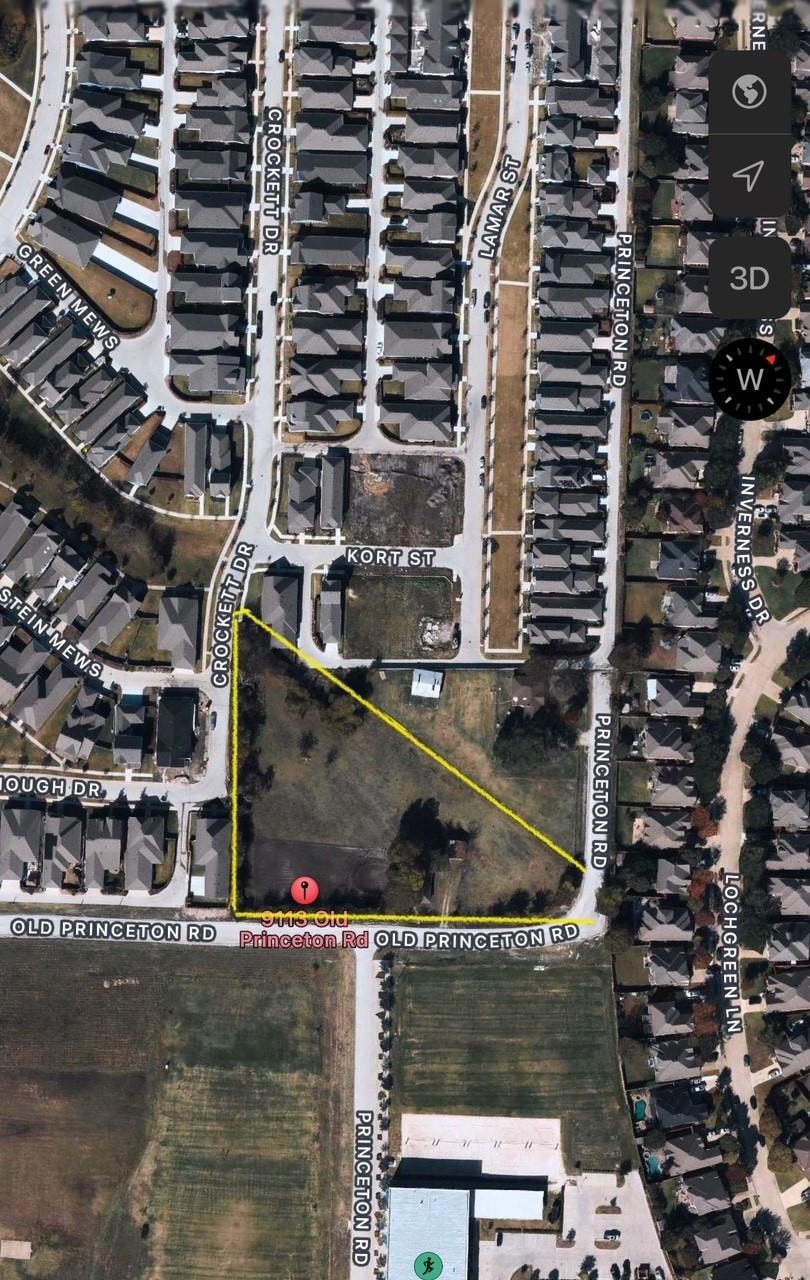

9113 Princeton Rd Rowlett, TX 75089

Waterview NeighborhoodEstimated payment $4,341/month

About This Lot

Location! Location! Location! Currently zoned for residential use. State codes indicate the property can be used for Multi-family residential apartments or commercial use. The City of Rowlett has approved many opportunities for the use of this land. See transaction desk for further information.

Listing Agent

eXp Realty LLC Brokerage Phone: 432-349-7780 License #0804879 Listed on: 05/31/2024

Property Details

Property Type

- Land

Est. Annual Taxes

- $2,220

Lot Details

- 2.33 Acre Lot

- Corner Lot

- Few Trees

- Zoning described as Property is zoned for Residential use. State Codes indicate property can be used for MFR-apartments and/or Commercial use

Schools

- Choice Of Elementary School

- Choice Of High School

Community Details

- James M Hamilton Subdivision

Listing and Financial Details

- Assessor Parcel Number 65054456010290000

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,264 | $96,170 | $96,170 | -- |

| 2024 | $2,264 | $96,170 | $96,170 | -- |

| 2023 | $2,264 | $96,170 | $96,170 | $0 |

| 2022 | $2,330 | $96,170 | $96,170 | $0 |

| 2021 | $2,518 | $96,170 | $96,170 | $0 |

| 2020 | $2,540 | $96,170 | $96,170 | $0 |

| 2019 | $2,764 | $96,170 | $96,170 | $0 |

| 2018 | $1,360 | $96,170 | $0 | $0 |

| 2017 | $4,178 | $143,970 | $143,970 | $0 |

| 2016 | $4,178 | $143,970 | $143,970 | $0 |

| 2015 | $670 | $143,970 | $143,970 | $0 |

| 2014 | $670 | $24,790 | $24,790 | $0 |

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 03/03/2025 03/03/25 | Price Changed | $759,000 | -15.7% | -- |

| 05/31/2024 05/31/24 | For Sale | $899,999 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | -- | -- |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Open | $54,000 | No Value Available |

Source: North Texas Real Estate Information Systems (NTREIS)

MLS Number: 20630431

APN: 65054456010290000

- 6628 Kort St

- 9212 Lamar St

- 9224 Lamar St

- 9205 Lamar St

- 9201 Royal Burgess Dr

- 9328 Lamar St

- 9213 Royal Burgess Dr

- 9309 Inverness Dr

- 9304 Crockett Dr

- 6514 Trafalgar Dr

- 9214 Waterview Pkwy

- 7713 Troon Dr

- 7910 Troon Dr

- 8218 Sawgrass Ln

- 9318 Waterview Pkwy

- 8505 Royal Montreal Dr

- 7701 Fern Hill Ln

- 9601 Waterview Pkwy

- 9610 Broadmoor Ln

- 7806 Albany Dr

- 9201 Royal Burgess Dr

- 8709 Homestead Blvd

- 9218 Oak Hollow Dr

- 7806 Albany Dr

- 8202 Quail Ct

- 9610 Glenshee Dr

- 7418 Fairfield Dr

- 9613 Glenshee Dr

- 7401 Centenary Dr

- 6713 Fairfield Dr

- 9006 Forest Park Ct

- 7618 Creek Wood Dr

- 8202 Weatherly Dr

- 7818 Spinnaker Cove

- 10706 Lansdowne Ln

- 7309 Aberdeen Dr

- 8414 Seafield Ln

- 7401 Aberdeen Dr

- 6902 Amesbury Ln

- 7513 Colfax Dr