915 Fawn Cir East Wenatchee, WA 98802

Estimated Value: $532,000 - $741,000

3

Beds

2

Baths

1,914

Sq Ft

$332/Sq Ft

Est. Value

About This Home

This home is located at 915 Fawn Cir, East Wenatchee, WA 98802 and is currently estimated at $635,552, approximately $332 per square foot. 915 Fawn Cir is a home located in Douglas County with nearby schools including Sterling Intermediate School, Eastmont Junior High School, and Eastmont Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 8, 2023

Sold by

Jessup Alan

Bought by

915 Fawn Circle Llc

Current Estimated Value

Purchase Details

Closed on

Jul 14, 2008

Sold by

Jessup Home Design Inc

Bought by

Jessup Alan and Jessup Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Interest Rate

6.31%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 9, 2008

Sold by

Jessup Alan and Jessup Nicole

Bought by

Jessup Home Design Inc

Purchase Details

Closed on

Jan 3, 2008

Sold by

Jessup Home Design Inc

Bought by

Jessup Alan and Jessup Nicole

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 915 Fawn Circle Llc | -- | None Listed On Document | |

| Jessup Alan | -- | First American Title Ins Co | |

| Jessup Home Design Inc | -- | None Available | |

| Jessup Alan | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jessup Alan | $256,000 | |

| Previous Owner | Jessup Alan | $253,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $260 | $531,400 | $100,000 | $431,400 |

| 2024 | $4,334 | $501,600 | $100,000 | $401,600 |

| 2023 | $4,627 | $463,400 | $100,000 | $363,400 |

| 2022 | $3,847 | $354,600 | $80,000 | $274,600 |

| 2021 | $4,314 | $354,600 | $80,000 | $274,600 |

| 2020 | $3,927 | $368,100 | $72,000 | $296,100 |

| 2018 | $3,204 | $265,600 | $60,000 | $205,600 |

| 2017 | $2,903 | $265,600 | $60,000 | $205,600 |

| 2016 | $2,654 | $261,000 | $60,000 | $201,000 |

| 2015 | $2,537 | $237,900 | $60,000 | $177,900 |

| 2014 | -- | $218,000 | $60,000 | $158,000 |

| 2013 | -- | $213,400 | $60,000 | $153,400 |

Source: Public Records

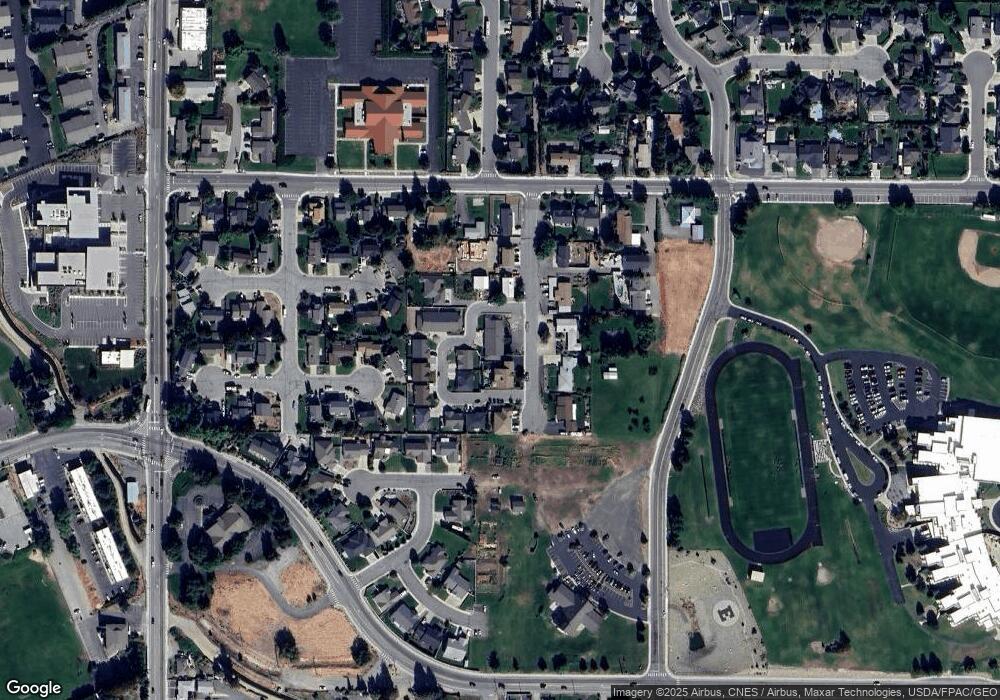

Map

Nearby Homes

- 1040 Gilbert Ct

- 520 11th St NE Unit 21

- 646 N Gale Place

- 845 N Devon Ave

- 1352 Eastmont Ave Unit 15

- 1055 N Jackson Ave

- 1046 Corum Cir

- 544 N Colorado Ave

- 1494 Eastmont Ave Unit 56

- 1494 Eastmont Ave Unit 33

- 1494 Eastmont Ave Unit 58

- 1051 N Baker Ave Unit A-202

- 1051 N Baker Ave Unit B 203

- 902 N Kenroy Terrace

- 772 N Keller Ave

- 946 Briarwood Dr

- 1218 N Ashland Ave

- 800 N Kentucky Ave

- 1653 Holly Ln

- 475 N Kansas Ave