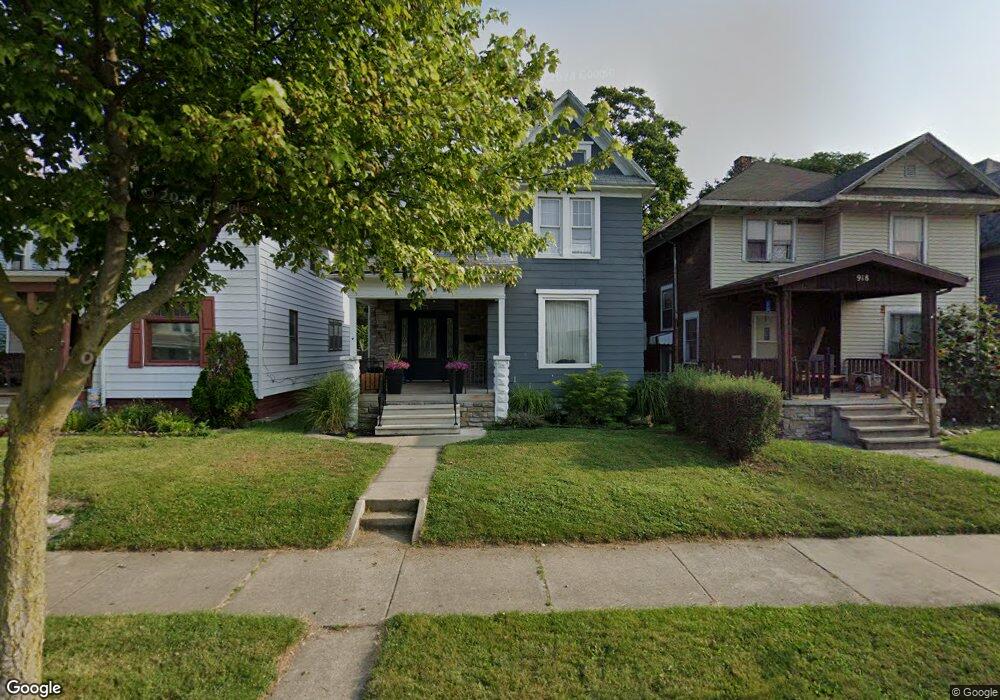

924 3rd St Fort Wayne, IN 46808

Hamilton NeighborhoodEstimated Value: $146,000 - $163,000

3

Beds

2

Baths

2,252

Sq Ft

$70/Sq Ft

Est. Value

About This Home

This home is located at 924 3rd St, Fort Wayne, IN 46808 and is currently estimated at $157,909, approximately $70 per square foot. 924 3rd St is a home located in Allen County with nearby schools including Bloomingdale Elementary School, Lakeside Middle School, and North Side High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2025

Sold by

Ltd Pg Management Llc

Bought by

Ariza Alexander Diaz and Curillo Blanca Leonor

Current Estimated Value

Purchase Details

Closed on

May 30, 2024

Sold by

Houck Thomas G

Bought by

Ltd Pg Management Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

6.39%

Mortgage Type

Construction

Purchase Details

Closed on

May 29, 2024

Sold by

Houck Thomas G

Bought by

Ltd Pg Management Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

6.39%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ariza Alexander Diaz | -- | None Listed On Document | |

| Ltd Pg Management Llc | -- | Metropolitan Title | |

| Ltd Pg Management Llc | $48,500 | Metropolitan Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Ltd Pg Management Llc | $50,000 | |

| Closed | Ltd Pg Management Llc | $50,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,641 | $164,000 | $14,100 | $149,900 |

| 2024 | $2,666 | $115,500 | $14,100 | $101,400 |

| 2023 | $2,666 | $116,600 | $14,100 | $102,500 |

| 2022 | $2,334 | $104,200 | $14,100 | $90,100 |

| 2021 | $1,874 | $84,000 | $6,800 | $77,200 |

| 2020 | $1,793 | $82,200 | $6,800 | $75,400 |

| 2019 | $1,377 | $63,500 | $6,800 | $56,700 |

| 2018 | $1,288 | $59,000 | $6,800 | $52,200 |

| 2017 | $1,305 | $59,300 | $6,800 | $52,500 |

| 2016 | $1,232 | $56,800 | $6,800 | $50,000 |

| 2014 | $1,159 | $55,900 | $6,800 | $49,100 |

| 2013 | $1,169 | $56,400 | $6,800 | $49,600 |

Source: Public Records

Map

Nearby Homes

- 1511 Oakland St

- 1117 3rd St

- 739 W 4th St

- 1129 Saint Marys Ave

- 1305 Sinclair St

- 1316 Sinclair St

- 1014 Huffman St

- 619 3rd St

- 825 Putnam St

- 619 Huffman St

- 925 Archer Ave

- 1516 W 4th St

- 653 Putnam St

- 1314 Burgess St

- 702 Archer Ave

- 415 Huffman St

- 1513 Huffman Blvd

- 715 W Superior St

- 1641 Howell St

- 1702 Sinclair St

Your Personal Tour Guide

Ask me questions while you tour the home.