9108 County Road 1620 Fitzhugh, OK 74843

Estimated Value: $154,000 - $352,000

4

Beds

2

Baths

2,260

Sq Ft

$105/Sq Ft

Est. Value

About This Home

This home is located at 9108 County Road 1620, Fitzhugh, OK 74843 and is currently estimated at $236,364, approximately $104 per square foot. 9108 County Road 1620 is a home located in Pontotoc County with nearby schools including Roff Elementary School and Roff High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 26, 2024

Sold by

Stark-Pittman Rebecca

Bought by

York Makynze

Current Estimated Value

Purchase Details

Closed on

Oct 3, 2024

Sold by

Mccullar Joe and Mccullar Tera

Bought by

Stark-Pittman Rebecca

Purchase Details

Closed on

Apr 25, 2024

Sold by

Stark-Pittman Rebecca Ann

Bought by

York Tyler David and Stallworth Kyara Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,836

Interest Rate

7.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 19, 2022

Sold by

Phyllis Stark

Bought by

Stark-Pittman Rebecca Ann

Purchase Details

Closed on

Jul 14, 2021

Sold by

Stark and Phyllis

Bought by

York Jennifer

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| York Makynze | -- | None Listed On Document | |

| York Makynze | -- | None Listed On Document | |

| Stark-Pittman Rebecca | -- | None Listed On Document | |

| York Tyler David | -- | Nations Title | |

| Stark-Pittman Rebecca Ann | -- | None Listed On Document | |

| York Jennifer | -- | None Listed On Document |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | York Tyler David | $107,836 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $520 | $6,554 | $1,822 | $4,732 |

| 2024 | $520 | $6,363 | $1,769 | $4,594 |

| 2023 | $520 | $6,178 | $1,731 | $4,447 |

| 2022 | $484 | $6,178 | $1,731 | $4,447 |

| 2021 | $457 | $6,178 | $1,731 | $4,447 |

| 2020 | $483 | $5,998 | $1,728 | $4,270 |

| 2019 | $474 | $5,824 | $1,726 | $4,098 |

| 2018 | $471 | $5,824 | $1,726 | $4,098 |

| 2017 | $366 | $5,824 | $1,726 | $4,098 |

| 2016 | $365 | $5,824 | $1,726 | $4,098 |

| 2015 | $361 | $5,655 | $958 | $4,697 |

| 2014 | $315 | $5,050 | $950 | $4,100 |

Source: Public Records

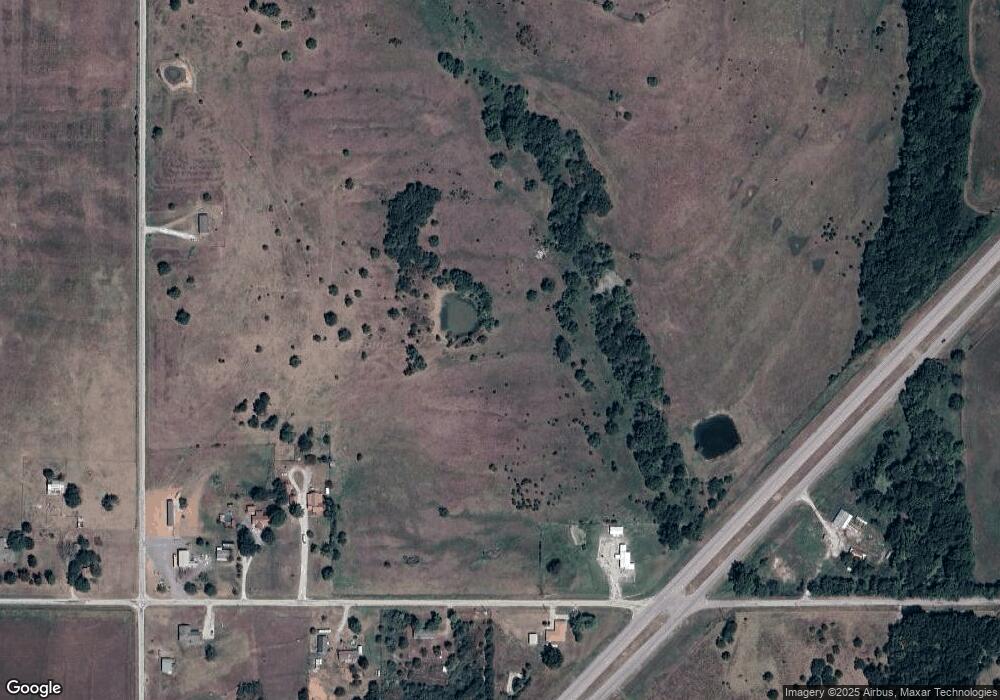

Map

Nearby Homes

- 22160 Highway 1w

- 19661 County Rd 3500

- 19661 County Road 3500

- 11551 County Road 1620

- 19767 County Road 3470

- 22996 County Road 3520

- 25074 County Road 3500

- 2246 County Road 1650

- 24008 County Road 3520

- 310 E Division St

- 131 W Gist Ave

- 801 N Hickory

- 300 W Frisco Ave

- 200 S 7th St

- 26881 Hwy 1

- 301 W Main

- 20720 County Road 3440

- 5775 County Road 1590

- 9692 County Road 3570

- 0 Lightning Ridge Rd

- 9070 County Road 1620

- 9197 County Road 1620

- 9051 County Road 1620

- 8956 County Road 1620

- 9261 County Road 1620

- 9261 County Road 1620

- 9300 E1620 Rd

- 8900 County Road 1620

- 22280 Hwy 1 Hwy W

- 22500 State Highway 1w

- 22500 State Highway 1w

- 21360 County Road 3400

- 21360 County Road 3490

- 17911 County Road 1620

- 17911 County Road 1620

- 22164 County Road 3497

- 22052 County Road 3498

- 19895 Cr 1620

- 21571 W Highway 1 Hwy

- 22285 County Road 3490