921 Adara Dr Unit 921 Columbus, OH 43240

Polaris North NeighborhoodEstimated Value: $390,867 - $421,000

2

Beds

3

Baths

2,491

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 921 Adara Dr Unit 921, Columbus, OH 43240 and is currently estimated at $407,217, approximately $163 per square foot. 921 Adara Dr Unit 921 is a home located in Delaware County with nearby schools including Glen Oak Elementary School, Olentangy Orange Middle School, and Orange High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2022

Sold by

Coyne Dennis J and Revoca Judith

Bought by

Romanoski Carol

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$271,270

Interest Rate

6.92%

Mortgage Type

New Conventional

Estimated Equity

$135,947

Purchase Details

Closed on

Sep 24, 2010

Sold by

Coyne Dennis J and Coyne Judith L

Bought by

Coyne Dennis J and Coyne Judith L

Purchase Details

Closed on

May 1, 2009

Sold by

Olympus Communities Ltd

Bought by

Coyne Dennis J and Coyne Judith L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Interest Rate

4.85%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romanoski Carol | $116,666 | Acs Title | |

| Coyne Dennis J | -- | Attorney | |

| Coyne Dennis J | $240,000 | Talon Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Romanoski Carol | $280,000 | |

| Previous Owner | Coyne Dennis J | $192,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,201 | $113,860 | $18,200 | $95,660 |

| 2023 | $6,224 | $113,860 | $18,200 | $95,660 |

| 2022 | $5,379 | $88,870 | $14,000 | $74,870 |

| 2021 | $5,409 | $88,870 | $14,000 | $74,870 |

| 2020 | $5,439 | $88,870 | $14,000 | $74,870 |

| 2019 | $4,672 | $80,260 | $14,000 | $66,260 |

| 2018 | $4,693 | $80,260 | $14,000 | $66,260 |

| 2017 | $4,534 | $78,050 | $12,250 | $65,800 |

| 2016 | $4,843 | $78,050 | $12,250 | $65,800 |

| 2015 | $4,424 | $78,050 | $12,250 | $65,800 |

| 2014 | $4,488 | $78,050 | $12,250 | $65,800 |

| 2013 | $4,590 | $78,050 | $12,250 | $65,800 |

Source: Public Records

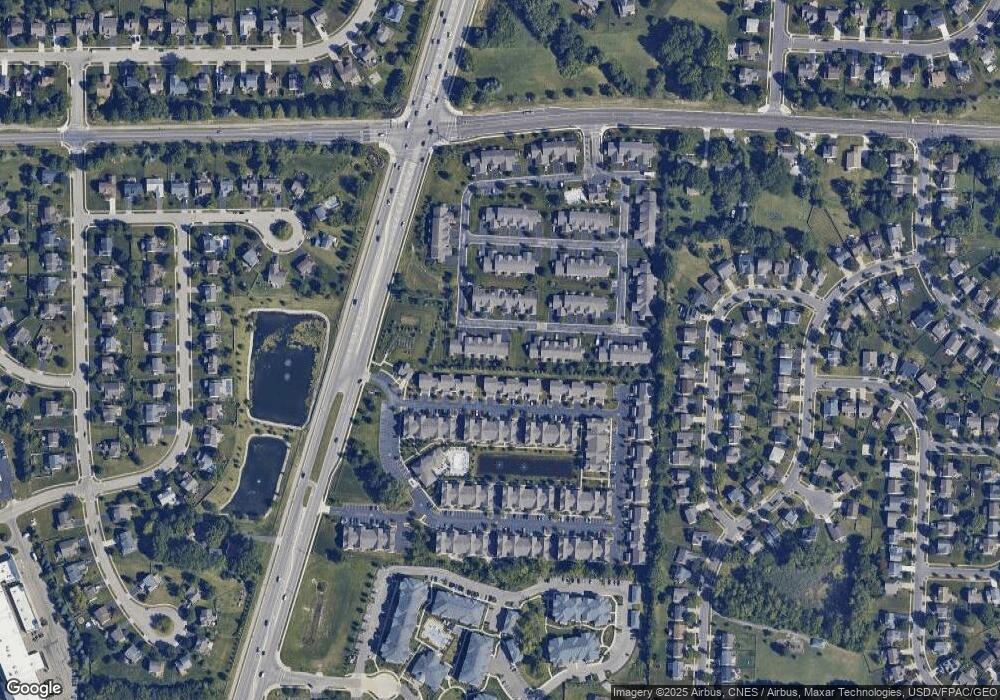

Map

Nearby Homes

- 974 Shaula Dr Unit 3974

- 9215 Misty Dawn Dr

- 1577 Cottonwood Dr

- 1746 E Powell Rd

- 9170 Parkbury Ln

- 1923 Myrtle St

- 2216 Reeves Ave

- 9073 Polaris Lakes Dr Unit 9073

- 1955 Royal Oak Dr

- 2165 Ben Brush Place

- 687 Sanville Dr

- 8060 Gladshire Blvd

- 1248 Westwood Dr

- 9192 Cambrian Commons Dr

- 8863 Olenbrook Dr

- 2383 Bold Venture Dr

- 8628 Clover Glade Dr

- 7485 Bold Venture Ct

- 8726 Woodwind Dr

- 2661 Bold Venture Dr

- 915 Adara Dr Unit 8915

- 903 Adara Dr Unit 8903

- 903 Adara Dr

- 927 Adara Dr Unit 7927

- 928 Adara Dr Unit 14928

- 897 Adara Dr Unit 8897

- 897 Adara Dr Unit 920

- 9232 Centauri Ave

- 933 Adara Dr Unit 7933

- 922 Adara Dr Unit 14922

- 934 Adara Dr Unit 14934

- 940 Adara Dr Unit 940

- 939 Adara Dr Unit 7939

- 945 Adara Dr Unit 945

- 923 Chara Ln Unit 13923

- 917 Chara Ln Unit 13917

- 935 Chara Ln Unit 935

- 941 Chara Ln Unit 13941

- 952 Adara Dr Unit 15952

- 951 Adara Dr Unit 7951