9295 Great Lakes Cir Unit 19295 Dayton, OH 45458

Estimated Value: $241,000 - $254,000

3

Beds

3

Baths

2,250

Sq Ft

$110/Sq Ft

Est. Value

About This Home

This home is located at 9295 Great Lakes Cir Unit 19295, Dayton, OH 45458 and is currently estimated at $247,352, approximately $109 per square foot. 9295 Great Lakes Cir Unit 19295 is a home located in Montgomery County with nearby schools including Primary Village North, John Hole Elementary, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2015

Sold by

Berberich Nicole

Bought by

Carr Anastasiya

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.96%

Purchase Details

Closed on

May 4, 2012

Sold by

Rana Hermins Matthew and Rana Hermis

Bought by

Berberich Nicole A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,186

Interest Rate

4%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 26, 2008

Sold by

Secretary Of Housing & Urban Development

Bought by

Hermis Matthew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,301

Interest Rate

6.41%

Mortgage Type

FHA

Purchase Details

Closed on

May 14, 2008

Sold by

Niehaus Burger Sharon K

Bought by

Hud

Purchase Details

Closed on

Nov 14, 2003

Sold by

Simms Twin Lakes Ltd

Bought by

Niehaus Sharon K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,362

Interest Rate

6.03%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carr Anastasiya | $120,000 | -- | |

| Berberich Nicole A | $111,000 | Home Services Title Llc | |

| Hermis Matthew | $95,000 | Lakeside Title & Escrow Agen | |

| Hud | $98,000 | None Available | |

| Niehaus Sharon K | $149,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Carr Anastasiya | -- | |

| Previous Owner | Berberich Nicole A | $108,186 | |

| Previous Owner | Hermis Matthew | $93,301 | |

| Previous Owner | Niehaus Sharon K | $146,362 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,826 | $61,940 | $14,280 | $47,660 |

| 2023 | $3,826 | $61,940 | $14,280 | $47,660 |

| 2022 | $3,561 | $45,600 | $10,500 | $35,100 |

| 2021 | $3,571 | $45,600 | $10,500 | $35,100 |

| 2020 | $3,566 | $45,600 | $10,500 | $35,100 |

| 2019 | $3,570 | $40,800 | $10,500 | $30,300 |

| 2018 | $3,190 | $40,800 | $10,500 | $30,300 |

| 2017 | $3,134 | $40,800 | $10,500 | $30,300 |

| 2016 | $3,230 | $39,630 | $10,500 | $29,130 |

| 2015 | $3,178 | $39,630 | $10,500 | $29,130 |

| 2014 | $3,178 | $39,630 | $10,500 | $29,130 |

| 2012 | -- | $36,940 | $11,200 | $25,740 |

Source: Public Records

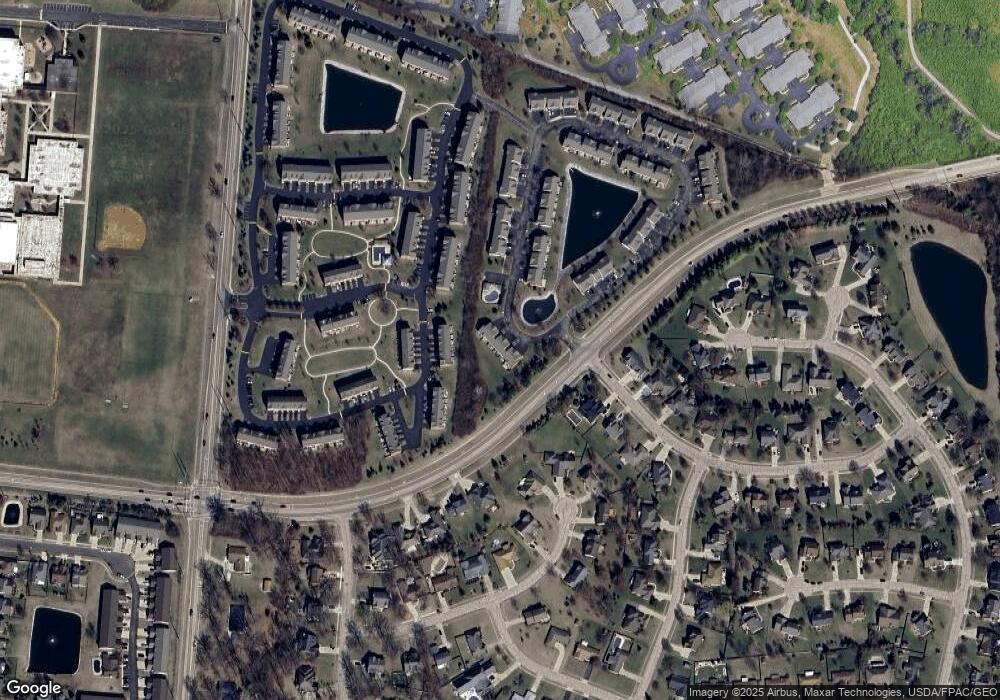

Map

Nearby Homes

- 9519 Tahoe Dr

- 9266 Great Lakes Cir Unit 29266

- 9515 Tahoe Dr

- 9540 Tahoe Dr

- 9251 Great Lakes Cir Unit 59251

- 9553 Tahoe Dr

- 9372 Parkside Dr

- 1794 Placid Dr

- 9604 Tahoe Dr

- 9406 Tahoe Dr Unit 19406

- 9475 Copperton Dr

- 1573 Watermark Ct Unit 221573

- 9607 Olde Georgetown

- 2115 Autumn Haze Trail

- 1875 Waterstone Blvd Unit 103

- 1875 Waterstone Blvd Unit 312

- 9747 Cobblewood Ct

- 1739 Waterstone Blvd Unit 208

- 1800 Olde Haley Dr

- 1963 Waterstone Blvd Unit 104

- 9297 Great Lakes Cir Unit 19297

- 9299 Great Lakes Cir Unit 19299

- 9299 Great Lakes Cir Unit 1

- 9293 Great Lakes Cir Unit 19293

- 9274 Great Lakes Cir Unit 29274

- 9533 Tahoe Dr

- 9535 Tahoe Dr

- 9537 Tahoe Dr

- 9529 Placid Dr

- 9531 Tahoe Dr

- 9529 Tahoe Dr

- 9539 Tahoe Dr

- 9272 Great Lakes Cir Unit 29272

- 9291 Great Lakes Cir Unit 9291

- 9291 Great Lakes Cir Unit 19291

- 9268 Great Lakes Cir Unit 29268

- 9523 Tahoe Dr Unit 9523

- 9541 Tahoe Dr Unit 9541

- 9172 Great Lakes Cir Unit 139172

- 9521 Tahoe Dr