9222 Great Lakes Cir Unit 79222 Dayton, OH 45458

Estimated Value: $240,112 - $255,000

3

Beds

3

Baths

1,359

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 9222 Great Lakes Cir Unit 79222, Dayton, OH 45458 and is currently estimated at $244,778, approximately $180 per square foot. 9222 Great Lakes Cir Unit 79222 is a home located in Montgomery County with nearby schools including Primary Village North, John Hole Elementary, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2020

Sold by

Luna Jose Gonzalo Garcia and Cantu Andrea Zavala

Bought by

Xiao Zhen and Xue Jinyun

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,500

Outstanding Balance

$105,007

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$139,771

Purchase Details

Closed on

Jan 13, 2014

Sold by

Cohn Jennifer S

Bought by

Garcia Luna Jose Gonzalo and Cantu Andrea Zavala

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,600

Interest Rate

4.5%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Nov 7, 2011

Sold by

Baber Joe and Mcewan Dawn

Bought by

Cohn Jennifer S

Purchase Details

Closed on

May 9, 2005

Sold by

Simms Twin Lakes Ltd

Bought by

Baber Joe

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,089

Interest Rate

5.25%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Xiao Zhen | $158,000 | Landmark Ttl Agcy South Inc | |

| Garcia Luna Jose Gonzalo | $123,000 | None Available | |

| Cohn Jennifer S | $95,000 | Attorney | |

| Baber Joe | $159,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Xiao Zhen | $118,500 | |

| Previous Owner | Garcia Luna Jose Gonzalo | $101,600 | |

| Previous Owner | Baber Joe | $143,089 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,864 | $62,560 | $14,280 | $48,280 |

| 2023 | $3,864 | $62,560 | $14,280 | $48,280 |

| 2022 | $3,596 | $46,050 | $10,500 | $35,550 |

| 2021 | $3,606 | $46,050 | $10,500 | $35,550 |

| 2020 | $3,601 | $46,050 | $10,500 | $35,550 |

| 2019 | $3,565 | $40,740 | $10,500 | $30,240 |

| 2018 | $3,185 | $40,740 | $10,500 | $30,240 |

| 2017 | $3,130 | $40,740 | $10,500 | $30,240 |

| 2016 | $3,226 | $39,580 | $10,500 | $29,080 |

| 2015 | $3,174 | $39,580 | $10,500 | $29,080 |

| 2014 | $3,174 | $39,580 | $10,500 | $29,080 |

| 2012 | -- | $41,700 | $11,200 | $30,500 |

Source: Public Records

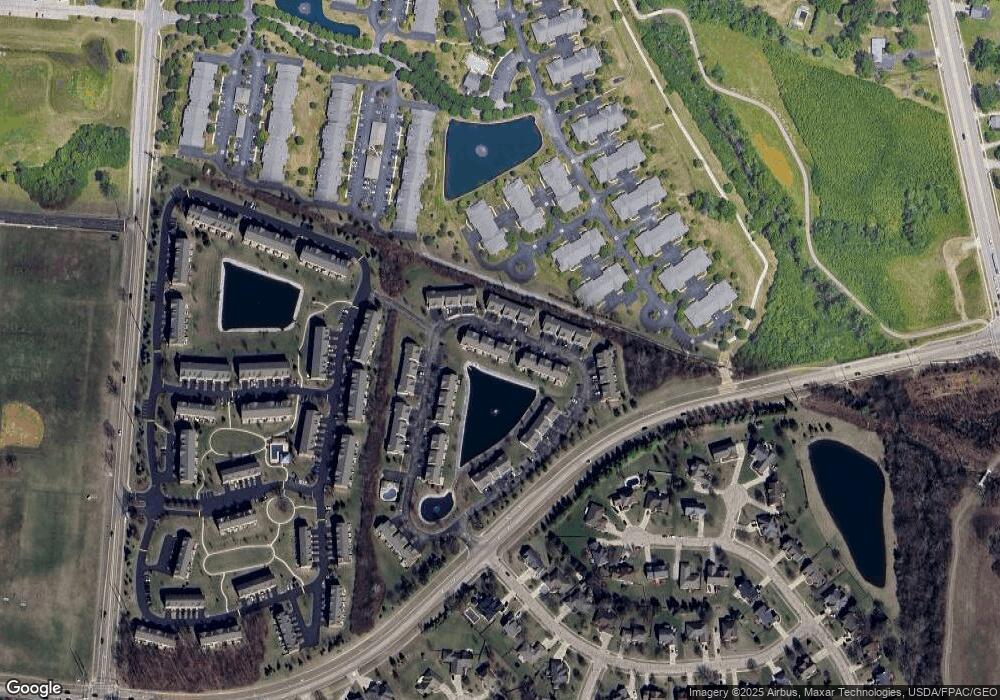

Map

Nearby Homes

- 1591 Watermark Ct Unit 241591

- 9251 Great Lakes Cir Unit 59251

- 1573 Watermark Ct Unit 221573

- 9266 Great Lakes Cir Unit 29266

- 9515 Tahoe Dr

- 9519 Tahoe Dr

- 9372 Parkside Dr

- 9540 Tahoe Dr

- 1794 Placid Dr

- 9406 Tahoe Dr Unit 19406

- 1739 Waterstone Blvd Unit 208

- 9604 Tahoe Dr

- 9553 Tahoe Dr

- 1875 Waterstone Blvd Unit 103

- 1875 Waterstone Blvd Unit 312

- 9475 Copperton Dr

- 1963 Waterstone Blvd Unit 104

- 9607 Olde Georgetown

- 2115 Autumn Haze Trail

- 9281 Little Yankee Run Unit 9281

- 9220 Great Lakes Cir Unit 79220

- 9224 Great Lakes Cir Unit 79224

- 9226 Great Lakes Cir Unit 79226

- 9228 Great Lakes Cir Unit 79228

- 9216 Great Lakes Cir Unit 109216

- 9214 Great Lakes Cir Unit 109214

- 9219 Great Lakes Cir Unit 89219

- 9221 Great Lakes Cir Unit 89221

- 9225 Great Lakes Cir Unit 89225

- 9230 Great Lakes Cir Unit 79230

- 9217 Great Lakes Cir Unit 89217

- 9227 Great Lakes Cir Unit 89227

- 9210 Great Lakes Cir Unit 109210

- 9250 Great Lakes Cir Unit 49250

- 9215 Great Lakes Cir Unit 99215

- 9231 Great Lakes Cir Unit 69231

- 9252 Great Lakes Cir Unit 49252

- 9212 Great Lakes Cir Unit 109212

- 9213 Great Lakes Cir Unit 99213

- 9208 Great Lakes Cir Unit 109208