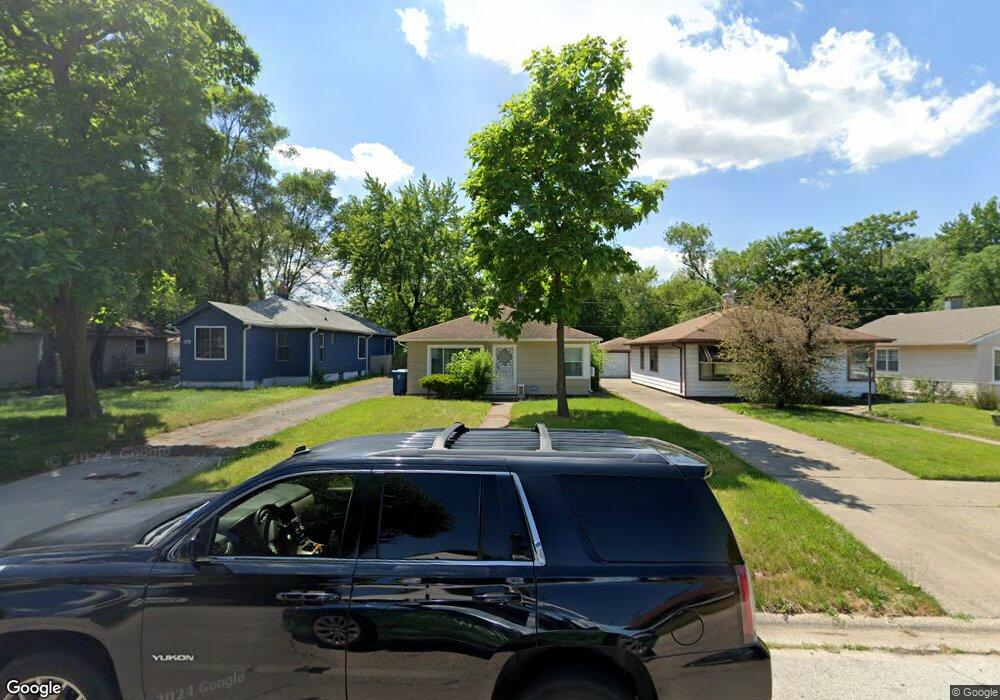

930 Greenbay Ave Calumet City, IL 60409

Estimated Value: $131,000 - $204,000

3

Beds

1

Bath

936

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 930 Greenbay Ave, Calumet City, IL 60409 and is currently estimated at $155,792, approximately $166 per square foot. 930 Greenbay Ave is a home located in Cook County with nearby schools including Lincoln Elementary School, Thornton Fractional North High School, and Hammond Academy Of Science & Tech.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2022

Sold by

Parker Michael

Bought by

Wentworth Parker Inv Llc

Current Estimated Value

Purchase Details

Closed on

Mar 31, 2009

Sold by

First National Bank Of Illinoi

Bought by

Parker Michael

Purchase Details

Closed on

Oct 16, 2008

Sold by

Residential Funding Company Llc

Bought by

Homecomings Financial Real Estate Holdin

Purchase Details

Closed on

Oct 3, 2008

Sold by

Homecomings Financial Real Estate Holdin

Bought by

First National Bank Of Illinois Trust #5

Purchase Details

Closed on

Sep 24, 2007

Sold by

Davis Kissner

Bought by

Residential Funding Co Llc

Purchase Details

Closed on

Nov 11, 2004

Sold by

Brinkman Frederick and Brinkman Paula

Bought by

Davis Kissner

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,955

Interest Rate

9.04%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wentworth Parker Inv Llc | -- | None Listed On Document | |

| Wentworth Parker Inv Llc | -- | None Listed On Document | |

| Parker Michael | -- | None Listed On Document | |

| Parker Michael | -- | None Listed On Document | |

| Homecomings Financial Real Estate Holdin | -- | Service Link | |

| First National Bank Of Illinois Trust #5 | $24,000 | Service Link | |

| Residential Funding Co Llc | -- | None Available | |

| Davis Kissner | $94,500 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Davis Kissner | $84,955 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,083 | $11,001 | $2,093 | $8,908 |

| 2023 | $4,237 | $11,001 | $2,093 | $8,908 |

| 2022 | $4,237 | $5,854 | $2,093 | $3,761 |

| 2021 | $4,323 | $5,852 | $2,092 | $3,760 |

| 2020 | $4,031 | $5,852 | $2,092 | $3,760 |

| 2019 | $3,716 | $5,139 | $1,953 | $3,186 |

| 2018 | $3,662 | $5,139 | $1,953 | $3,186 |

| 2017 | $3,528 | $5,139 | $1,953 | $3,186 |

| 2016 | $3,163 | $4,891 | $1,813 | $3,078 |

| 2015 | $3,053 | $4,891 | $1,813 | $3,078 |

| 2014 | $3,050 | $4,891 | $1,813 | $3,078 |

| 2013 | $3,095 | $5,464 | $1,813 | $3,651 |

Source: Public Records

Map

Nearby Homes

- 929 Greenbay Ave

- 863 Mackinaw Ave

- 856 Mackinaw Ave

- 509 Webb St

- 446 Warren St

- 521 157th St

- 550 Michigan City Rd Unit 3A

- 1040 Hirsch Blvd Unit 204

- 510 157th St

- 1051 Burnham Ave

- 518 156th Place

- 419 157th St

- 531 156th St

- 775 Greenbay Ave

- 344 156th Place

- 301 Warren St

- 300 Waltham St

- 320 157th St

- 347 156th St

- 241 Warren St

- 926 Greenbay Ave

- 942 Greenbay Ave

- 944 Greenbay Ave

- 922 Greenbay Ave

- 946 Greenbay Ave

- 920 Greenbay Ave

- 916 Greenbay Ave

- 948 Greenbay Ave

- 941 Greenbay Ave

- 925 Greenbay Ave

- 950 Greenbay Ave

- 921 Greenbay Ave

- 943 Greenbay Ave

- 917 Greenbay Ave

- 912 Greenbay Ave

- 952 Greenbay Ave

- 902 Greenbay Ave

- 902 Greenbay Ave

- 949 Greenbay Ave

- 954 Greenbay Ave