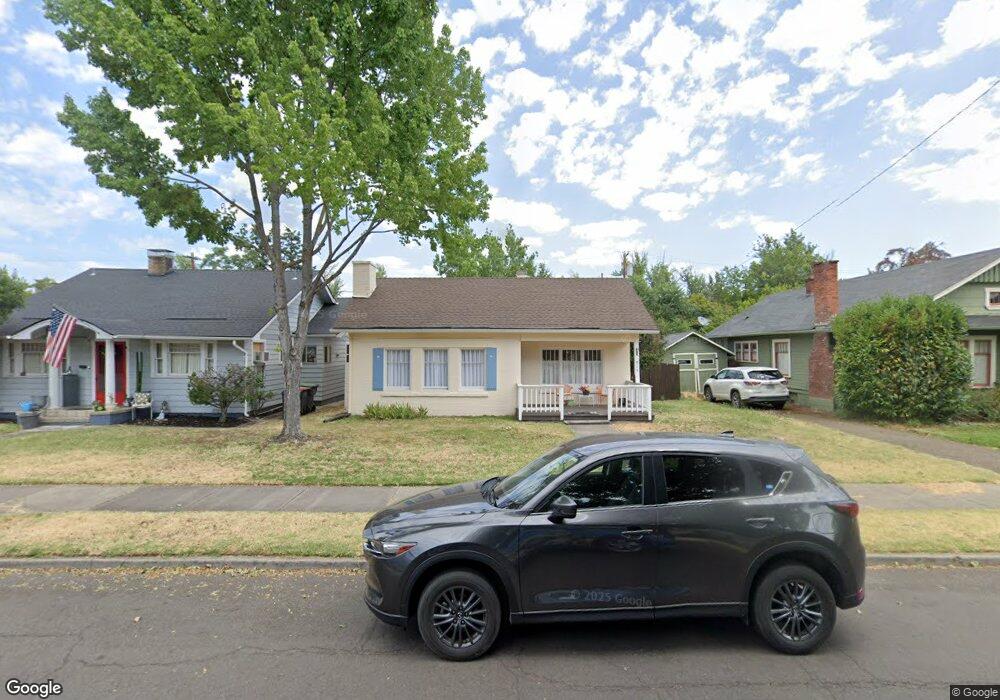

915 Reddy Ave Medford, OR 97504

Estimated Value: $286,545 - $301,000

2

Beds

1

Bath

1,138

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 915 Reddy Ave, Medford, OR 97504 and is currently estimated at $296,636, approximately $260 per square foot. 915 Reddy Ave is a home located in Jackson County with nearby schools including Roosevelt Elementary School, Hedrick Middle School, and South Medford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 1, 2024

Sold by

Ohara Nola Dean

Bought by

Nola Dean O Hara Revocable Living Trust and Ohara

Current Estimated Value

Purchase Details

Closed on

Dec 6, 2004

Sold by

Ohara Nola D

Bought by

Nola O Hara Enterprises Llc

Purchase Details

Closed on

Jul 2, 2003

Sold by

Morgan Katy B and Ohara Nola D

Bought by

Ohara Nola D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

5.15%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 19, 2002

Sold by

Morgan Katy B and Ohara Nola D

Bought by

Morgan Katy B and Ohara Nola D

Purchase Details

Closed on

Jul 1, 2002

Sold by

Borsz Laurie and Thomas Laurie Ann

Bought by

Ohara Nola D and Morgan Katy B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nola Dean O Hara Revocable Living Trust | -- | None Listed On Document | |

| Nola O Hara Enterprises Llc | -- | -- | |

| Ohara Nola D | -- | First Amer Title Ins Co Of O | |

| Morgan Katy B | -- | Amerititle | |

| Ohara Nola D | $103,900 | Jackson County Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ohara Nola D | $112,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,141 | $147,660 | $66,230 | $81,430 |

| 2024 | $2,141 | $143,360 | $64,300 | $79,060 |

| 2023 | $2,076 | $139,190 | $62,430 | $76,760 |

| 2022 | $2,025 | $139,190 | $62,430 | $76,760 |

| 2021 | $1,973 | $135,140 | $60,620 | $74,520 |

| 2020 | $1,931 | $131,210 | $58,860 | $72,350 |

| 2019 | $1,886 | $123,680 | $55,490 | $68,190 |

| 2018 | $1,837 | $120,080 | $53,880 | $66,200 |

| 2017 | $1,804 | $120,080 | $53,880 | $66,200 |

| 2016 | $1,816 | $113,200 | $50,790 | $62,410 |

| 2015 | $2,060 | $113,200 | $50,790 | $62,410 |

| 2014 | $1,715 | $106,710 | $47,870 | $58,840 |

Source: Public Records

Map

Nearby Homes

- 1008 Queen Anne Ave

- 1016 Queen Anne Ave

- 23 - 27 Crater Lake Ave

- 120 Stark St

- 23 Crater Lake Ave

- 214 Stark St

- 818 Sherman St

- 313 Marie St

- 109 Geneva St

- 31 Geneva St

- 719 Bennett Ave

- 619 E Main St

- 514 Marie St

- 122 Willamette Ave

- 120 Ashland Ave

- 858 E 9th St

- 200 Oregon Terrace

- 2749 Pronghorn Ln

- 302 Medford Heights Ln

- 818 E 9th St

- 919 Reddy Ave

- 921 Reddy Ave

- 106 Crater Lake Ave

- 914 Queen Anne Ave

- 908 Queen Anne Ave

- 920 Queen Anne Ave

- 914 Reddy Ave

- 902 Queen Anne Ave

- 932 Queen Anne Ave

- 922 Reddy Ave

- 34 Crater Lake Ave

- 1004 Queen Anne Ave

- 204 Crater Lake Ave

- 1007 Reddy Ave

- 107 Crater Lake Ave

- 915 Queen Anne Ave

- 115 Crater Lake Ave Unit 117

- 115 Crater Lake Ave

- 911 Queen Anne Ave

- 103 Crater Lake Ave