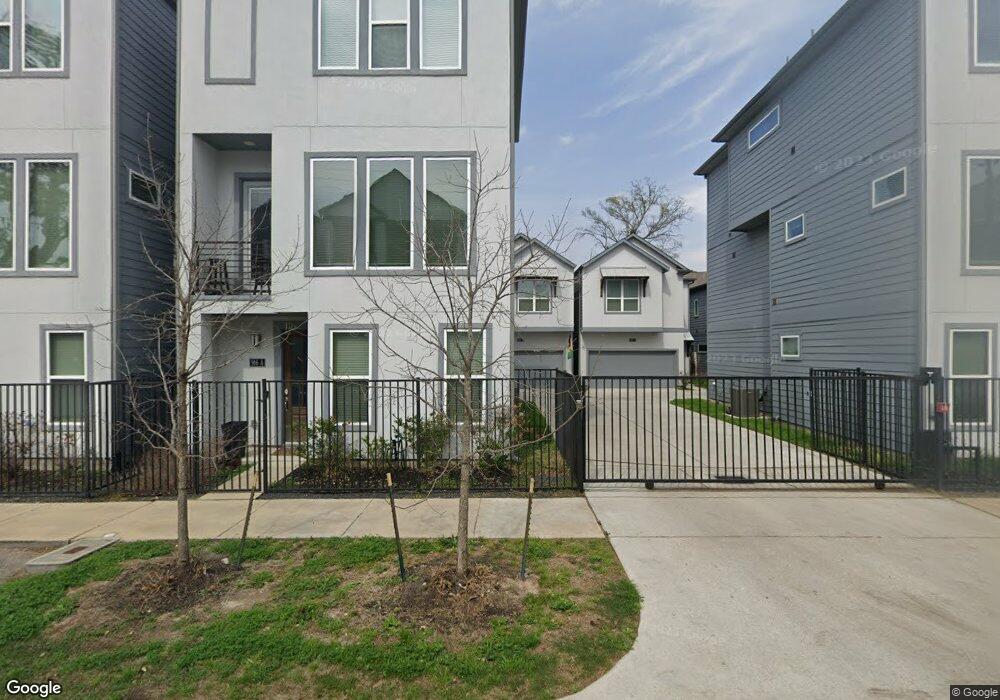

912 W 35th St Unit B Houston, TX 77018

Oak Forest-Garden Oaks NeighborhoodEstimated Value: $454,522 - $483,000

3

Beds

3

Baths

1,889

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 912 W 35th St Unit B, Houston, TX 77018 and is currently estimated at $467,381, approximately $247 per square foot. 912 W 35th St Unit B is a home located in Harris County with nearby schools including Garden Oaks Montessori, Frank Black Middle School, and Waltrip High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2023

Sold by

Torres Jason and Torres Ashley

Bought by

Oshea James Bartholomew and Lopez Renee Dominique

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$389,250

Outstanding Balance

$379,791

Interest Rate

6.69%

Mortgage Type

New Conventional

Estimated Equity

$87,590

Purchase Details

Closed on

Nov 14, 2019

Sold by

Lexington 26 L P

Bought by

Torres Jason

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Interest Rate

3.65%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oshea James Bartholomew | -- | None Listed On Document | |

| Torres Jason | -- | Landtitle Texas Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Oshea James Bartholomew | $389,250 | |

| Previous Owner | Torres Jason | $296,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,225 | $479,484 | $208,198 | $271,286 |

| 2024 | $8,225 | $459,466 | $144,137 | $315,329 |

| 2023 | $8,225 | $425,041 | $128,122 | $296,919 |

| 2022 | $8,664 | $393,485 | $128,122 | $265,363 |

| 2021 | $8,410 | $360,852 | $128,122 | $232,730 |

| 2020 | $8,714 | $359,841 | $128,122 | $231,719 |

| 2019 | $4,173 | $195,560 | $128,122 | $67,438 |

Source: Public Records

Map

Nearby Homes

- 915 W 35th St Unit B

- 3607 Cedar Vista Ln

- 3502 Autumndale Dr

- 3511 Autumndale Dr

- 923 Fisher St Unit A

- 925 Fisher St Unit D

- 909 Fisher St

- 3505 Golf Dr Unit D

- 1003 Wakefield Dr

- 954 Fisher St Unit E

- 831 Wakefield Dr Unit A

- 1414 W 34th 1/2 St

- 1115 Gardendale Dr

- 820 Wakefield Dr Unit A

- 833 Fisher St Unit C

- 1424 W 34th 1/2 St

- 963 W 41st St

- 811 Sara Rose St

- 824 Wakefield Dr Unit A

- The Austin Plan at Park View

- 912 W 35th St Unit C

- 912 W 35th St Unit A

- 912 W 35th St

- 910 W 35th St

- 910 W 35th St Unit A

- 910 W 35th St Unit C

- 910 W 35th St Unit B

- 911 Judiway St

- 914 W 35th St

- 914 W 35th St Unit B

- 914 W 35th St Unit A

- 914 W 35th St Unit C

- 916 W 35th St

- 916 W 35th St Unit A

- 916 W 35th St Unit B

- 3507 Facundo St

- 3503 Alba Rd

- 3503 Facundo St

- 918 W 35th St

- 3523 Alba Rd