $9,440 | $26,970 |

| 2019 | $3,389 | $36,410 | $9,440 | $26,970 |

| 2018 | $2,898 | $30,660 | $8,140 | $22,520 |

| 2017 | $2,638 | $30,660 | $8,140 | $22,520 |

| 2016 | $2,334 | $26,620 | $9,200 | $17,420 |

| 2015 | $2,384 | $26,620 | $9,200 | $17,420 |

| 2014 | $1,055 | $21,750 | $6,130 | $15,620 |

Source: Public Records

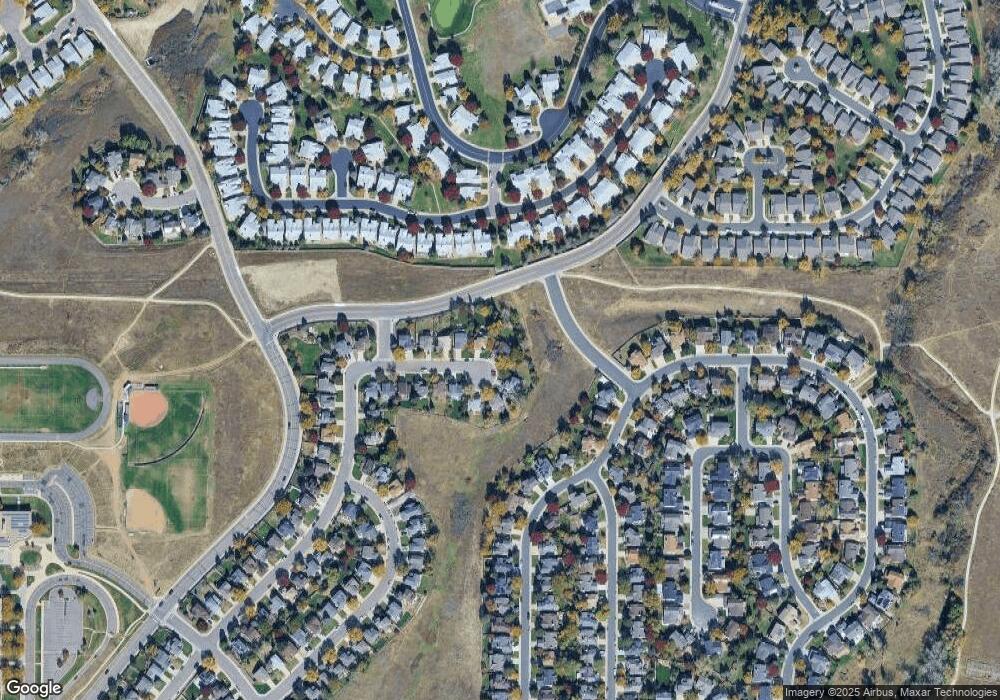

Map

Nearby Homes

- 9224 Weeping Willow Place

- 5322 Shetland Ct

- 9222 Buttonhill Ct

- 6 Abernathy Ct

- 5055 Weeping Willow Cir

- 14 Stonehaven Ct

- 5126 Tuscany Ct

- 9382 Morning Glory Ln

- 6340 Ashburn Ln

- 41 Canongate Ln

- 5329 Morning Glory Place

- 8951 Greenwich St

- 4927 Greenwich Way

- 6428 Silver Mesa Dr Unit C

- 6418 Silver Mesa Dr Unit C

- 8766 Cresthill Ln

- 9678 Rockhampton Way

- 8925 Copeland St

- 9254 Lark Sparrow Dr

- 9634 Merimbula St

- 9111 Weeping Willow Ct

- 9102 Weeping Willow Ct

- 9121 Weeping Willow Ct

- 9131 Weeping Willow Ct

- 9112 Weeping Willow Ct

- 9122 Weeping Willow Ct

- 9132 Weeping Willow Ct

- 9141 Weeping Willow Ct

- 9142 Weeping Willow Ct

- 9152 Weeping Willow Ct

- 9151 Weeping Willow Ct

- 4 Shetland Ct

- 6 Shetland Ct

- 9117 Sugarstone Cir

- 5418 Shetland Ct

- 9162 Weeping Willow Ct

- 9119 Sugarstone Cir

- 12 Shetland Ct

- 5406 Shetland Ct

- 9121 Sugarstone Cir