9311 Hawthorne Ct Odessa, TX 79765

Estimated Value: $234,849 - $254,000

3

Beds

2

Baths

1,518

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 9311 Hawthorne Ct, Odessa, TX 79765 and is currently estimated at $247,212, approximately $162 per square foot. 9311 Hawthorne Ct is a home located in Ector County with nearby schools including Barbara Jordan Elementary School, Wilson & Young Medal of Honor Middle School, and Permian High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 21, 2024

Sold by

Meraz Jesus Ivan and Richards Jennifer

Bought by

Meraz Jesus Ivan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Outstanding Balance

$166,062

Interest Rate

6.77%

Mortgage Type

New Conventional

Estimated Equity

$81,150

Purchase Details

Closed on

Oct 19, 2010

Sold by

Real Property Resources Inc

Bought by

Meraz Jesus Ivan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,178

Interest Rate

4.41%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meraz Jesus Ivan | -- | None Listed On Document | |

| Meraz Jesus Ivan | -- | Stewart Title Of Lubbock Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meraz Jesus Ivan | $168,000 | |

| Previous Owner | Meraz Jesus Ivan | $130,178 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,932 | $234,025 | $15,284 | $218,741 |

| 2023 | $4,843 | $229,727 | $15,284 | $214,443 |

| 2022 | $5,243 | $226,951 | $15,284 | $211,667 |

| 2021 | $5,313 | $225,241 | $15,284 | $209,957 |

| 2020 | $5,036 | $217,154 | $15,284 | $201,870 |

| 2019 | $4,872 | $197,584 | $15,284 | $182,300 |

| 2018 | $4,258 | $180,852 | $15,284 | $165,568 |

| 2017 | $4,028 | $176,822 | $15,284 | $161,538 |

| 2016 | $3,854 | $173,586 | $12,048 | $161,538 |

| 2015 | $3,154 | $173,586 | $12,048 | $161,538 |

| 2014 | $3,154 | $165,894 | $12,048 | $153,846 |

Source: Public Records

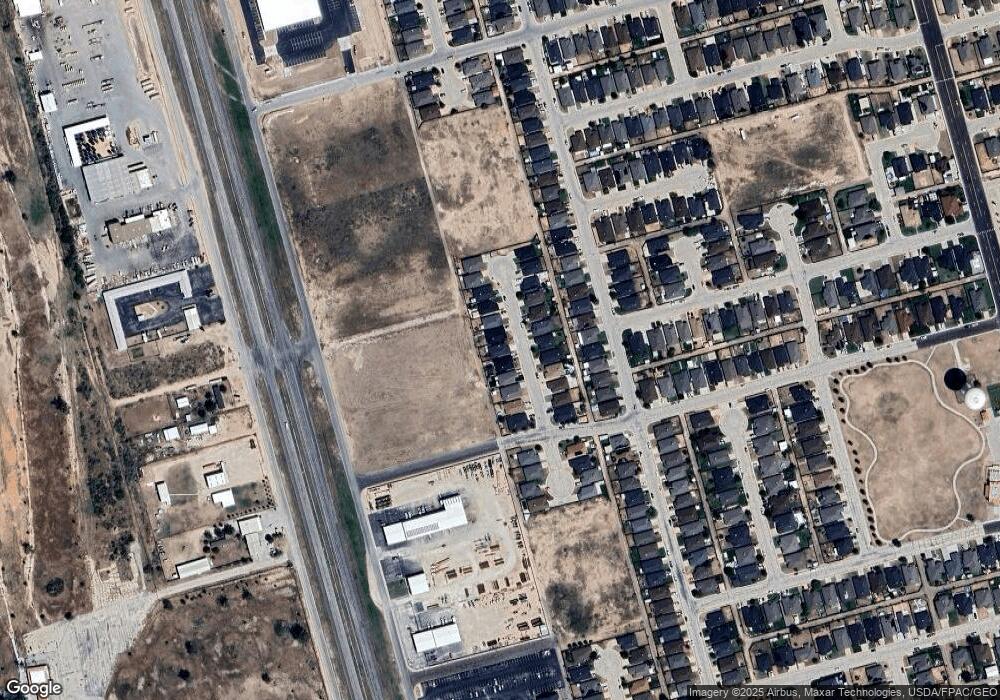

Map

Nearby Homes

- 301 E 93rd St

- 403 E 95th St

- 9125 Lamar Ave

- 509 E 96th St

- 9901 Mccraw Dr

- 616 E 96th Ct

- 9913 Mccraw Dr

- 609 E 98th St

- 9705 Desert Ave

- 102 Panhandle Dr

- 205 Panhandle Dr

- 10205 Pronghorn Rd

- 9323 Bee Balm Ave

- 9021 Desert Ave

- 806 E 98th St

- 806 Panhandle Dr

- 800 Panhandle Dr

- 804 Panhandle Dr

- 808 Brittlebush Ct

- Gracie Plan at Windmill Crossing

- 9309 Hawthorne Ct

- 9313 Hawthorne Ct

- 9307 Hawthorne Ct

- 9315 Hawthorne Ct

- 9317 Hawthorne Ct

- 9305 Hawthorne Ct

- 9310 Hawthorne Ct

- 9312 Hawthorne Ct

- 9308 Hawthorne Ct

- 9314 Hawthorne Ct

- 9319 Hawthorne Ct

- 9303 Hawthorne Ct

- 9306 Hawthorne Ct

- 9316 Hawthorne Ct

- 9304 Hawthorne Ct

- 9301 Hawthorne Ct

- 9321 Hawthorne Ct

- 9318 Hawthorne Ct

- 9302 Hawthorne Ct

- 9323 Hawthorne Ct