9140 Ravenna Rd Unit 2 Twinsburg, OH 44087

Estimated Value: $286,155

--

Bed

1

Bath

3,200

Sq Ft

$89/Sq Ft

Est. Value

About This Home

This home is located at 9140 Ravenna Rd Unit 2, Twinsburg, OH 44087 and is currently estimated at $286,155, approximately $89 per square foot. 9140 Ravenna Rd Unit 2 is a home located in Summit County with nearby schools including Wilcox Primary School, Dodge Intermediate School, and Samuel Bissell Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2013

Sold by

Sanderson James R

Bought by

Bmj Management Llc

Current Estimated Value

Purchase Details

Closed on

Mar 19, 2007

Sold by

Sanderson James R and Sanderson Josephine

Bought by

Sanderson James R and Sanderson James B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,971

Interest Rate

6.31%

Mortgage Type

Commercial

Purchase Details

Closed on

Dec 18, 2003

Sold by

Hoaglin Ted C and Hoaglin Kathleen E

Bought by

Sanderson James R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,579

Interest Rate

6.04%

Mortgage Type

Commercial

Purchase Details

Closed on

Nov 16, 2000

Sold by

M And M Properties

Bought by

Hoaglin Ted C and Hoaglin Kathleen E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bmj Management Llc | $172,000 | None Available | |

| Sanderson James R | -- | Western Reserve Title Co Ltd | |

| Sanderson James R | $160,000 | Approved Statewide Title | |

| Hoaglin Ted C | $116,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sanderson James R | $163,971 | |

| Previous Owner | Sanderson James R | $127,579 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,881 | $75,625 | $29,484 | $46,141 |

| 2024 | $4,881 | $75,625 | $29,484 | $46,141 |

| 2023 | $3,827 | $75,625 | $29,484 | $46,141 |

| 2022 | $3,827 | $56,018 | $21,840 | $34,178 |

| 2021 | $3,866 | $56,018 | $21,840 | $34,178 |

| 2020 | $3,956 | $56,020 | $21,840 | $34,180 |

| 2019 | $3,802 | $55,860 | $21,840 | $34,020 |

| 2018 | $3,900 | $55,860 | $21,840 | $34,020 |

| 2017 | $3,647 | $55,860 | $21,840 | $34,020 |

| 2016 | $3,647 | $55,860 | $21,840 | $34,020 |

| 2015 | $3,647 | $55,860 | $21,840 | $34,020 |

| 2014 | $3,624 | $55,860 | $21,840 | $34,020 |

| 2013 | $4,180 | $54,830 | $19,660 | $35,170 |

Source: Public Records

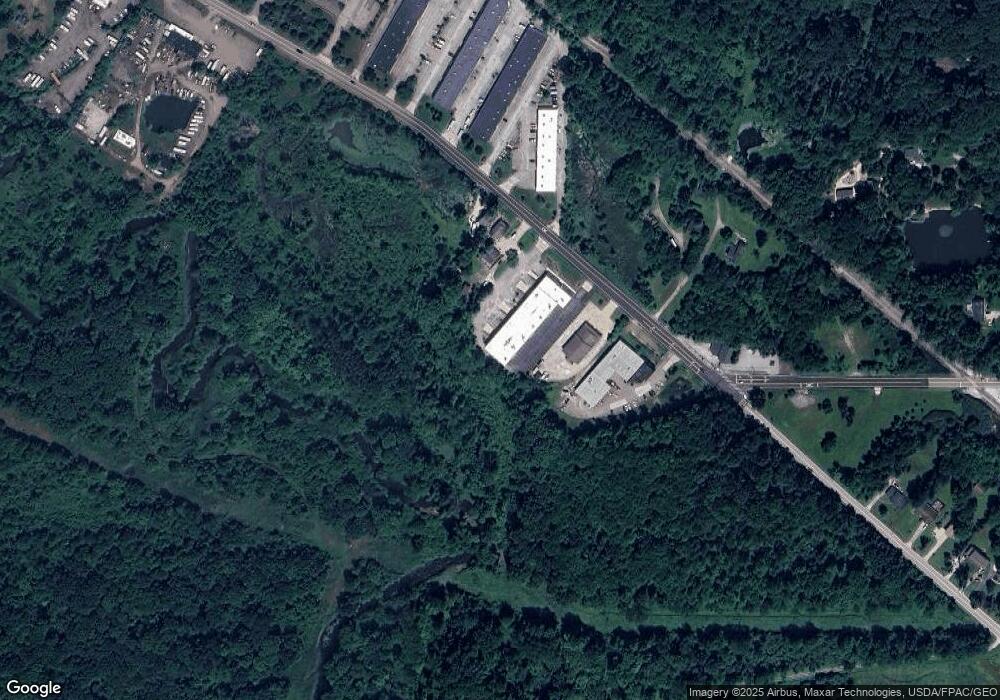

Map

Nearby Homes

- 3284 Cannon Rd

- 3590 E Aurora Rd

- 2869 Tinkers Ln

- 3281 Evans Way

- 2619 E Aurora Rd

- 2607 Burridge Cir Unit M29

- 2708 Edgebrook Crossing Unit 19

- 10000 Ravenna Rd

- 3110 Blue Jaye Ln

- 2825 Veron Ln

- 2064 Case St

- V/L- Eton St

- 2055 Rugby St

- 1959 Rugby St

- 2590 Post Rd

- 982 W Garfield Rd

- 2219 Fairway Blvd Unit 4E

- 2668 Walton Blvd

- 3425 Eryn Place

- 10413 Fox Hollow Cir

- 9222 Ravenna Rd

- 9228 Ravenna Rd

- 9221 Ravenna Rd Unit D8

- 9165 Ravenna Rd

- 9165 Ravenna Rd

- 9241 Ravenna Rd Unit C-1

- 9241 Ravenna Rd Unit C-3

- 9149 Ravenna Rd

- 3400 E Aurora Rd

- 9261 Ravenna Rd Unit B-5&6

- 9261 Ravenna Rd Unit B-6

- 9261 Ravenna Rd Unit B-5

- 9261 Ravenna Rd Unit B-11

- 9294 Ravenna Rd

- 9296 Ravenna Rd

- 3536 Cannon Rd

- 9081 Ravenna Rd

- 3600 Cannon Rd

- 9069 Ravenna Rd

- 3500 Cannon Rd