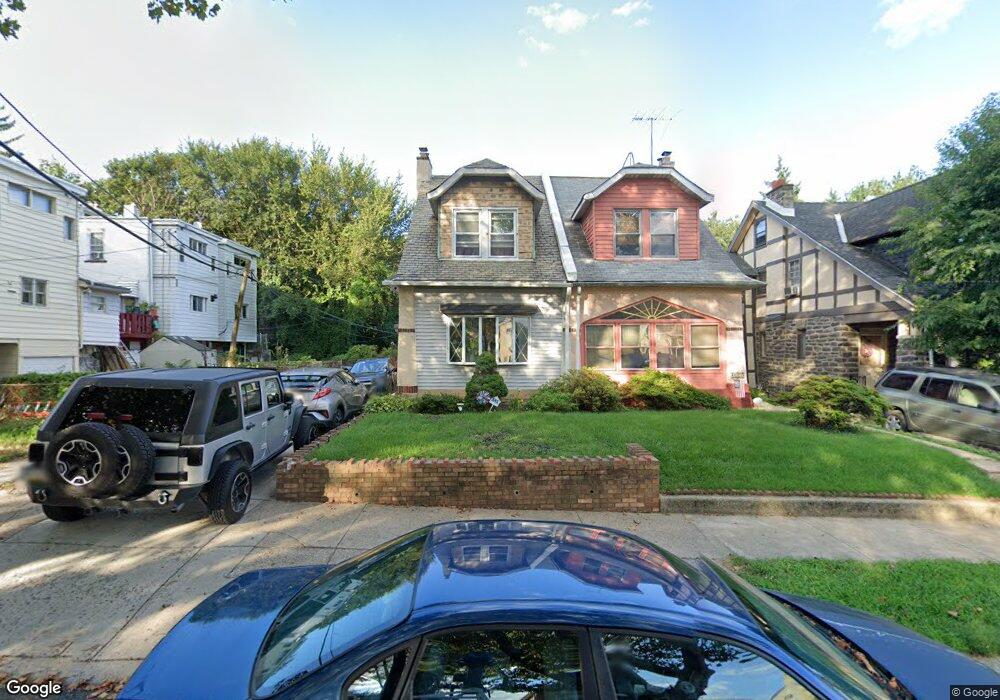

913 Fillmore St Philadelphia, PA 19124

Lawncrest NeighborhoodEstimated Value: $265,306 - $295,000

4

Beds

1

Bath

1,536

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 913 Fillmore St, Philadelphia, PA 19124 and is currently estimated at $275,077, approximately $179 per square foot. 913 Fillmore St is a home located in Philadelphia County with nearby schools including Frankford High School, Northwood Academy Charter School, and The Philadelphia Charter School for the Arts & Sciences.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 2, 2015

Sold by

Mcshea Timothy

Bought by

Mcshea Timothy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,895

Outstanding Balance

$121,627

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$153,450

Purchase Details

Closed on

Apr 19, 2002

Sold by

Mariano Richard T

Bought by

Mcshea Timothy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,239

Interest Rate

7.05%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 24, 2002

Sold by

Mariano Richard T and Mariano Denise M

Bought by

Mariano Richard T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcshea Timothy | -- | None Available | |

| Mcshea Timothy | $97,000 | -- | |

| Mariano Richard T | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcshea Timothy | $156,895 | |

| Closed | Mcshea Timothy | $96,239 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,057 | $275,200 | $55,000 | $220,200 |

| 2025 | $3,057 | $275,200 | $55,000 | $220,200 |

| 2024 | $3,057 | $275,200 | $55,000 | $220,200 |

| 2023 | $3,057 | $218,400 | $43,680 | $174,720 |

| 2022 | $2,261 | $218,400 | $43,680 | $174,720 |

| 2021 | $2,261 | $0 | $0 | $0 |

| 2020 | $2,261 | $0 | $0 | $0 |

| 2019 | $2,170 | $0 | $0 | $0 |

| 2018 | $2,135 | $0 | $0 | $0 |

| 2017 | $2,135 | $0 | $0 | $0 |

| 2016 | $1,558 | $0 | $0 | $0 |

| 2015 | $2,044 | $0 | $0 | $0 |

| 2014 | -- | $152,500 | $42,309 | $110,191 |

| 2012 | -- | $22,528 | $3,720 | $18,808 |

Source: Public Records

Map

Nearby Homes

- 926 Foulkrod St

- 1859 Harrison St

- 4046 E Roosevelt Blvd

- 1052 Allengrove St

- 4717 Northwood St

- 1001-3 Arrott St

- 4704 E Roosevelt Blvd

- 5505 Loretto Ave

- 894 Granite St

- 880 Granite St

- 1208 Haworth St

- 1048 Bridge St

- 1214 Haworth St

- 5640 Miriam Rd

- 934 Brill St

- 1300 Harrison St

- 1204 Pratt St

- 5659 Miriam Rd

- 5661 Miriam Rd

- 1218 Pratt St

- 915 Fillmore St

- 911 Fillmore St

- 4827 E Roosevelt Blvd

- 4829 E Roosevelt Blvd

- 4825 E Roosevelt Blvd

- 4825 Roosevelt Blvd

- 4823 E Roosevelt Blvd

- 4827 Roosevelt Blvd

- 4829 Roosevelt Blvd

- 917 Fillmore St

- 4819 Roosevelt Blvd

- 921 Fillmore St

- 914 Fillmore St

- 916 Fillmore St

- 4815 Roosevelt Blvd

- 923 Fillmore St

- 918 Fillmore St

- 925 Fillmore St Unit R

- 925 Fillmore St

- 922 Fillmore St Unit 24