92-1017 Koio Dr Unit P Kapolei, HI 96707

Estimated Value: $1,970,710 - $2,267,000

4

Beds

3

Baths

2,216

Sq Ft

$964/Sq Ft

Est. Value

About This Home

This home is located at 92-1017 Koio Dr Unit P, Kapolei, HI 96707 and is currently estimated at $2,135,678, approximately $963 per square foot. 92-1017 Koio Dr Unit P is a home located in Honolulu County with nearby schools including Barbers Point Elementary School, Kapolei Middle School, and Kapolei High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 5, 2022

Sold by

Ahrens Robert Allen and Ahrens Pauline Mitchell

Bought by

Revocable Trust Of Robert A Ahrens And Paulin and Ahrens

Current Estimated Value

Purchase Details

Closed on

Aug 9, 2010

Sold by

Sloan Bruce N and Sloan Joni

Bought by

Ahrens Robert Allen and Ahrens Pauline Mitchell

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$637,500

Interest Rate

4.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 3, 2006

Sold by

Sloan Bruce Nowlin and Sloan Joni Lynn

Bought by

Sloan Bruce N and Sloan Joni

Purchase Details

Closed on

Nov 14, 2005

Sold by

Centex Homes

Bought by

Nowlin Sloan Bruce and Sloan Joni Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,173,496

Interest Rate

5.93%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Revocable Trust Of Robert A Ahrens And Paulin | -- | None Listed On Document | |

| Revocable Trust | $50,000 | Yim Stephen B | |

| Revocable Trust | $50,000 | Yim Stephen B | |

| Ahrens Robert Allen | $1,100,000 | Fam | |

| Sloan Bruce N | -- | None Available | |

| Nowlin Sloan Bruce | $1,466,857 | Itc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ahrens Robert Allen | $637,500 | |

| Previous Owner | Nowlin Sloan Bruce | $1,173,496 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,578 | $2,202,600 | $1,668,500 | $534,100 |

| 2024 | $6,578 | $2,039,400 | $1,345,600 | $693,800 |

| 2023 | $6,610 | $2,028,500 | $1,345,600 | $682,900 |

| 2022 | $5,483 | $1,706,600 | $1,089,900 | $616,700 |

| 2021 | $4,204 | $1,341,000 | $796,600 | $544,400 |

| 2020 | $4,461 | $1,414,500 | $869,600 | $544,900 |

| 2019 | $3,786 | $1,351,100 | $827,000 | $524,100 |

| 2018 | $3,786 | $1,201,700 | $717,300 | $484,400 |

| 2017 | $3,678 | $1,170,800 | $581,300 | $589,500 |

| 2016 | $3,411 | $1,094,500 | $568,900 | $525,600 |

| 2015 | $3,317 | $1,067,600 | $530,400 | $537,200 |

| 2014 | $2,605 | $996,500 | $391,700 | $604,800 |

Source: Public Records

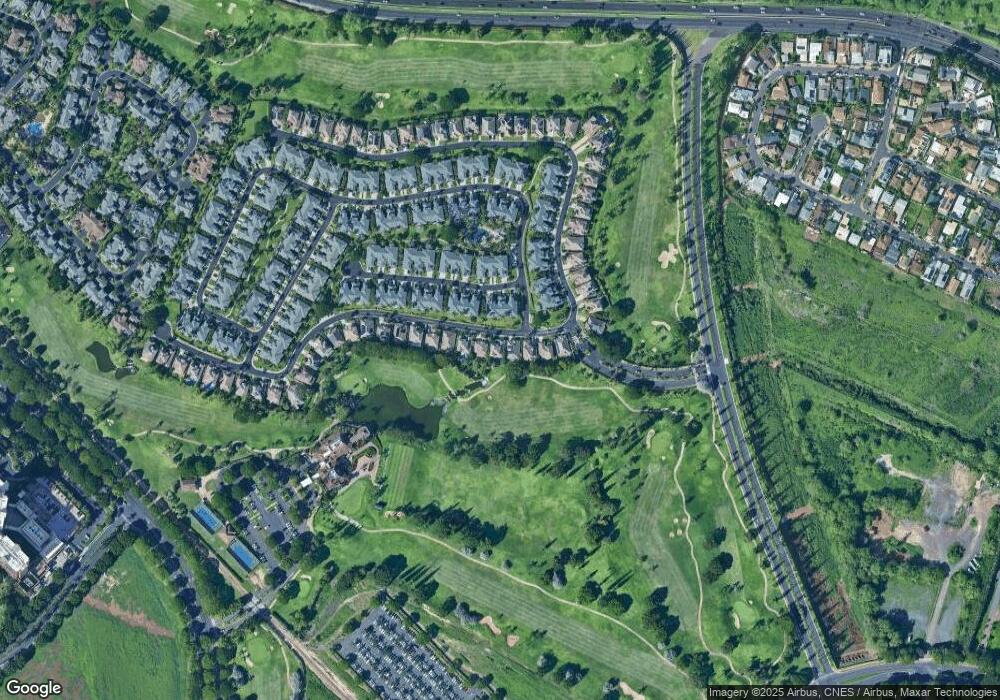

Map

Nearby Homes

- 92-1015 Koio Dr Unit S-57

- 92-1015 Koio Dr Unit S-58

- 92-1015 Koio Dr Unit S-52

- 92-1057 Koio Dr Unit F

- 92-1087 Koio Dr Unit M29-3 (Apt C)

- 92-1081 Koio Dr Unit M265

- 92-1081 Koio Dr Unit M261

- 92-1051 Koio Dr Unit M83

- 92-1027 Koio Dr Unit B (M10-2)

- 92-1033 Koio Dr Unit M156

- 92-1067 Koio Dr Unit M426

- 92-1071 Koio Dr Unit M442

- 92-1192 Olani St Unit 613

- 92-1037 Koio Dr Unit M11

- 92-1017 Koio Dr Unit S-30

- 92-1196 Olani St Unit 632

- 92-1214 Olani St Unit 721

- 92-1164 Olani St Unit 473

- 92-1132 Olani St Unit 313

- 92-365 Malahuna Place

- 92-1021-1021 Koio Dr

- 92-1015 Koio Dr Unit K

- 92-1015 Koio Dr Unit S45

- 92-1017 Koio Dr Unit K

- 92-1017 Koio Dr Unit G

- 92-1015 Koio Dr Unit X

- 92-1015 Koio Dr Unit U

- 92-1019 Koio Dr Unit H

- 92-1019 Koio Dr Unit U

- 92-1017 Koio Dr Unit D

- 92-1019 Koio Dr Unit S14

- 92-1015 Koio Dr Unit S47

- 92-1015 Koio Dr Unit R

- 92-1015 Koio Dr Unit N

- 92-1015 Koio Dr Unit M

- 92-1015 Koio Dr Unit S54

- 92-1015 Koio Dr Unit F

- 92-1015 Koio Dr Unit J

- 92-1015 Koio Dr Unit S56

- 92-1019 Koio Dr Unit J