929 W 670 S Unit 8 Pleasant Grove, UT 84062

Estimated Value: $299,000 - $332,000

3

Beds

2

Baths

1,264

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 929 W 670 S Unit 8, Pleasant Grove, UT 84062 and is currently estimated at $314,384, approximately $248 per square foot. 929 W 670 S Unit 8 is a home located in Utah County with nearby schools including Mount Mahogany School, Pleasant Grove Junior High School, and Pleasant Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 8, 2025

Sold by

Harris Cheryl Lynne

Bought by

Cheryl Lynne Harris Living Trust and Harris

Current Estimated Value

Purchase Details

Closed on

Jun 11, 2025

Sold by

Oberhansley Elisa Brooke

Bought by

Harris Cheryl Lynne

Purchase Details

Closed on

Sep 5, 2023

Sold by

Harris Cheryl L

Bought by

Oberhansley Elisa Brooke

Purchase Details

Closed on

Aug 28, 2023

Sold by

Oberhansley Garth H

Bought by

Oberhansley Elise Brooke

Purchase Details

Closed on

Aug 23, 2023

Sold by

Harris Cheryl L

Bought by

Oberhansley Elisa Brooke

Purchase Details

Closed on

Apr 16, 2004

Sold by

P G Development Co Llc

Bought by

Sundance Homes Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cheryl Lynne Harris Living Trust | -- | None Listed On Document | |

| Harris Cheryl Lynne | -- | None Listed On Document | |

| Oberhansley Elisa Brooke | -- | None Listed On Document | |

| Oberhansley Elise Brooke | -- | None Listed On Document | |

| Oberhansley Elisa Brooke | -- | None Listed On Document | |

| Sundance Homes Llc | -- | Backman Stewart Title Servi |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,300 | $284,300 | $31,600 | $252,700 |

| 2024 | $1,300 | $155,320 | $0 | $0 |

| 2023 | $1,324 | $161,810 | $0 | $0 |

| 2022 | $1,437 | $174,680 | $0 | $0 |

| 2021 | $1,262 | $233,500 | $28,000 | $205,500 |

| 2020 | $1,180 | $214,200 | $25,700 | $188,500 |

| 2019 | $1,038 | $194,700 | $22,700 | $172,000 |

| 2018 | $896 | $159,000 | $19,100 | $139,900 |

| 2017 | $838 | $79,200 | $0 | $0 |

| 2016 | $796 | $72,600 | $0 | $0 |

| 2015 | $841 | $72,600 | $0 | $0 |

| 2014 | $791 | $67,650 | $0 | $0 |

Source: Public Records

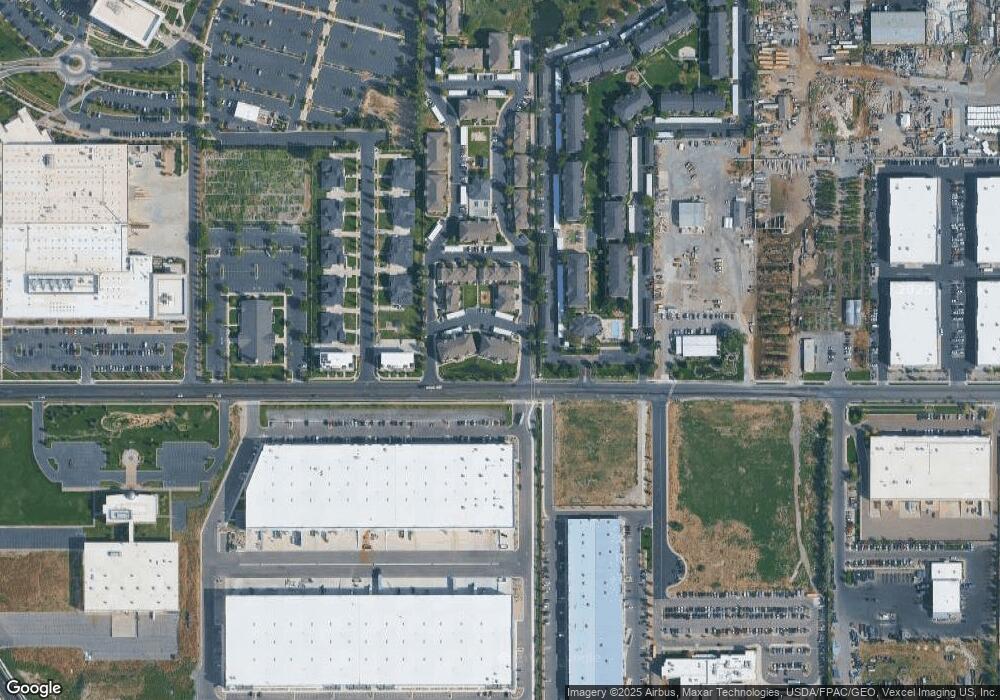

Map

Nearby Homes

- 584 S 980 W Unit 58

- 963 W 670 S Unit 20

- 929 W 670 S Unit 9

- 851 W 310 S

- 364 S 700 W

- 278 S 740 W

- 1208 W 80 S

- 1211 W 20 S

- 1434 W Watson Ln

- 1267 W 20 S

- 1078 W 70 N

- 1249 W Cambria Dr Unit 101

- 1597 W 80 S

- 1406 W 50 N

- Washington Farmhouse Plan at Anderson Farms

- 169 W 200 S

- 611 N Briarwood Ln

- 742 W State St Unit D

- 1470 W 50 N

- 128 S 1700 W Unit 12

- 929 W 670 S Unit 10

- 929 W 670 S Unit 7

- 929 W 670 S Unit 6

- 929 W 670 S Unit 5

- 929 W 670 S Unit 4

- 929 W 670 S

- 929 W 670 S Unit A2

- 929 W 670 S

- 929 W 670 S Unit 11

- 929 W 670 S Unit 12

- 929 W 670 S Unit 3

- 929 W 670 S Unit 2

- 656 S 910 W Unit 26

- 656 S 910 W Unit 25

- 656 S 910 W Unit 27

- 656 S 910 W

- 656 S 910 W

- 963 W 670 S

- 963 W 670 S

- 963 W 670 S Unit B21