9201 N 22nd West Place Sperry, OK 74073

Estimated Value: $254,000 - $306,000

3

Beds

3

Baths

1,624

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 9201 N 22nd West Place, Sperry, OK 74073 and is currently estimated at $282,437, approximately $173 per square foot. 9201 N 22nd West Place is a home located in Osage County with nearby schools including Sperry Elementary School, Sperry Middle School, and Sperry High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 3, 2015

Sold by

Henton Kacey L and Henton Brad Lee

Bought by

Martin Joe A and Martin Carla J

Current Estimated Value

Purchase Details

Closed on

Aug 14, 2009

Sold by

Kirkendoll Ronald Brett and Kirkendoll Angie Dawn

Bought by

Henton Kecey L and Tanner Brad Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,900

Interest Rate

5.19%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 4, 2007

Sold by

Kirkendoll Ronald Brett and Jobe Angie Dawh

Bought by

Kirkendoll Ronald Brett and Kirkendoll Angie Dawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,000

Interest Rate

6.3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 20, 1997

Sold by

Kirkendoll Ronald Brett

Bought by

Kirkendoll Ronald Brett

Purchase Details

Closed on

Oct 30, 1996

Sold by

Shoemake Reba S

Bought by

Kirkendoll Ronald Brett

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martin Joe A | $169,500 | -- | |

| Henton Kecey L | $145,000 | -- | |

| Kirkendoll Ronald Brett | -- | -- | |

| Kirkendoll Ronald Brett | -- | -- | |

| Kirkendoll Ronald Brett | $11,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Henton Kecey L | $147,900 | |

| Previous Owner | Kirkendoll Ronald Brett | $97,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,101 | $21,357 | $1,134 | $20,223 |

| 2024 | $1,999 | $20,340 | $1,080 | $19,260 |

| 2023 | $1,999 | $20,340 | $1,080 | $19,260 |

| 2022 | $1,990 | $20,340 | $1,080 | $19,260 |

| 2021 | $1,976 | $20,340 | $1,080 | $19,260 |

| 2020 | $1,980 | $20,340 | $1,080 | $19,260 |

| 2019 | $2,006 | $20,340 | $1,080 | $19,260 |

| 2018 | $2,004 | $20,340 | $1,080 | $19,260 |

| 2017 | $1,944 | $20,340 | $1,080 | $19,260 |

| 2016 | $1,934 | $20,336 | $1,080 | $19,256 |

| 2015 | $1,411 | $16,131 | $1,080 | $15,051 |

| 2014 | $1,419 | $16,131 | $1,080 | $15,051 |

| 2013 | $1,513 | $16,131 | $1,080 | $15,051 |

Source: Public Records

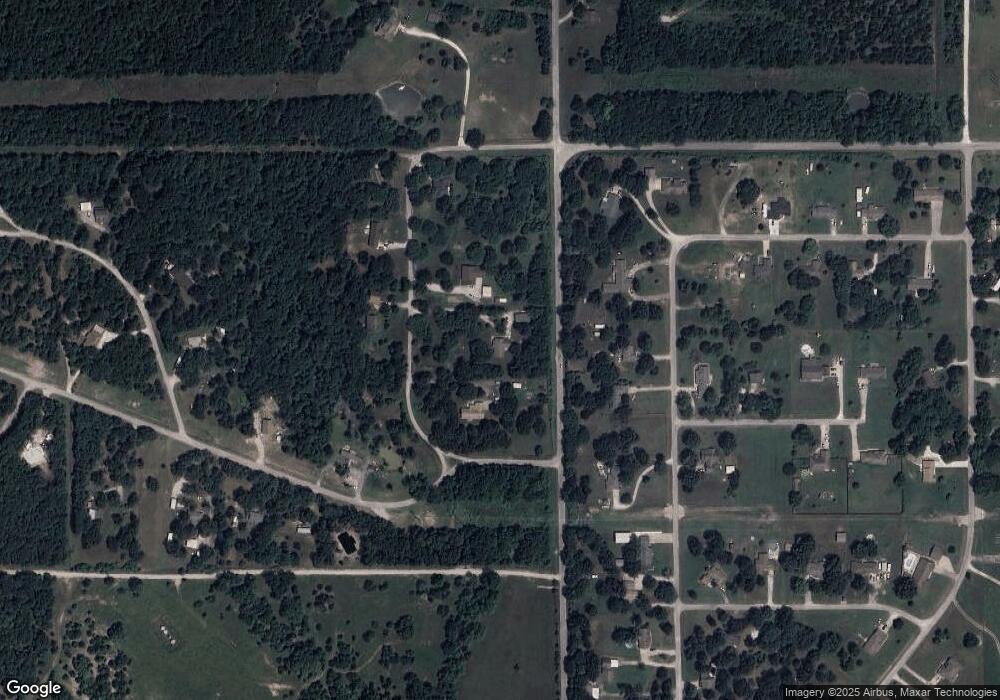

Map

Nearby Homes

- 9026 Crestwood Dr

- 1819 W Oak Knoll

- 2781 W 88th St N

- 9084 N Osage Dr

- 2012 W 88th St N

- 10044 N 30th West Ave

- 0 N 36th West Ave

- 4812 E 76th

- 2744 W 103rd St N

- 0 Sunset Unit 2544339

- 0 Sunset Unit 2544356

- 299 W Cherry

- 9858 N 38 Ave W

- 8588 N Cincinnati Ave

- 308 S Cincinnati Ave

- 202 W Ada St

- 9545 S Cincinnati St

- 10739 N 25th West Ave

- 6146 W 108th St N

- 109 N Coal St

- 9145 N 22nd West Place

- 9227 N 22nd West Place

- 2223 W 91st St N

- 2207 W 91st St N

- 9198 N 22nd West Place

- 9255 N 22nd West Place

- 2208 W 91st St N

- 9180 Crestwood Dr

- 2204 W 91st St N

- 9006 Crestwood Dr

- 9218 Crestwood Dr

- 9250 N 22nd West Place

- 9281 N 22nd West Place

- 9006 N 24th West Ave

- 9006 Crestwood Dr

- 9236 Crestwood Dr

- 9018 Crestwood Dr

- 8815 Crestwood Dr

- 9280 N 22nd West Place

- 0 E 91st St