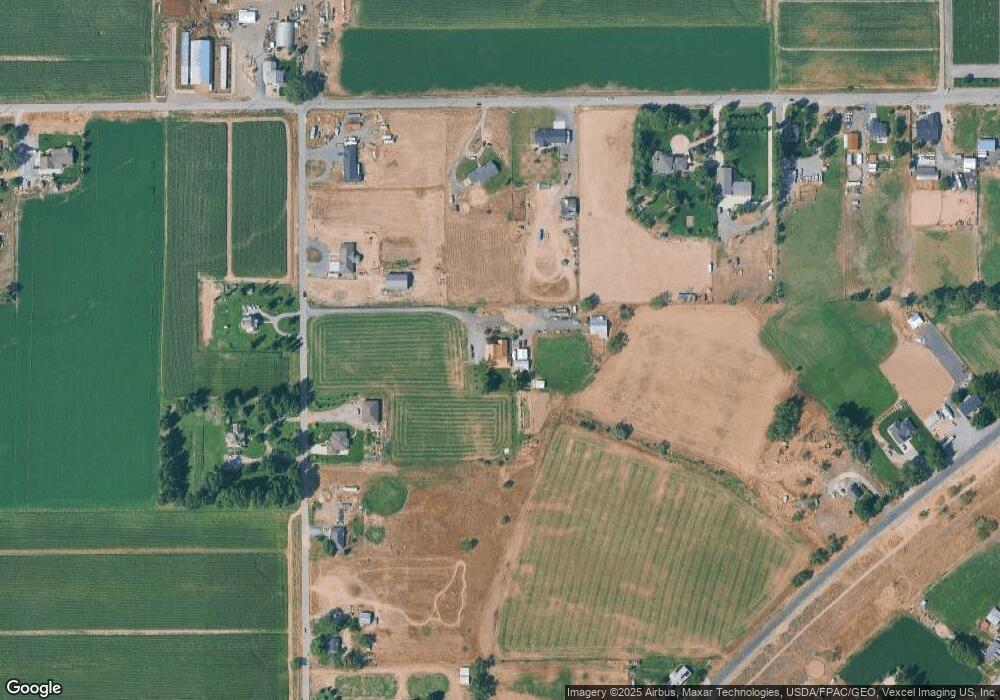

913 S 400 W Genola, UT 84655

Estimated Value: $947,000 - $2,590,000

7

Beds

4

Baths

4,976

Sq Ft

$306/Sq Ft

Est. Value

About This Home

This home is located at 913 S 400 W, Genola, UT 84655 and is currently estimated at $1,523,964, approximately $306 per square foot. 913 S 400 W is a home with nearby schools including Goshen Elementary school, Payson Junior High School, and Payson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2018

Sold by

Barlow Nephi O and The Nephi Barlow Family Trust

Bought by

Barlow Paul Winford

Current Estimated Value

Purchase Details

Closed on

Feb 21, 2018

Sold by

Carlile Milton Lee and Carlile Carolyn S

Bought by

Barlow Nephi O and Nephi Barlow Family Trust

Purchase Details

Closed on

Jan 7, 2013

Sold by

Carlile Milton Le and Carlile Carolyn S

Bought by

Carlile Milton Lee and Carlile Carolyn S

Purchase Details

Closed on

Oct 26, 2012

Sold by

Martin Val D and Martin Jill D

Bought by

Carlile Milton Lee and Carlile Carolyn S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$253,500

Interest Rate

3.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barlow Paul Winford | -- | None Available | |

| Barlow Nephi O | -- | Integrated Title Ins Svcs | |

| Carlile Milton Lee | -- | None Available | |

| Carlile Milton Lee | -- | Inwest Title Services Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carlile Milton Lee | $253,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,803 | $361,794 | $384,200 | $562,700 |

| 2024 | $1,803 | $186,461 | $0 | $0 |

| 2023 | $1,968 | $203,896 | $0 | $0 |

| 2022 | $1,804 | $633,200 | $390,100 | $243,100 |

| 2021 | $1,596 | $480,300 | $281,200 | $199,100 |

| 2020 | $1,359 | $420,200 | $226,900 | $193,300 |

| 2019 | $1,168 | $386,600 | $218,500 | $168,100 |

| 2018 | $1,215 | $371,600 | $203,500 | $168,100 |

| 2017 | $1,130 | $96,523 | $0 | $0 |

| 2016 | $1,082 | $92,892 | $0 | $0 |

| 2015 | $1,052 | $89,300 | $0 | $0 |

| 2014 | -- | $79,551 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1010 S Anna Ekins Memorial Ln

- 1896 S Marigold Way Unit 443

- 346 Red Rock Dr

- 686 W Frost St Unit 86

- 975 E 715 S

- 402 Topaz Dr

- 583 Sunset Dr

- 926 S Tanner Rd

- 1623 Sageberry Dr Unit 339

- 1691 Sageberry Dr Unit 345

- 1681 Sageberry Dr Unit 344

- 1669 Sageberry Dr Unit 343

- 1144 Crest Dale Ln

- 1022 Vista Ridge Dr Unit 149

- 633 Little Rock Dr

- 1858 W View Cove

- 1859 W View Cove

- 1208 Crest Dale Ln

- 1851 W View Cove

- 1217 Crest Dale Ln