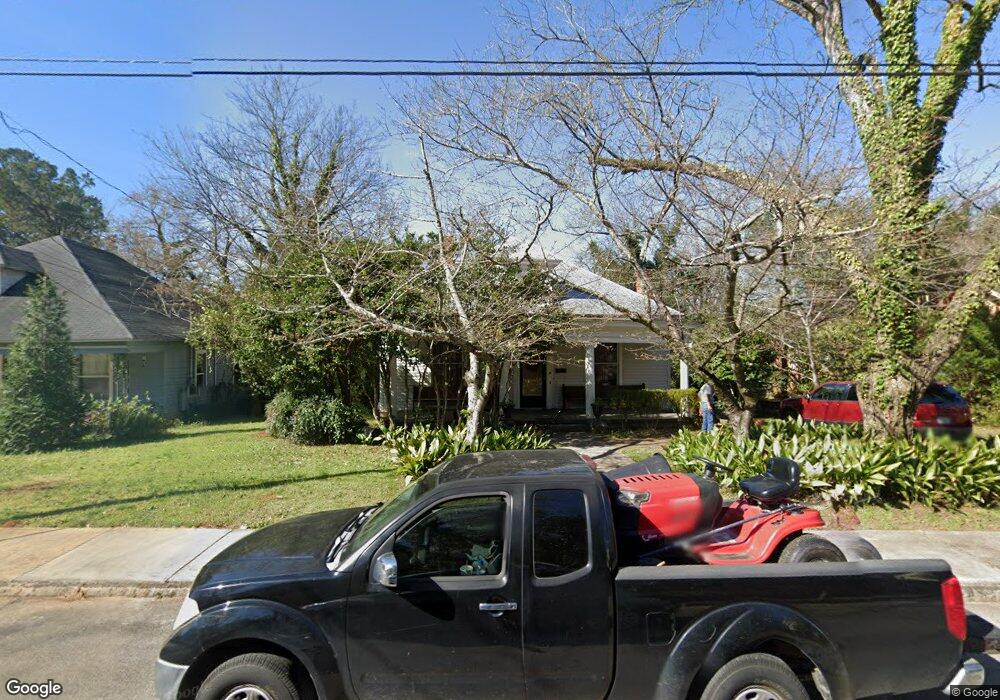

930 Laurel Ave Macon, GA 31211

North Highlands Historic District NeighborhoodEstimated Value: $132,000 - $173,000

3

Beds

2

Baths

1,711

Sq Ft

$92/Sq Ft

Est. Value

About This Home

This home is located at 930 Laurel Ave, Macon, GA 31211 and is currently estimated at $157,358, approximately $91 per square foot. 930 Laurel Ave is a home located in Bibb County with nearby schools including Burdell Elementary School, Appling Middle School, and Northeast High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2025

Sold by

Hayward Amanda E and Giles Charles K

Bought by

Lopez Cynthia M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,192

Outstanding Balance

$151,281

Interest Rate

6.87%

Mortgage Type

New Conventional

Estimated Equity

$6,077

Purchase Details

Closed on

Sep 29, 2008

Sold by

Ambrose Judith Lilly

Bought by

Giles Charles and Hayward Amanda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,770

Interest Rate

6.45%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 15, 2007

Sold by

Brannon Judith Lilly

Bought by

Ambrose Judith Lilly

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Cynthia M | $155,000 | None Listed On Document | |

| Giles Charles | $116,000 | None Available | |

| Ambrose Judith Lilly | $5,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lopez Cynthia M | $152,192 | |

| Previous Owner | Giles Charles | $114,770 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,177 | $47,885 | $5,920 | $41,965 |

| 2024 | $1,168 | $45,978 | $5,920 | $40,058 |

| 2023 | $1,119 | $44,070 | $5,920 | $38,150 |

| 2022 | $1,359 | $39,262 | $6,260 | $33,002 |

| 2021 | $1,273 | $33,498 | $5,406 | $28,092 |

| 2020 | $1,225 | $31,565 | $4,837 | $26,728 |

| 2019 | $1,236 | $31,565 | $4,837 | $26,728 |

| 2018 | $1,653 | $31,565 | $4,837 | $26,728 |

| 2017 | $660 | $24,627 | $5,535 | $19,092 |

| 2016 | $610 | $24,627 | $5,535 | $19,092 |

| 2015 | $1,031 | $28,046 | $6,227 | $21,819 |

| 2014 | $1,391 | $30,774 | $6,227 | $24,546 |

Source: Public Records

Map

Nearby Homes

- 939 Boulevard

- 940 Curry Dr

- 916 Summit Ave

- 988 North Ave

- 833 Parkview Ct

- 1158 Jackson Springs Rd

- 845 N Garden Terrace

- 846 N Garden Terrace

- 1020 Clay Ave

- 1006 Clay Ave Unit 1008,1020,1022

- 1260 Jackson Springs Rd

- 1435 Twin Pines Dr

- 378 Cowan St

- 390 Cowan St

- 990 Center St

- 970 Center St

- 1464 Twin Pines Dr

- 842 Little Short St

- 363 AND 361 Woolfolk St

- 363 Woolfolk St Unit 361 Woolfolk Street