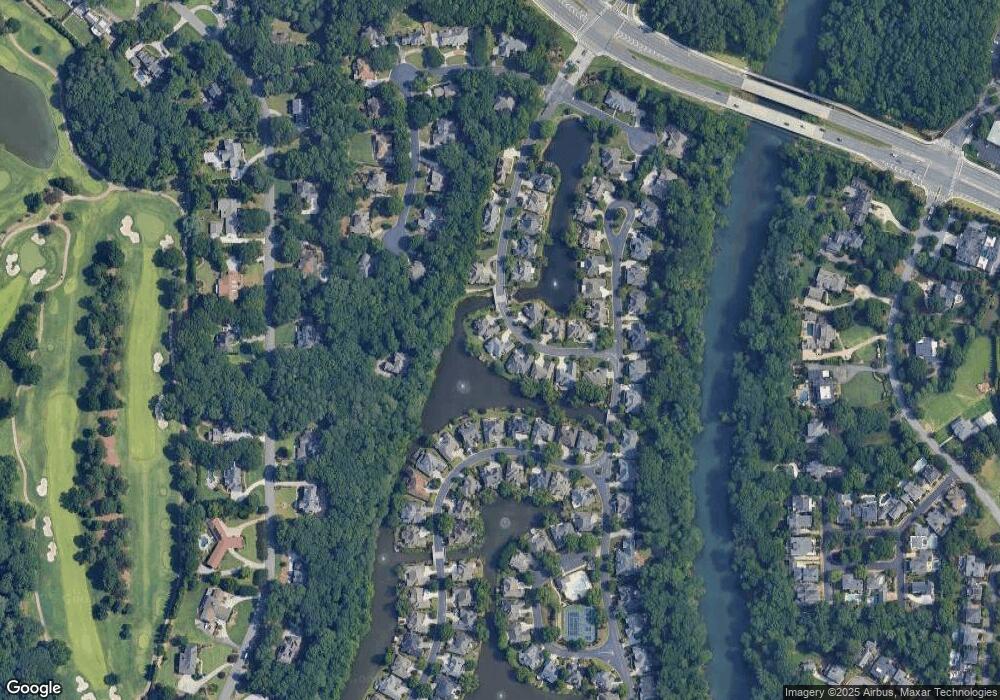

9290 Saint Georgen Common Duluth, GA 30097

Warsaw NeighborhoodEstimated Value: $822,779 - $1,043,000

4

Beds

4

Baths

2,864

Sq Ft

$333/Sq Ft

Est. Value

About This Home

This home is located at 9290 Saint Georgen Common, Duluth, GA 30097 and is currently estimated at $954,195, approximately $333 per square foot. 9290 Saint Georgen Common is a home located in Fulton County with nearby schools including Medlock Bridge Elementary School, Autrey Mill Middle School, and Johns Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2015

Sold by

Hooda Zaheer

Bought by

Hooda Nesreen Z and Hooda Zulfiqar Z

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,000

Outstanding Balance

$260,247

Interest Rate

4.11%

Mortgage Type

New Conventional

Estimated Equity

$693,948

Purchase Details

Closed on

Dec 6, 2010

Sold by

Shafer John

Bought by

Hooda Zaheer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$359,200

Interest Rate

4.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 16, 2005

Sold by

Gastley Richard D and Gastley Carol R

Bought by

Shafer John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Interest Rate

6.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 19, 1993

Sold by

Profile Homes Inc

Bought by

Castley Carol R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hooda Nesreen Z | $450,000 | -- | |

| Hooda Zaheer | $450,000 | -- | |

| Shafer John | $500,000 | -- | |

| Castley Carol R | $279,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hooda Nesreen Z | $330,000 | |

| Previous Owner | Hooda Zaheer | $359,200 | |

| Previous Owner | Shafer John | $400,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,084 | $304,880 | $86,520 | $218,360 |

| 2023 | $6,959 | $246,560 | $46,880 | $199,680 |

| 2022 | $6,158 | $200,680 | $52,000 | $148,680 |

| 2021 | $5,798 | $184,040 | $31,440 | $152,600 |

| 2020 | $5,965 | $185,320 | $41,240 | $144,080 |

| 2019 | $718 | $182,000 | $40,480 | $141,520 |

| 2018 | $3,989 | $180,000 | $46,520 | $133,480 |

| 2017 | $4,169 | $122,480 | $31,000 | $91,480 |

| 2016 | $4,108 | $122,480 | $31,000 | $91,480 |

| 2015 | $3,733 | $122,480 | $31,000 | $91,480 |

| 2014 | $3,860 | $122,480 | $31,000 | $91,480 |

Source: Public Records

Map

Nearby Homes

- 9355 Riverclub Pkwy

- 3967 Sweet Bottom Dr

- 4027 Wood Acres Ct

- 717 Beaufort Cir

- 3533 Mulberry Way

- 509 Bedfort Dr

- 3865 Whitney Place

- 4166 Oakwood Way

- 113 Brittany Ct

- 3732 Whitney Place

- 121 Brittany Ct

- 4160 Darby Way

- 3476 Silver Maple Dr

- 4128 Boxwood Way

- 3692 Howell Wood Trail NW

- 9240 Prestwick Club Dr

- 4030 Howell Ferry Rd

- 203 Southern Hill Dr

- 5435 Hoylake Ct

- 4197 Westriver Park

- 9290 St Georgen Common

- 9280 Saint Georgen Common

- 9280 Saint Georgen Common Unit 9280

- 9280 Saint Georgian Commons

- 9300 Saint Georgen Common

- 9315 Saint Georgen Common

- 9260 Saint Georgen Common

- 9305 Saint Georgen Common

- 9345 Saint Georgen Common

- 5880 Hershinger Close

- 9320 St Georgen Common

- 9320 Saint Georgen Common

- 9320 Saint Georgen Common Unit 59

- 5870 Hershinger Close

- 5900 Hershinger Close

- 5935 W Andechs Summit

- 9250 Saint Georgen Common

- 9355 Saint Georgen Common

- 9170 Etching Overlook