929 Phaeton Way Auburn, IN 46706

Estimated Value: $472,000 - $529,000

4

Beds

5

Baths

4,100

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 929 Phaeton Way, Auburn, IN 46706 and is currently estimated at $505,753, approximately $123 per square foot. 929 Phaeton Way is a home located in DeKalb County with nearby schools including DeKalb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 24, 2017

Sold by

Pfister Jeremy D and Pfister Katherine F

Bought by

Hawkins Wesley S and Hawkins Erica M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,600

Outstanding Balance

$165,238

Interest Rate

4.32%

Mortgage Type

New Conventional

Estimated Equity

$340,515

Purchase Details

Closed on

Nov 23, 2007

Sold by

Holwerda Timothy S and Holwerda Julie A

Bought by

Pfister Jeremy D and Pfister Katherine F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.33%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 3, 2000

Sold by

Williams Larry R and Williams Roxanne

Bought by

Holwerda Timothy S and Holwerda Julie A

Purchase Details

Closed on

Feb 1, 2000

Sold by

Howard Edward C and Howard Rosemary A

Bought by

Williams Larry R and Williams Roxanne

Purchase Details

Closed on

Aug 31, 1995

Sold by

R Max Miller C M Inc

Bought by

Howard Edward C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hawkins Wesley S | -- | -- | |

| Pfister Jeremy D | -- | None Available | |

| Holwerda Timothy S | $232,000 | -- | |

| Williams Larry R | $225,000 | -- | |

| Howard Edward C | $259,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hawkins Wesley S | $245,600 | |

| Previous Owner | Pfister Jeremy D | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,471 | $491,000 | $70,000 | $421,000 |

| 2023 | $3,964 | $461,100 | $67,000 | $394,100 |

| 2022 | $4,075 | $408,000 | $58,300 | $349,700 |

| 2021 | $3,420 | $342,000 | $52,600 | $289,400 |

| 2020 | $2,954 | $301,400 | $47,900 | $253,500 |

| 2019 | $3,118 | $311,200 | $47,900 | $263,300 |

| 2018 | $2,833 | $282,700 | $47,900 | $234,800 |

| 2017 | $2,748 | $274,200 | $47,900 | $226,300 |

| 2016 | $2,616 | $261,000 | $47,900 | $213,100 |

| 2014 | $2,333 | $233,300 | $35,300 | $198,000 |

Source: Public Records

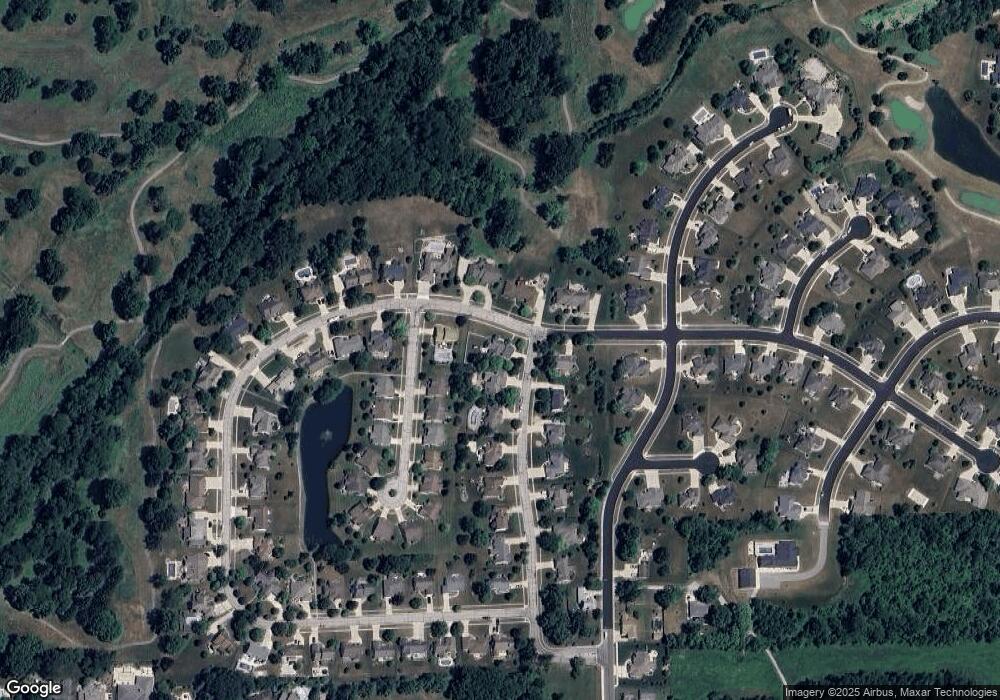

Map

Nearby Homes

- 1102 Packard Place

- 1208 Phaeton Way

- 816 E 1st St

- TBD County Road 40

- 307 Clinton St

- 2002 Approach Dr

- 271 N Mcclellan St Unit 105

- 2001 Bogey Ct

- 812 E 9th St

- 2002 Bogey Ct

- 410 N Cedar St

- 2021 Approach Dr

- 1815 Bent Tree Ct

- 300 E 7th St

- 218 Iwo St

- 1908 Bent Tree Ct

- 1408 Katherine St

- 3483 Indiana 8

- 2213 Golfview Dr

- 303 Hunters Ridge

- 1123 Essex Dr

- 919 Phaeton Way

- 1126 Packard Place

- 934 Phaeton Way

- 939 Phaeton Way

- 1122 Packard Place

- 1124 Essex Dr

- 942 Phaeton Way

- 918 Phaeton Way

- 1118 Packard Place

- 1115 Essex Dr

- 831 Phaeton Way

- 1120 Essex Dr

- 1125 Packard Place

- 910 Phaeton Way

- 1121 Packard Place

- 1116 Essex Dr

- 1111 Essex Dr

- 943 Phaeton Way

- 1117 Packard Place