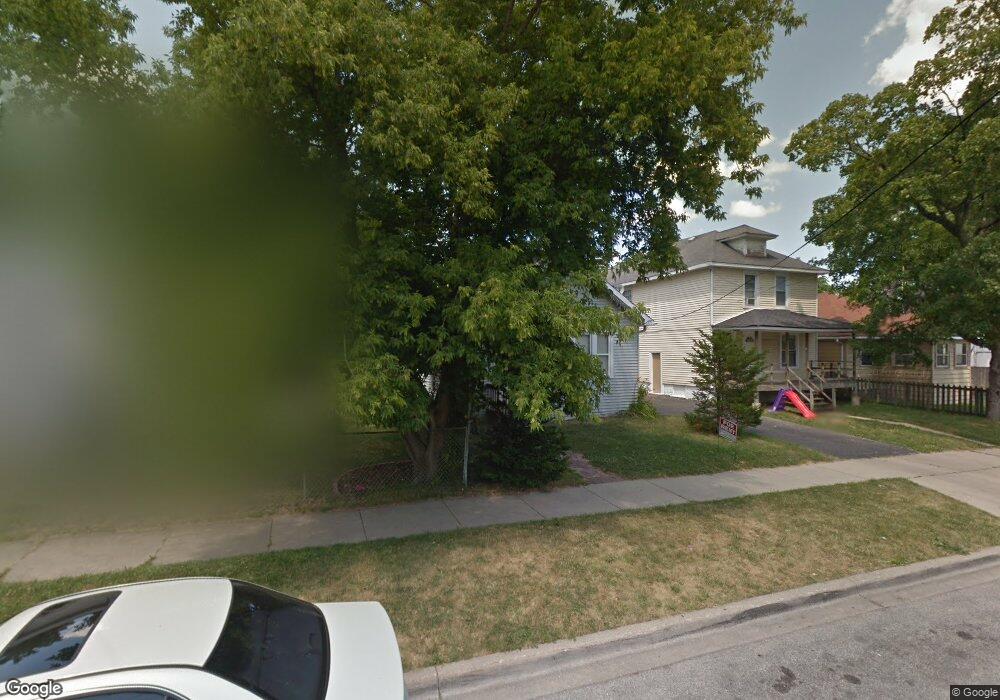

912 Franklin St Waukegan, IL 60085

Estimated Value: $184,000 - $214,000

3

Beds

1

Bath

1,093

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 912 Franklin St, Waukegan, IL 60085 and is currently estimated at $197,154, approximately $180 per square foot. 912 Franklin St is a home located in Lake County with nearby schools including Glen Flora Elementary School, Edith M Smith Middle School, and Waukegan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2018

Sold by

Chicago Title Land Trust Co

Bought by

Kjk Solutions Llc 912

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,100,000

Outstanding Balance

$787,568

Interest Rate

4.25%

Mortgage Type

Commercial

Estimated Equity

-$590,414

Purchase Details

Closed on

Mar 15, 2004

Sold by

Kruse Keith J and Kruse Keith

Bought by

Bank Of Waukegan

Purchase Details

Closed on

Dec 10, 1996

Sold by

Jones Marjory

Bought by

Kruse Keith

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kjk Solutions Llc 912 | -- | Chicago Title Land Trust Com | |

| Bank Of Waukegan | -- | Ctic | |

| Kruse Keith | $500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kjk Solutions Llc 912 | $1,100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,715 | $44,010 | $5,464 | $38,546 |

| 2023 | $3,582 | $39,402 | $4,892 | $34,510 |

| 2022 | $3,582 | $36,642 | $4,653 | $31,989 |

| 2021 | $3,294 | $31,593 | $4,150 | $27,443 |

| 2020 | $3,336 | $29,432 | $3,866 | $25,566 |

| 2019 | $3,358 | $26,970 | $3,543 | $23,427 |

| 2018 | $3,200 | $24,751 | $4,512 | $20,239 |

| 2017 | $3,115 | $21,898 | $3,992 | $17,906 |

| 2016 | $2,941 | $19,029 | $3,469 | $15,560 |

| 2015 | $2,877 | $17,031 | $3,105 | $13,926 |

| 2014 | $2,686 | $15,876 | $2,684 | $13,192 |

| 2012 | $2,894 | $17,200 | $2,907 | $14,293 |

Source: Public Records

Map

Nearby Homes

- 620 N Poplar St

- 702 Franklin St

- 522 N Poplar St

- 511 Chestnut St

- 428 N Poplar St

- 1109 Massena Ave

- 917 N Linden Ave

- 509 N Butrick St

- 824 N Butrick St

- 918 N Ash St

- 452 North Ave

- 1000 Pine St

- 325 4th St

- 1110 N Ash St

- 1105 Woodlawn Cir

- 1122 N Ash St

- 415 W Ridgeland Ave

- 968 Judge Ave

- 723 N County St

- 28 N Saint James St

- 910 Franklin St

- 918 Franklin St

- 611 Walnut St

- 908 Franklin St

- 615 Walnut St

- 904 Franklin St

- 604 N Jackson St

- 612 N Jackson St

- 608 N Jackson St

- 619 Walnut St

- 621 Walnut St

- 618 N Jackson St

- 924 Porter St

- 909 Franklin St

- 920 Porter St

- 1006 Porter St

- 524 N Jackson St

- 633 Walnut St

- 612 Walnut St

- 614 Walnut St