913 Mennonite Rd Royersford, PA 19468

Estimated Value: $565,000 - $772,000

4

Beds

3

Baths

2,395

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 913 Mennonite Rd, Royersford, PA 19468 and is currently estimated at $628,864, approximately $262 per square foot. 913 Mennonite Rd is a home located in Montgomery County with nearby schools including Upper Providence Elementary School, Spring-Ford Middle School 5/6/7 Grade Center, and Spring-Ford Middle School 8th Grade Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2019

Sold by

Attalla Emad N

Bought by

Attalla Emad N and Abdelmalak Caroline K

Current Estimated Value

Purchase Details

Closed on

Jun 29, 2007

Sold by

Phillips Thomas F and Phillips Suzanne M

Bought by

Attalla Emad N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,500

Outstanding Balance

$169,519

Interest Rate

6.48%

Estimated Equity

$459,345

Purchase Details

Closed on

Sep 26, 2003

Sold by

Maynard Dennis E and Maynard Stephanie L

Bought by

Phillips Suzanne and Phillips Thomas

Purchase Details

Closed on

May 31, 2000

Sold by

Sukonik Indian Creek Corp

Bought by

Maynard Dennis E and Maynard Stephanie L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Attalla Emad N | -- | Penn Title Co | |

| Attalla Emad N | $315,000 | None Available | |

| Phillips Suzanne | $248,000 | -- | |

| Maynard Dennis E | $170,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Attalla Emad N | $271,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,056 | $183,030 | $45,750 | $137,280 |

| 2024 | $7,056 | $183,030 | $45,750 | $137,280 |

| 2023 | $6,735 | $183,030 | $45,750 | $137,280 |

| 2022 | $6,507 | $183,030 | $45,750 | $137,280 |

| 2021 | $6,115 | $183,030 | $45,750 | $137,280 |

| 2020 | $5,953 | $183,030 | $45,750 | $137,280 |

| 2019 | $3,938 | $183,030 | $45,750 | $137,280 |

| 2018 | $4,715 | $183,030 | $45,750 | $137,280 |

| 2017 | $5,728 | $183,030 | $45,750 | $137,280 |

| 2016 | $5,656 | $183,030 | $45,750 | $137,280 |

| 2015 | $5,403 | $183,030 | $45,750 | $137,280 |

| 2014 | $5,289 | $183,030 | $45,750 | $137,280 |

Source: Public Records

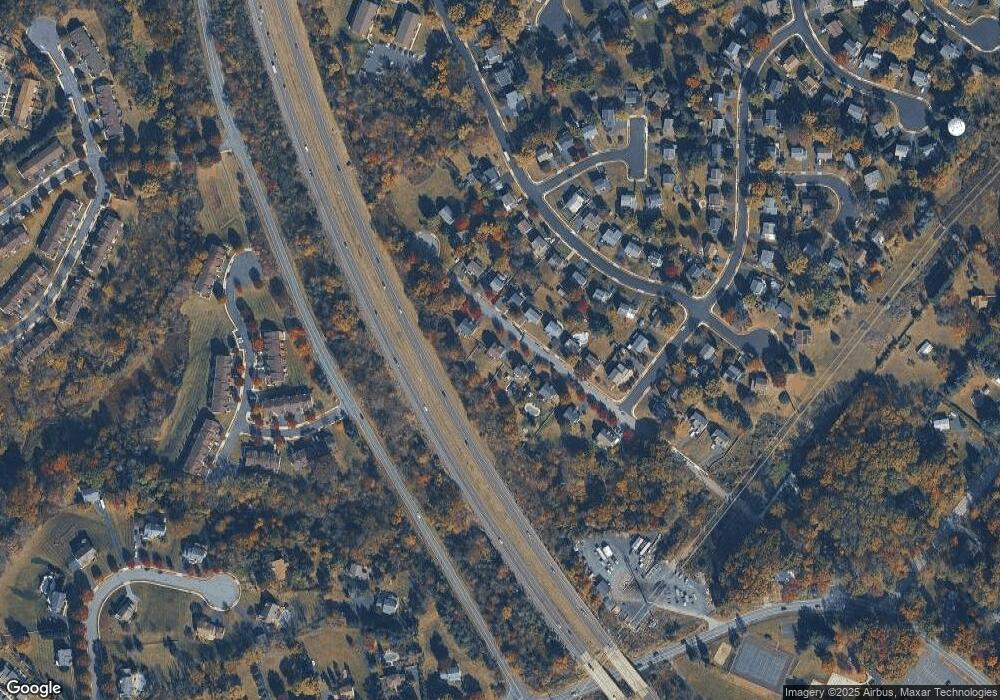

Map

Nearby Homes

- 28 Cochise Ln

- 3 Cree Square

- 975 Katie Cir

- 47 Orchard Ct

- 5 Cheyenne Rd

- 470 Fruit Farm Rd

- 103 Beacon Ct Unit 10102

- 36 Roboda Blvd

- 104 Beacon Ct Unit 10403

- 123 Beacon Ct Unit 10205

- 5 Fords Edge

- 680 S 6th Ave

- 676 S 5th Ave

- 210 New St Unit 84

- 22 Windy Knoll Dr

- 408 Emmett Ct

- 408 Emmitt Ct

- 404 Emmett Ct

- 335 Arch St

- 518 Walnut St

- 911 Mennonite Rd

- 917 Mennonite Rd

- 912 Mennonite Rd

- 907 Mennonite Rd

- 914 Mennonite Rd

- 910 Mennonite Rd

- 918 Mennonite Rd

- 908 Mennonite Rd

- 922 Mennonite Rd

- 903 Mennonite Rd

- 904 Mennonite Rd

- 72 Keokuk Rd

- 74 Keokuk Rd

- 70 Keokuk Rd

- 926 Mennonite Rd

- 76 Keokuk Rd

- 30 Cochise Ln

- 78 Keokuk Rd

- 839 Mennonite Rd

- 66 Keokuk Rd