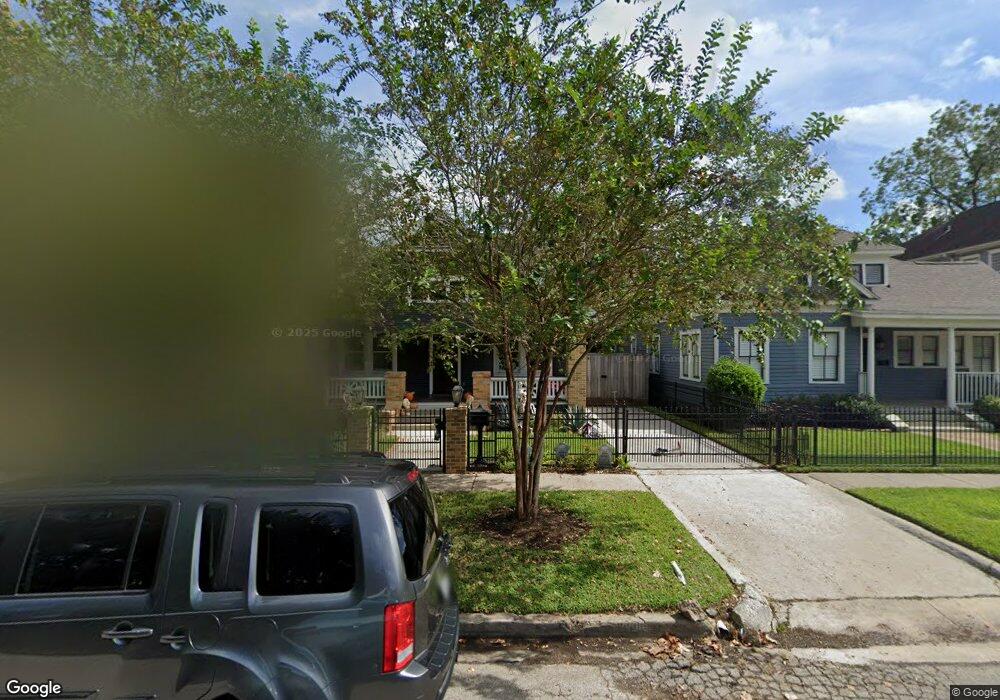

930 Harvard St Houston, TX 77008

Greater Heights NeighborhoodEstimated Value: $1,659,163 - $1,963,000

5

Beds

7

Baths

4,288

Sq Ft

$422/Sq Ft

Est. Value

About This Home

This home is located at 930 Harvard St, Houston, TX 77008 and is currently estimated at $1,808,541, approximately $421 per square foot. 930 Harvard St is a home located in Harris County with nearby schools including Harvard Elementary School, Hogg Middle, and Heights High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2016

Sold by

West Charles Adger and West Jane Alice

Bought by

Scardino Thompson James Taylor and Scardino Thompson Stacey

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$840,000

Outstanding Balance

$669,417

Interest Rate

3.61%

Estimated Equity

$1,139,124

Purchase Details

Closed on

Mar 28, 2013

Sold by

Bicycle Bugaows Llc

Bought by

West Charles Adger and West Jane Alice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$891,100

Interest Rate

4%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jan 30, 2012

Sold by

Klaus Bonnie Hanson

Bought by

Bicycle Bungalows Llc

Purchase Details

Closed on

Nov 1, 2002

Sold by

Courtney Donald G and Weeden Frank G

Bought by

Weeden Kenneth C

Purchase Details

Closed on

Jun 11, 2002

Sold by

Weeden Patricia L

Bought by

Weeden Kenneth C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scardino Thompson James Taylor | -- | Fidelity National Title | |

| West Charles Adger | -- | None Available | |

| Bicycle Bungalows Llc | -- | Stewart Title Houston Div | |

| Bicycle Bungalows Llc | -- | Stewart Title Houston Divisi | |

| Weeden Kenneth C | -- | -- | |

| Weeden Kenneth C | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Scardino Thompson James Taylor | $840,000 | |

| Previous Owner | West Charles Adger | $891,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $24,680 | $1,525,460 | $594,000 | $931,460 |

| 2024 | $24,680 | $1,523,671 | $594,000 | $929,671 |

| 2023 | $24,680 | $1,510,324 | $594,000 | $916,324 |

| 2022 | $32,801 | $1,604,211 | $445,500 | $1,158,711 |

| 2021 | $31,563 | $1,354,266 | $445,500 | $908,766 |

| 2020 | $31,700 | $1,309,076 | $433,620 | $875,456 |

| 2019 | $30,551 | $1,226,213 | $386,100 | $840,113 |

| 2018 | $22,027 | $1,097,573 | $356,400 | $741,173 |

| 2017 | $27,753 | $1,097,573 | $356,400 | $741,173 |

| 2016 | $28,654 | $1,133,213 | $392,040 | $741,173 |

| 2015 | $21,924 | $1,199,932 | $326,700 | $873,232 |

| 2014 | $21,924 | $1,069,259 | $261,360 | $807,899 |

Source: Public Records

Map

Nearby Homes

- 921 Arlington St

- 844 Cortlandt St

- 912 Heights Blvd

- 826 Heights Blvd

- 815 Arlington St

- 1007 Heights Blvd

- 515 E 9th St

- 1100 Harvard St Unit 8

- 220 E 8th St

- 809 Heights Blvd

- 953 Yale St Unit 1

- 805 Heights Blvd

- 602 E 10th 1/2 St

- 836 Allston St

- 811 Yale St

- 1026 Allston St

- 208 E 12th St

- 619 E 10th 1/2 St

- 319 W 10th St

- 224 W 8th St

- 936 Harvard St

- 928 Harvard St

- 938 Harvard St

- 922 Harvard St

- 939 Cortlandt St

- 918 Harvard St

- 941 Cortlandt St

- 927 Cortlandt St

- 202 E 10th St

- 943 Cortlandt St Unit 5

- 943 Cortlandt St

- 208 E 10th St

- 931 Harvard St

- 935 Harvard St

- 927 Harvard St

- 943 1/2 Cortlandt St

- 939 Harvard St

- 923 Harvard St

- 201 E 9th St

- 945 Cortlandt St