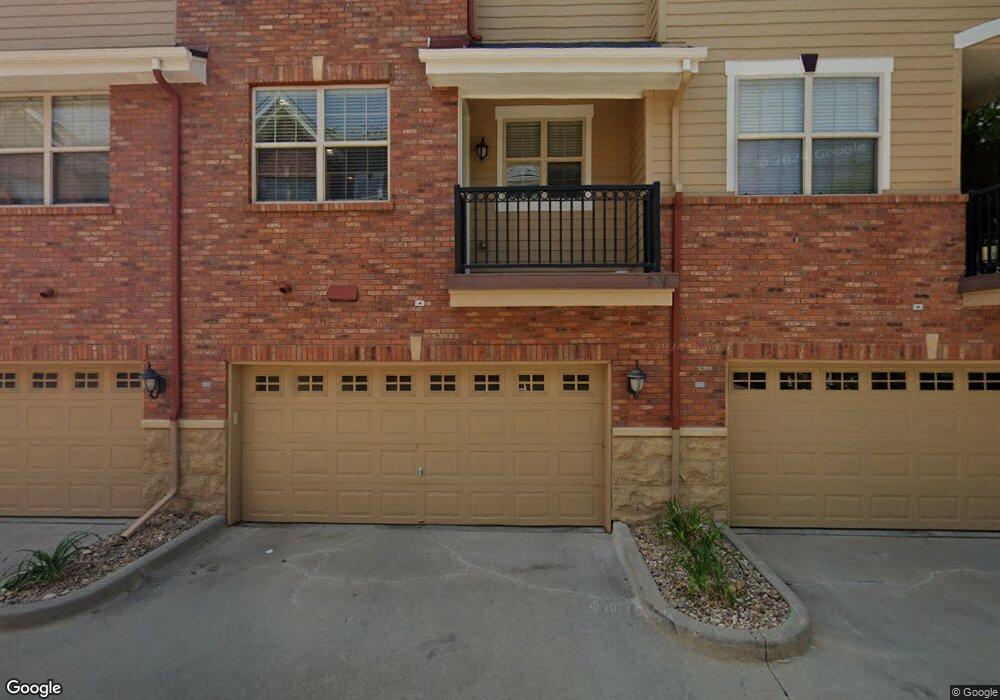

9301 Kornbrust Cir Lone Tree, CO 80124

Estimated Value: $584,390 - $599,000

2

Beds

3

Baths

1,646

Sq Ft

$360/Sq Ft

Est. Value

About This Home

This home is located at 9301 Kornbrust Cir, Lone Tree, CO 80124 and is currently estimated at $593,098, approximately $360 per square foot. 9301 Kornbrust Cir is a home located in Douglas County with nearby schools including Eagle Ridge Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2019

Sold by

Dragatsis Antonia

Bought by

Huggins Brian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Outstanding Balance

$224,190

Interest Rate

4.3%

Mortgage Type

New Conventional

Estimated Equity

$368,908

Purchase Details

Closed on

Jun 9, 2017

Sold by

Dragatsis Antonia

Bought by

Dragatsis Antonia

Purchase Details

Closed on

Jul 13, 2015

Sold by

Branam Michael S

Bought by

Dragatsis Antonia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$307,793

Interest Rate

3.99%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 11, 2007

Sold by

Renaissance At Ridgegate Llc

Bought by

Branam Michael S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

2.25%

Mortgage Type

Negative Amortization

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Huggins Brian | $405,000 | Land Title Guarantee Co | |

| Dragatsis Antonia | -- | None Available | |

| Dragatsis Antonia | $342,500 | Land Title Guarantee | |

| Branam Michael S | $340,000 | Security Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Huggins Brian | $255,000 | |

| Previous Owner | Dragatsis Antonia | $307,793 | |

| Previous Owner | Branam Michael S | $304,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,137 | $41,110 | $7,370 | $33,740 |

| 2023 | $5,172 | $41,110 | $7,370 | $33,740 |

| 2022 | $3,926 | $29,320 | $2,090 | $27,230 |

| 2021 | $4,058 | $29,320 | $2,090 | $27,230 |

| 2020 | $3,832 | $28,410 | $2,150 | $26,260 |

| 2019 | $3,841 | $28,410 | $2,150 | $26,260 |

| 2018 | $3,333 | $26,000 | $2,160 | $23,840 |

| 2017 | $3,369 | $26,000 | $2,160 | $23,840 |

| 2016 | $3,256 | $25,170 | $2,390 | $22,780 |

| 2015 | $3,306 | $25,170 | $2,390 | $22,780 |

| 2014 | $2,598 | $18,900 | $2,390 | $16,510 |

Source: Public Records

Map

Nearby Homes

- 10311 Belvedere Ln

- 10164 Ridgegate Cir

- 9165 Kornbrust Dr

- 10262 Greentrail Cir

- 10225 Bellwether Ln

- 10205 Bluffmont Dr

- 9520 Halstead Ln

- 10357 Bluffmont Dr

- 10488 Bluffmont Dr

- 10066 Belvedere Cir

- 10031 Town Ridge Ln

- 10102 Prestwick Trail

- 10590 Ladera Dr

- 10884 Lyric St

- 10814 Bluffside Dr

- 9645 Viewside Dr

- 7855 Arundel Ln

- 9873 Greensview Cir

- 9851 Greensview Cir

- 9565 Silent Hills Ln

- 9299 Kornbrust Cir

- 9303 Kornbrust Cir

- 9297 Kornbrust Cir

- 9295 Kornbrust Cir

- 9293 Kornbrust Cir

- 9099 Kornbrust Cir

- 9228 Kornbrust Dr

- 9234 Kornbrust Dr

- 9242 Kornbrust Dr

- 9215 Kornbrust Cir

- 9213 Kornbrust Cir

- 9217 Kornbrust Cir

- 9291 Kornbrust Cir

- 9101 Kornbrust Cir

- 9248 Kornbrust Dr

- 9219 Kornbrust Cir

- 9256 Kornbrust Dr

- 9221 Kornbrust Cir

- 9103 Kornbrust Cir

- 9204 Kornbrust Dr